Why Are Stocks Climbing Amidst Trump's Trade Wars? A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Are Stocks Climbing Amidst Trump's Trade Wars? A Market Analysis

The seemingly paradoxical rise of the stock market amidst President Trump's ongoing trade wars has left many investors scratching their heads. While headlines scream of escalating tariffs and trade disputes, the Dow Jones Industrial Average and other major indices continue to climb. This isn't simply a matter of luck; several contributing factors explain this perplexing market behavior. Let's delve into a comprehensive market analysis to understand this complex situation.

The Resilience of the US Economy:

One key factor driving stock market growth is the surprisingly robust performance of the US economy. Despite the trade tensions, key economic indicators such as employment figures and consumer spending remain relatively strong. This resilience suggests that the impact of tariffs, at least so far, has been less severe than initially predicted. The strength of the domestic economy continues to fuel corporate profits, a major driver of stock prices. Data from the Bureau of Economic Analysis (BEA) [link to BEA website] provides further insight into the current economic climate.

Interest Rate Cuts and Monetary Policy:

The Federal Reserve's decision to cut interest rates has played a significant role in supporting the stock market. Lower interest rates make borrowing cheaper for businesses, encouraging investment and expansion. This, in turn, boosts corporate profits and supports higher stock valuations. The Fed's proactive monetary policy is acting as a counterweight to the negative effects of trade uncertainty. Understanding the intricacies of monetary policy is crucial for navigating the current market landscape. [Link to a reputable source explaining monetary policy]

Market Expectations and Long-Term Growth:

While the immediate impact of trade wars may be negative, many investors are focusing on the long-term potential of the US economy. They believe that even with trade disruptions, the fundamental strength of the American economy will prevail. This long-term outlook, coupled with the hope for a resolution to the trade disputes, is fueling investor confidence and driving stock prices higher. This "buy the dip" mentality is a significant factor in the current market dynamics.

Investor Behavior and Speculation:

It's crucial to acknowledge the role of investor behavior and speculation. Some investors might be anticipating a resolution to trade conflicts, leading them to invest now before potential price increases. Others might be engaging in short-term trading strategies, capitalizing on market volatility. Understanding these behavioral factors is essential for a complete picture of the current market conditions.

Sectoral Shifts and Opportunities:

While some sectors are undeniably impacted negatively by trade wars, others are experiencing growth. For instance, companies focused on domestic production and those benefiting from import substitution are seeing increased demand. This shift creates opportunities for investors who can identify and capitalize on these emerging trends.

Potential Risks and Future Outlook:

It's important to acknowledge the inherent risks. The current market optimism could be misplaced if trade tensions escalate further, leading to a significant economic downturn. The impact of prolonged trade wars on consumer confidence and business investment remains a key uncertainty. Careful risk management is vital in this volatile environment.

Conclusion:

The stock market's climb amidst Trump's trade wars is a complex phenomenon driven by a confluence of factors. The resilience of the US economy, the Fed's monetary policy adjustments, investor expectations, behavioral economics, and sectoral shifts all play significant roles. While the situation offers opportunities, investors must remain aware of potential risks and maintain a diversified investment strategy. The ongoing trade negotiations and their outcome will continue to shape the future trajectory of the market. Staying informed and adaptable is key for navigating the current economic climate effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Are Stocks Climbing Amidst Trump's Trade Wars? A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Strengthening Mental Health Through Spirituality Evidence And Practices

Aug 14, 2025

Strengthening Mental Health Through Spirituality Evidence And Practices

Aug 14, 2025 -

180 Life Sciences Atnf Stock Soars 80 After 350 M Ethereum Investment

Aug 14, 2025

180 Life Sciences Atnf Stock Soars 80 After 350 M Ethereum Investment

Aug 14, 2025 -

Since November First Golden Cross Whats Next For Dogecoin

Aug 14, 2025

Since November First Golden Cross Whats Next For Dogecoin

Aug 14, 2025 -

Netflix Series Hooking Breaking Bad Fans 96 Rating Must Stream Now

Aug 14, 2025

Netflix Series Hooking Breaking Bad Fans 96 Rating Must Stream Now

Aug 14, 2025 -

Extreme Heat Alert Las Vegas Valleys Scorching 112 Degree Day

Aug 14, 2025

Extreme Heat Alert Las Vegas Valleys Scorching 112 Degree Day

Aug 14, 2025

Latest Posts

-

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025 -

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025 -

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025 -

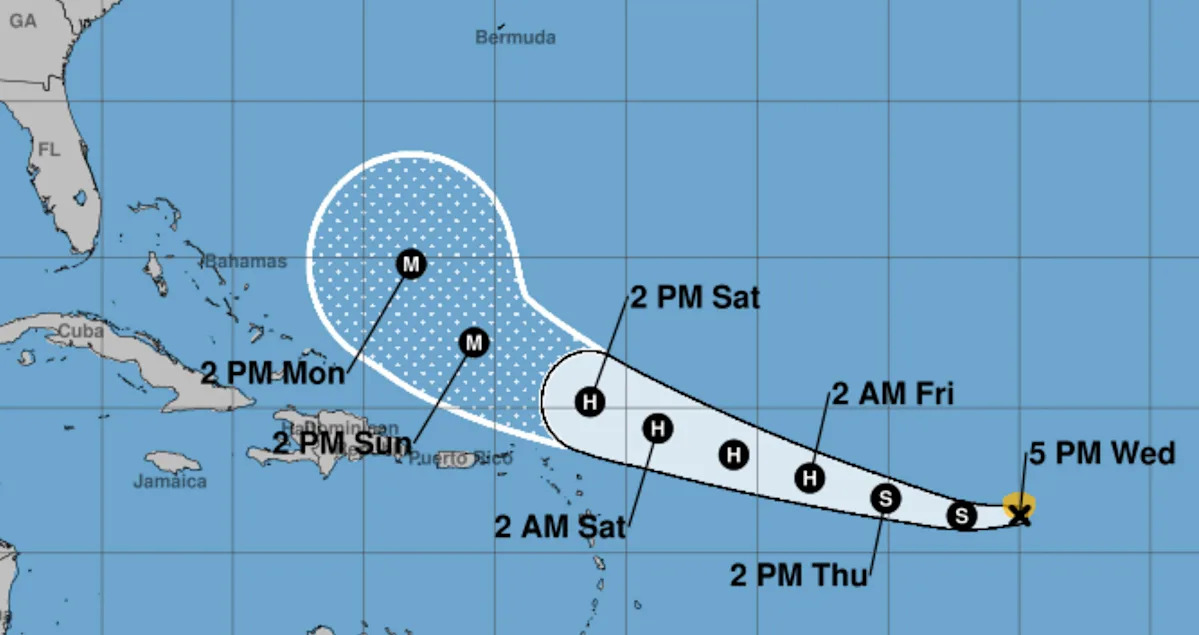

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025