The Future Of Hims & Hers (HIMS): A Stock Market Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

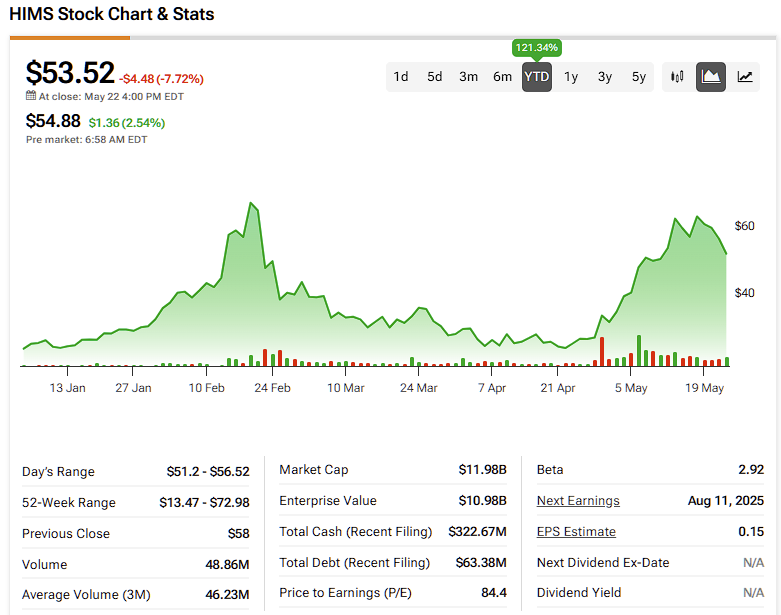

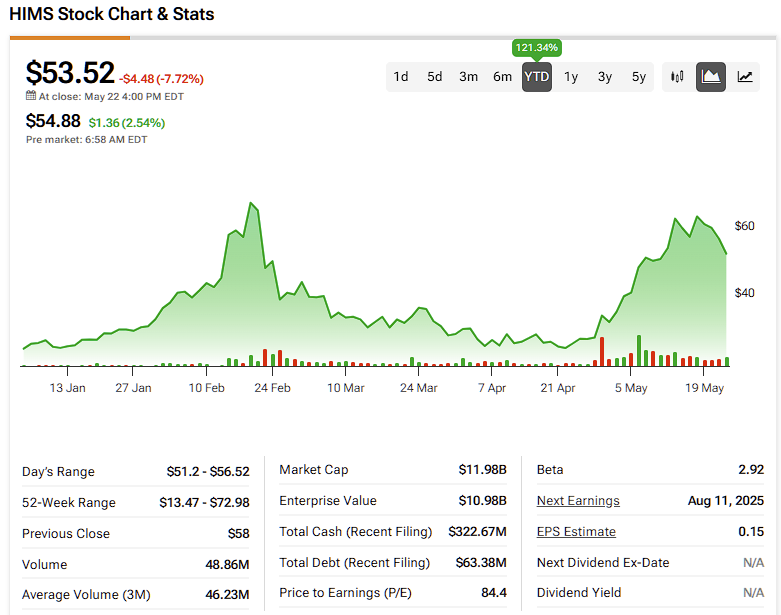

The Future of Hims & Hers (HIMS): A Stock Market Forecast

Hims & Hers (HIMS), the telehealth company disrupting the men's and women's health space, has seen its stock price fluctuate significantly since its IPO. While its innovative approach to healthcare accessibility has attracted many investors, understanding its future trajectory requires a careful examination of market trends, competition, and the company's strategic direction. This article delves into a stock market forecast for HIMS, considering both the opportunities and challenges ahead.

Hims & Hers: A Quick Overview

Hims & Hers offers a convenient and discreet way to access treatment for various health concerns, ranging from hair loss and sexual health to skincare and mental wellness. Their direct-to-consumer model, leveraging telemedicine and online platforms, has resonated with a tech-savvy generation seeking simpler healthcare solutions. This business model has been key to their initial success, but maintaining this momentum in a rapidly evolving market presents ongoing challenges.

Factors Influencing the HIMS Stock Forecast:

Several key factors will significantly impact HIMS's future stock performance:

1. Market Competition: The telehealth industry is becoming increasingly crowded. Established players and new entrants constantly vie for market share. HIMS must differentiate itself through superior customer service, expanded product offerings, and strategic partnerships to maintain a competitive edge. This includes competing against both specialized telehealth companies and traditional healthcare providers expanding their online offerings.

2. Regulatory Landscape: The regulatory environment for telehealth is constantly evolving. Changes in regulations concerning telehealth reimbursements, data privacy (HIPAA compliance), and prescription drug distribution can significantly affect HIMS's operational costs and profitability. Staying ahead of these regulatory shifts is crucial for long-term success.

3. Expansion and Diversification: HIMS's future growth hinges on its ability to expand its product offerings and target new demographics. Diversification into new therapeutic areas and international markets could unlock substantial growth potential, but also presents significant risks and requires substantial investment.

4. Customer Acquisition Costs (CAC): Acquiring new customers can be expensive, particularly in a competitive market. HIMS needs to optimize its marketing strategies to reduce CAC while maintaining a strong brand presence. A sustainable and profitable customer acquisition model is vital for long-term financial health.

5. Financial Performance and Profitability: Ultimately, investor confidence rests on HIMS's ability to demonstrate consistent financial growth and profitability. Investors will closely monitor key metrics such as revenue growth, operating margins, and customer retention rates.

HIMS Stock Market Forecast: A Cautiously Optimistic Outlook

While the future of HIMS is not without its challenges, a cautiously optimistic outlook seems warranted. The company's innovative business model has proven successful in tapping into a significant market demand. Continued focus on customer experience, strategic expansion, and careful management of operational costs could drive significant long-term growth.

However, investors should be aware of the risks involved. The competitive landscape is fiercely contested, and regulatory changes could negatively impact the company's operations. A comprehensive due diligence process is essential before investing in HIMS stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions. Conduct thorough research and consider your own risk tolerance before investing in HIMS or any other stock.

Further Reading:

This information is intended to provide a comprehensive overview and should not be considered exhaustive. Staying informed about market trends and company developments is crucial for any investor considering HIMS stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Future Of Hims & Hers (HIMS): A Stock Market Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hollywood Mourns Jonathan Joss Actor In King Of The Hill And Parks And Recreation Dead At 59

Jun 04, 2025

Hollywood Mourns Jonathan Joss Actor In King Of The Hill And Parks And Recreation Dead At 59

Jun 04, 2025 -

Hims And Hers Health Hims Risks And Rewards Of Investing

Jun 04, 2025

Hims And Hers Health Hims Risks And Rewards Of Investing

Jun 04, 2025 -

Taylor Jenkins Reids Publishing Strategy Lessons In Literary Success

Jun 04, 2025

Taylor Jenkins Reids Publishing Strategy Lessons In Literary Success

Jun 04, 2025 -

1 Billion Acquisition Private Equity Buys Beloved Fried Chicken Restaurant Chain

Jun 04, 2025

1 Billion Acquisition Private Equity Buys Beloved Fried Chicken Restaurant Chain

Jun 04, 2025 -

Nio Q1 Earnings Loom Should You Buy The Dip

Jun 04, 2025

Nio Q1 Earnings Loom Should You Buy The Dip

Jun 04, 2025