Hims & Hers Health (HIMS): Risks And Rewards Of Investing.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers Health (HIMS): Weighing the Risks and Rewards of Investment

Hims & Hers Health (HIMS), a telehealth company specializing in personalized healthcare products and services, has captured significant attention in the market. But is investing in HIMS a smart move? This article delves into the potential risks and rewards, providing you with the information you need to make an informed decision.

Hims & Hers: A Telehealth Giant in the Making?

Hims & Hers Health offers a convenient and accessible platform for various health concerns, including hair loss, sexual health, skincare, and mental wellness. Their direct-to-consumer model, utilizing telehealth technology, has disrupted traditional healthcare practices, attracting a large and growing customer base. This business model offers scalability and potential for significant revenue growth. The company’s strong brand recognition and marketing prowess further contribute to its appeal to investors.

Potential Rewards of Investing in HIMS:

- High Growth Potential: The telehealth market is booming, and HIMS is positioned to capitalize on this trend. Increased adoption of telehealth services, coupled with HIMS’ expansion into new therapeutic areas, suggests significant future growth potential.

- Expanding Market Share: HIMS is continuously expanding its product offerings and targeting new demographic groups, positioning itself for increased market share within the competitive telehealth landscape.

- Strong Brand Recognition: The company has effectively built a strong brand identity, creating a recognizable and trusted name in the consumer healthcare space. This brand loyalty can translate into sustained customer acquisition and retention.

- Innovative Business Model: HIMS' direct-to-consumer model bypasses traditional healthcare intermediaries, leading to cost efficiencies and faster growth.

Potential Risks Associated with HIMS Investment:

- Regulatory Scrutiny: The telehealth industry faces increasing regulatory scrutiny, and changes in regulations could significantly impact HIMS' operations and profitability. New laws regarding telehealth practices and data privacy pose ongoing challenges.

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. Maintaining a competitive edge will require continuous innovation and strategic investments.

- Dependence on Marketing: HIMS' success is heavily reliant on its marketing and advertising strategies. Changes in consumer preferences or increased marketing costs could negatively impact profitability.

- Reliance on Technology: HIMS' platform is heavily reliant on technology. Technical glitches, cybersecurity breaches, or other technological issues could severely disrupt operations and damage customer trust.

Financial Performance and Future Outlook:

Analyzing HIMS' financial statements, including revenue growth, profitability, and debt levels, is crucial before investing. Look for consistent revenue growth, improving profitability margins, and a manageable debt load. Furthermore, examining the company's future outlook, including planned product launches and market expansion strategies, can provide valuable insights into its long-term growth potential. Consult financial news sources and analyst reports for up-to-date financial performance data.

Conclusion: Proceed with Caution and Due Diligence

Investing in HIMS presents both significant opportunities and substantial risks. Before investing, conduct thorough due diligence, carefully analyzing the company's financial performance, competitive landscape, and regulatory environment. Consider diversifying your investment portfolio to mitigate potential losses. Remember that investing in the stock market always involves risk, and past performance is not indicative of future results. Consulting a financial advisor is recommended before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS): Risks And Rewards Of Investing.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Slowdown In Hiring Private Sector Adds Only 37 000 Jobs In May

Jun 04, 2025

Slowdown In Hiring Private Sector Adds Only 37 000 Jobs In May

Jun 04, 2025 -

Snowfall Spinoff Pilot Asante Blackk Peyton Alex Smith And Simmie Sims Iii Join Cast

Jun 04, 2025

Snowfall Spinoff Pilot Asante Blackk Peyton Alex Smith And Simmie Sims Iii Join Cast

Jun 04, 2025 -

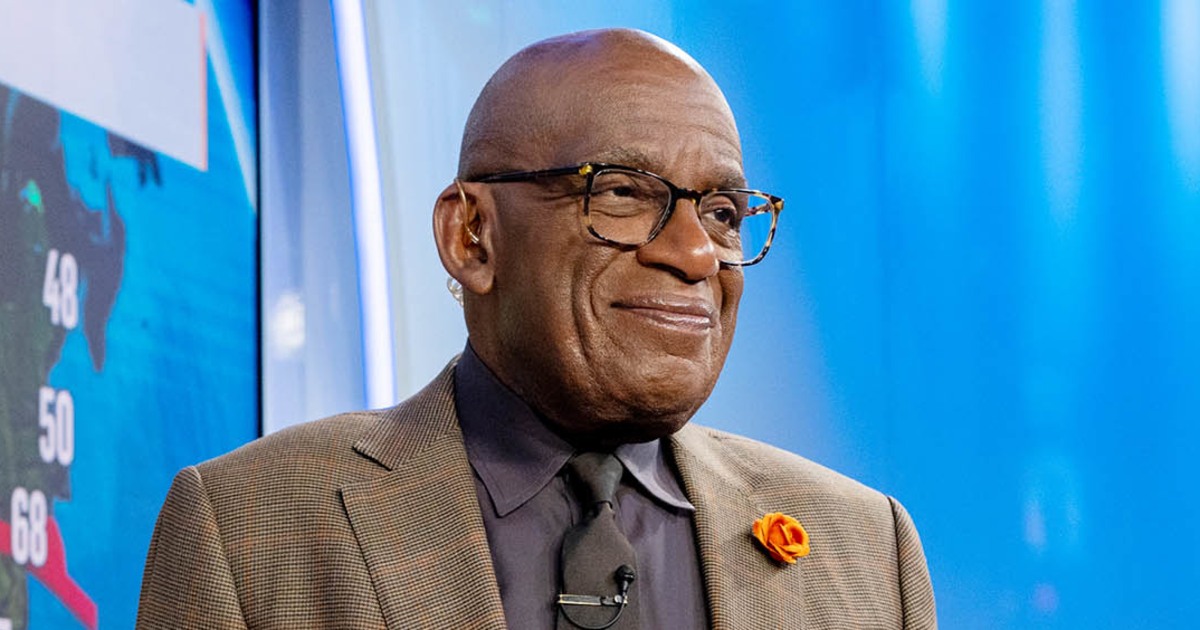

Al Rokers Weight Loss Long Term Strategies For Sustainable Results

Jun 04, 2025

Al Rokers Weight Loss Long Term Strategies For Sustainable Results

Jun 04, 2025 -

20 Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Strategies

Jun 04, 2025

20 Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Strategies

Jun 04, 2025 -

Billion Dollar Deal Subway Expands Its Restaurant Empire With Chicken Chain Purchase

Jun 04, 2025

Billion Dollar Deal Subway Expands Its Restaurant Empire With Chicken Chain Purchase

Jun 04, 2025