The Economic Stakes Of Clean Energy Tax Policy In The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Economic Stakes of Clean Energy Tax Policy in the United States

The United States stands at a crucial juncture in its energy transition. The economic implications of clean energy tax policy are profound, shaping not only the environment but also the nation's economic future. This article delves into the complex interplay between tax incentives, investment, job creation, and the overall health of the US economy.

The Current Landscape: A Shifting Energy Paradigm

The shift towards renewable energy sources like solar, wind, and geothermal is no longer a distant aspiration; it's a rapidly unfolding reality. Driven by climate concerns and technological advancements, this transition presents both challenges and opportunities. However, the speed and effectiveness of this transformation hinge significantly on the government's tax policies. Current legislation, such as the Inflation Reduction Act (IRA), offers substantial tax credits and incentives for clean energy investments, aiming to accelerate the adoption of renewable technologies. But how effective are these policies, and what are the broader economic consequences?

Tax Incentives: Fueling Investment and Job Growth?

The core argument for clean energy tax incentives is their ability to stimulate investment. By reducing the upfront costs of developing and deploying renewable energy projects, these policies incentivize private sector involvement. This translates to:

- Increased Investment in Renewable Energy Infrastructure: Tax credits directly lower the financial risk associated with renewable energy projects, attracting both domestic and foreign investment. This leads to the construction of new solar farms, wind turbines, and energy storage facilities.

- Job Creation in a Growing Sector: The renewable energy sector is a significant job creator. From manufacturing and installation to maintenance and research, the industry provides a diverse range of employment opportunities. Tax incentives amplify this job creation potential. A recent report by the [insert credible source, e.g., National Renewable Energy Laboratory] highlights the substantial job growth projected in the clean energy sector over the next decade, largely contingent on sustained policy support.

- Technological Innovation and Development: Incentives foster innovation by encouraging research and development into more efficient and cost-effective renewable energy technologies. This continuous improvement is crucial for achieving widespread adoption and driving down energy costs.

Economic Challenges and Considerations:

While the benefits are clear, several economic challenges need addressing:

- Regional Economic Disparities: The distribution of clean energy projects and associated jobs isn't uniform across the US. Some regions might benefit disproportionately, leaving others behind. Policies need to be carefully designed to mitigate these regional disparities and ensure equitable economic development.

- Transition Costs for Fossil Fuel Workers: The shift away from fossil fuels presents challenges for workers in the traditional energy sector. Retraining programs and support for affected communities are crucial to ensuring a just transition and avoiding social unrest.

- Potential for Market Distortion: Some argue that excessive tax incentives can distort the market, leading to inefficiencies and potentially creating an over-reliance on government subsidies. Finding the right balance between support and market forces is crucial.

The Future of Clean Energy Tax Policy:

The long-term economic success of the US's clean energy transition depends on the continued refinement and effectiveness of its tax policies. This requires:

- Policy Stability and Predictability: Long-term policy certainty provides investors with confidence, encouraging sustained investment in the sector. Frequent changes in tax incentives can hinder long-term planning and investment decisions.

- Data-Driven Policy Evaluation: Regular assessments of the effectiveness of existing policies are essential to make necessary adjustments and maximize their impact.

- Collaboration and Public-Private Partnerships: Effective clean energy policies require collaboration between government agencies, private companies, and research institutions to foster innovation and streamline the deployment of renewable energy technologies.

Conclusion:

The economic stakes of clean energy tax policy in the United States are high. While the transition to a clean energy economy presents challenges, the potential for economic growth, job creation, and technological advancement is immense. By carefully designing and implementing effective tax policies, the US can harness the economic opportunities presented by the transition while mitigating potential risks and ensuring a just and equitable outcome for all. Continued monitoring, evaluation, and adaptation of these policies will be essential to achieving a sustainable and prosperous future powered by clean energy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Economic Stakes Of Clean Energy Tax Policy In The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Esports Star Uzi Awarded Electric G Wagon By Mercedes Benz

