U.S. Treasury Market Reacts: Yields Fall After Fed's Rate Cut Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Yields Fall After Fed's Rate Cut Forecast

The U.S. Treasury market experienced a significant shift following the Federal Reserve's recent announcement hinting at potential interest rate cuts. Yields on government bonds tumbled, reflecting investor sentiment and expectations for a less aggressive monetary policy stance. This move has significant implications for the broader economy and financial markets.

Understanding the Fed's Shift and its Impact on Treasury Yields

The Federal Reserve's projection of future rate cuts, a departure from its previous hawkish tone, sent shockwaves through the financial world. For months, the Fed had maintained a commitment to combating inflation, even if it meant slower economic growth. This latest forecast suggests a potential pivot, prioritizing economic stability over aggressive inflation control. This change in outlook immediately impacted investor confidence and Treasury yields.

Historically, higher interest rates generally lead to higher Treasury yields, as investors demand a greater return for lending money to the government. Conversely, the anticipation of lower interest rates, as signaled by the Fed, makes existing bonds more attractive, driving up their prices and consequently pushing yields down. This inverse relationship is a fundamental principle in bond markets.

A Deeper Dive into the Market Reaction

The immediate reaction in the Treasury market was dramatic. Yields on benchmark 10-year and 30-year Treasury notes saw notable declines. This drop indicates increased demand for these relatively safer assets, as investors seek refuge in the face of potential economic uncertainty.

- 10-Year Treasury Yield: Experienced a significant fall, reflecting investor confidence in the safety and stability of U.S. government debt.

- 30-Year Treasury Yield: Similarly, the longer-term yield also decreased, signaling a belief in long-term economic stability despite the potential for near-term economic slowdown.

- Short-Term Treasury Yields: These remained relatively stable, indicating less immediate expectation of significant rate cuts in the very near future.

What This Means for Investors and the Broader Economy

The decline in Treasury yields has several key implications:

- Lower Borrowing Costs: Reduced yields translate to lower borrowing costs for businesses and consumers, potentially stimulating economic activity. However, this could also fuel inflation if not managed carefully.

- Impact on the Stock Market: Lower yields can be positive for the stock market, as investors may shift their investments from bonds to equities in search of higher returns. However, this depends on various factors including overall economic conditions.

- Dollar's Value: Changes in Treasury yields can impact the value of the U.S. dollar. Lower yields may weaken the dollar relative to other currencies.

Looking Ahead: Uncertainty Remains

While the Fed's signal suggests a potential easing of monetary policy, several uncertainties remain. The actual timing and magnitude of future rate cuts are still subject to ongoing economic data and inflation trends. Furthermore, geopolitical events and global economic conditions could significantly influence market dynamics. Investors should carefully monitor these factors and adapt their strategies accordingly. Staying informed through reputable financial news sources is crucial for navigating this complex landscape. [Link to a reputable financial news source]

Call to Action: Understanding the nuances of the Treasury market and its connection to broader economic trends is vital for informed investment decisions. Consider consulting a financial advisor to discuss your personal investment strategy in light of these recent developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Yields Fall After Fed's Rate Cut Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

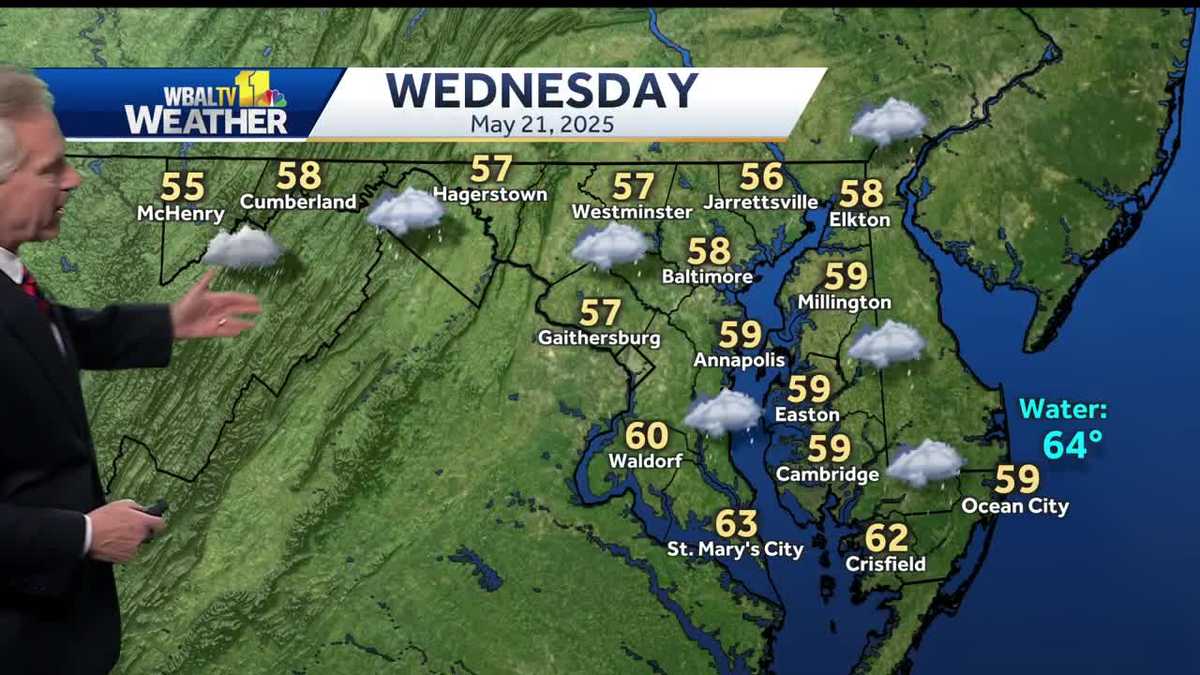

Rain And Cold To Dominate Weather Forecast For The Coming Week

May 21, 2025

Rain And Cold To Dominate Weather Forecast For The Coming Week

May 21, 2025 -

Chilly Temperatures And Rain To Impact Region Wednesday

May 21, 2025

Chilly Temperatures And Rain To Impact Region Wednesday

May 21, 2025 -

Colder Weather Arrives With Continued Rain Throughout The Week

May 21, 2025

Colder Weather Arrives With Continued Rain Throughout The Week

May 21, 2025 -

Japanese Businesses Boost Corporate Value With Nature Conservation A 13 Sector Initiative

May 21, 2025

Japanese Businesses Boost Corporate Value With Nature Conservation A 13 Sector Initiative

May 21, 2025 -

2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Too Expensive

May 21, 2025

2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Too Expensive

May 21, 2025