The Trump Tax Legacy: What Americans Need To Know And How To Protect Themselves

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Trump Tax Legacy: What Americans Need to Know and How to Protect Themselves

The Tax Cuts and Jobs Act of 2017, a landmark piece of legislation spearheaded by the Trump administration, significantly altered the American tax landscape. While touted as a boon for the economy and American families, its long-term effects are still unfolding, leaving many taxpayers wondering what it all means for them. Understanding the Trump tax legacy is crucial for navigating the current tax system and protecting your financial future.

Key Changes Introduced by the TCJA:

The TCJA implemented several sweeping changes, impacting everything from individual income tax rates to corporate taxes. Here are some of the most significant:

- Individual Income Tax Rates: The act reduced individual income tax rates, creating seven brackets instead of the previous seven. While this lowered taxes for many, the changes were temporary for some brackets, resulting in potential tax increases in subsequent years.

- Standard Deduction: The standard deduction was significantly increased, benefiting many taxpayers, particularly those who previously itemized. This simplified tax filing for a large segment of the population.

- Child Tax Credit: The child tax credit was expanded, increasing the maximum credit amount and making it partially refundable. This provided relief for many families.

- Corporate Tax Rate: The corporate tax rate was slashed from 35% to 21%, a dramatic reduction aimed at boosting business investment and economic growth. The long-term impact on corporate profitability and job creation remains a subject of ongoing debate among economists.

The Unintended Consequences and Long-Term Impacts:

While the TCJA delivered immediate tax cuts for many, some argue that its long-term effects are less beneficial. Concerns include:

- Increased National Debt: The substantial tax cuts led to a significant increase in the national debt, raising concerns about the country's fiscal stability. [Link to a reputable source discussing the national debt].

- Inequality: Critics argue that the tax cuts disproportionately benefited high-income earners and corporations, exacerbating income inequality. [Link to a reputable source on income inequality].

- Sunset Provisions: Certain provisions of the TCJA, such as some individual tax cuts, are set to expire, creating uncertainty for taxpayers in the future. Understanding these sunset provisions is crucial for long-term financial planning.

How to Protect Yourself:

Navigating the complexities of the Trump tax legacy requires proactive planning. Here's what you can do:

- Consult a Tax Professional: A qualified tax advisor can help you understand how the TCJA impacts your specific financial situation and develop a tax strategy tailored to your needs.

- Review Your Tax Returns: Carefully review your past tax returns to understand how the TCJA has affected your tax liability.

- Plan for the Future: Consider the potential impact of expiring tax provisions and adjust your financial plans accordingly.

- Stay Informed: Keep up-to-date on any changes in tax laws and regulations. [Link to a reputable source for tax news].

Conclusion:

The Trump tax legacy is a complex and multifaceted issue with both benefits and drawbacks. Understanding its key features, potential pitfalls, and long-term implications is essential for every American taxpayer. By taking proactive steps, such as consulting with a tax professional and staying informed about tax law changes, you can effectively navigate the current tax system and protect your financial well-being. Don't wait – take control of your tax future today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Trump Tax Legacy: What Americans Need To Know And How To Protect Themselves. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Why Are Stocks Climbing Amidst Trumps Trade Wars A Market Analysis

Aug 14, 2025

Why Are Stocks Climbing Amidst Trumps Trade Wars A Market Analysis

Aug 14, 2025 -

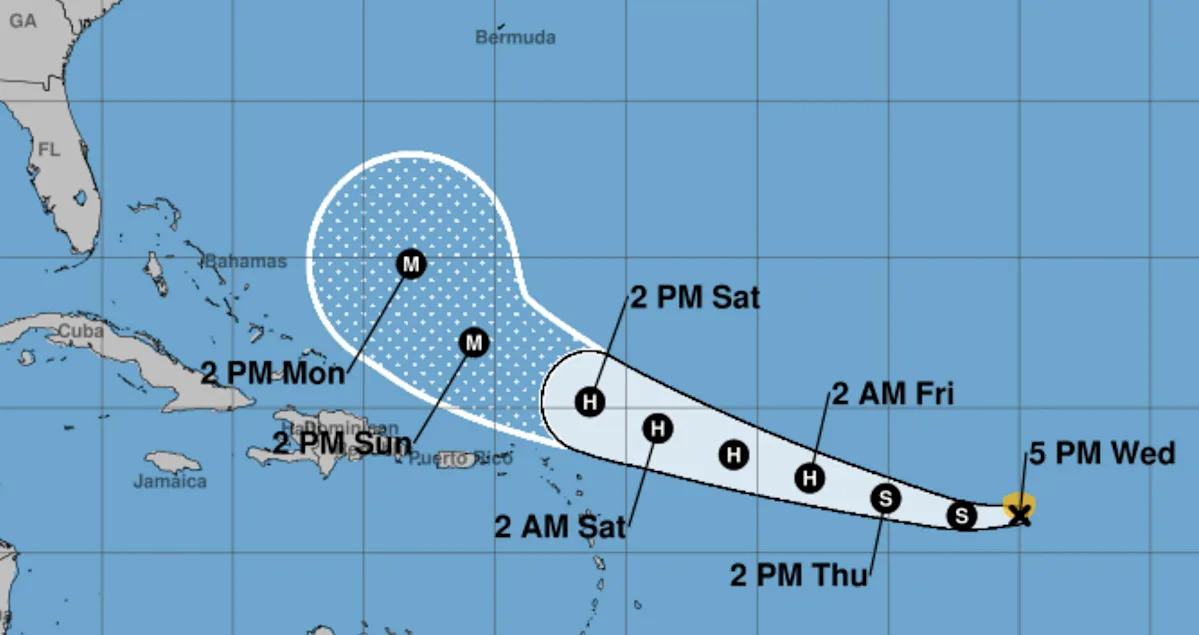

Tropical Storm Erin Latest Updates On Path Intensity And Hurricane Potential

Aug 14, 2025

Tropical Storm Erin Latest Updates On Path Intensity And Hurricane Potential

Aug 14, 2025 -

Tracking A 10 000 Dogecoin Investment 2018 To 2023 Performance

Aug 14, 2025

Tracking A 10 000 Dogecoin Investment 2018 To 2023 Performance

Aug 14, 2025 -

Check West Virginia Lottery Results Powerball And Lotto America August 13 2025

Aug 14, 2025

Check West Virginia Lottery Results Powerball And Lotto America August 13 2025

Aug 14, 2025 -

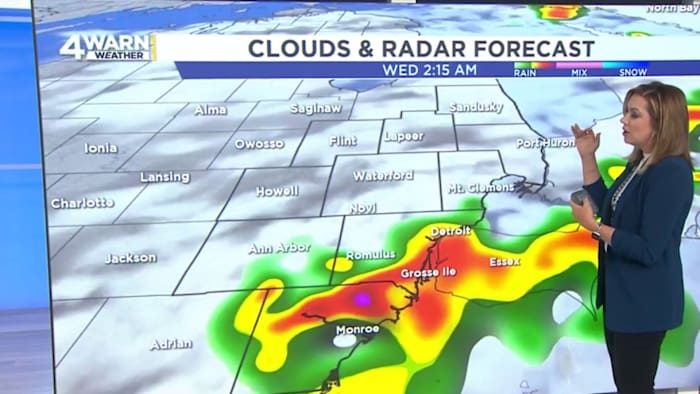

Tracking Tuesdays Storms Southeast Michigans Severe Weather Timeline

Aug 14, 2025

Tracking Tuesdays Storms Southeast Michigans Severe Weather Timeline

Aug 14, 2025

Latest Posts

-

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025 -

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025 -

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025 -

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025