May 21, 2025

Esports Star Uzi Awarded Electric G Wagon By Mercedes Benz

May 21, 2025 -

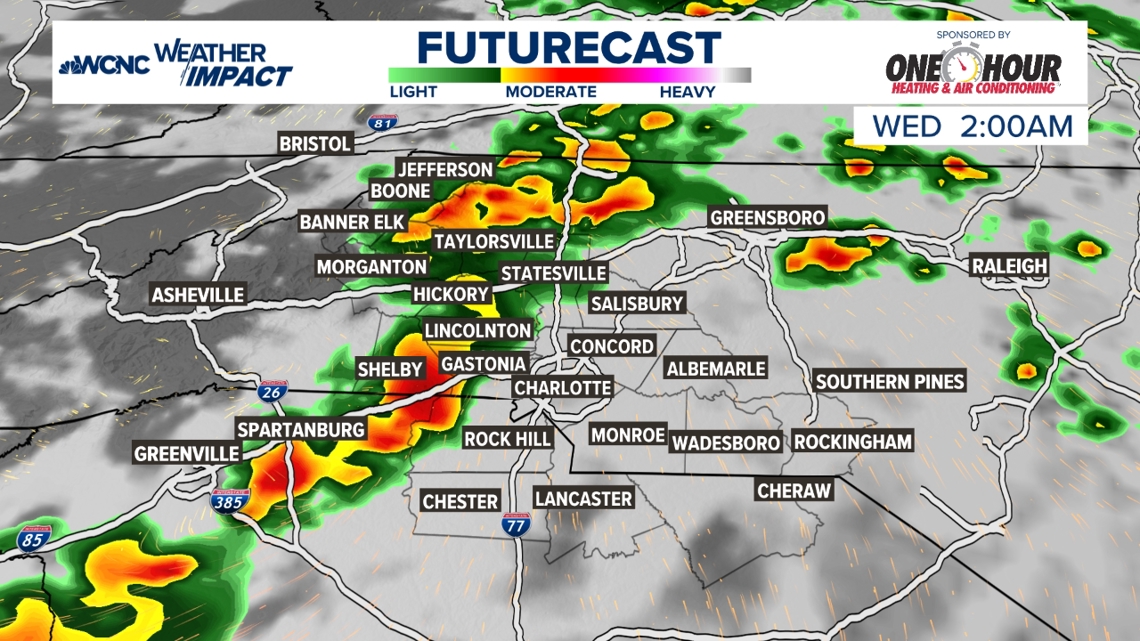

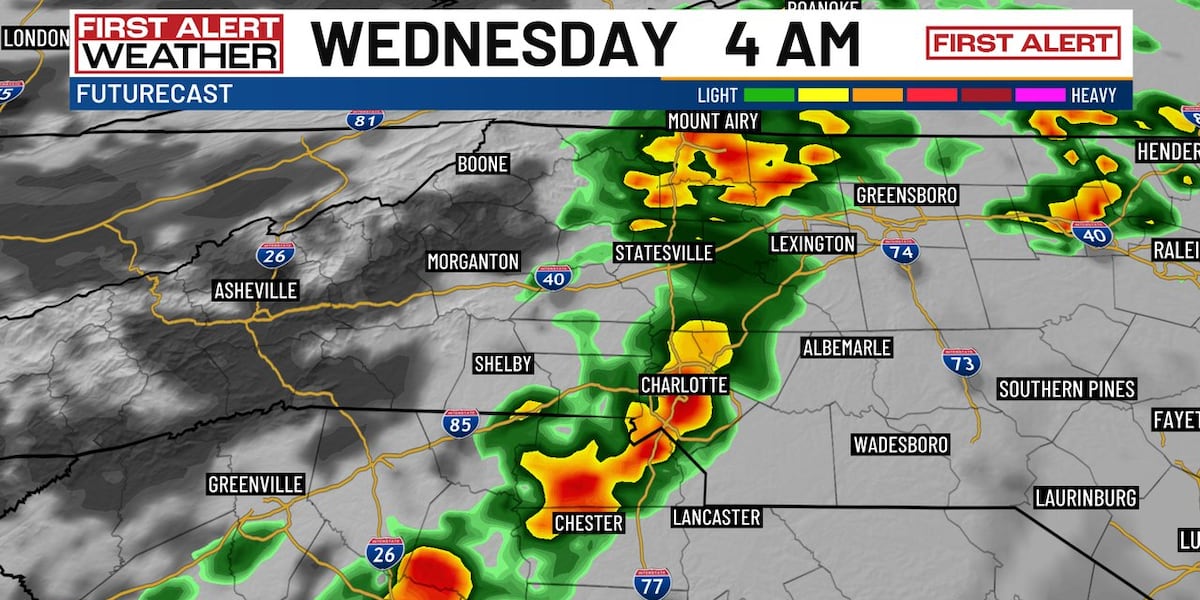

Limited Severe Weather Risk Tuesday Night Localized Storm Outlook

May 21, 2025

Limited Severe Weather Risk Tuesday Night Localized Storm Outlook

May 21, 2025 -

Charlotte Weather Alert Overnight Storms Expected Cooldown To Follow

May 21, 2025

Charlotte Weather Alert Overnight Storms Expected Cooldown To Follow

May 21, 2025 -

Amidst Heightened Russian Offensive Trumps Diplomatic Push For Ukraine Cease Fire Through Talks With Putin And Zelensky

May 21, 2025

Amidst Heightened Russian Offensive Trumps Diplomatic Push For Ukraine Cease Fire Through Talks With Putin And Zelensky

May 21, 2025 -

Trump Administration Wins Supreme Court Case Venezuelan Migrant Protections Removed

May 21, 2025

Trump Administration Wins Supreme Court Case Venezuelan Migrant Protections Removed

May 21, 2025