The Economic Fallout: Analyzing The Clean Energy Tax Debate In The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Economic Fallout: Analyzing the Clean Energy Tax Debate in the US

The debate surrounding clean energy tax policies in the United States is far from settled, sparking intense economic and political discussions. Proposed tax credits, deductions, and potential levies on carbon emissions are creating a ripple effect across various sectors, leaving businesses, consumers, and policymakers grappling with complex economic consequences. This article delves into the core arguments, examining potential benefits and drawbacks of different approaches.

The Allure of Incentives: Tax Credits and Their Impact

Numerous clean energy tax incentives are currently in place or under consideration. The most prominent include tax credits for renewable energy investments (solar, wind, geothermal), electric vehicle purchases, and energy efficiency upgrades. Proponents argue these incentives are crucial for stimulating innovation, creating green jobs, and accelerating the transition to a cleaner energy future. Studies by organizations like the National Renewable Energy Laboratory (NREL) [link to NREL study] consistently show a positive correlation between tax incentives and renewable energy deployment.

However, critics raise concerns about the cost. The significant financial outlays required to fund these credits raise questions about their long-term fiscal sustainability and potential impact on the national debt. Furthermore, concerns exist about potential inefficiencies, such as "rent-seeking" behavior where companies benefit from incentives without significantly contributing to the broader clean energy goals.

Carbon Taxes: A Controversial Approach

Another prominent element of the debate centers around carbon taxes – levies imposed on carbon emissions from fossil fuels. Supporters argue this approach effectively internalizes the environmental costs associated with burning fossil fuels, incentivizing businesses and consumers to reduce their carbon footprint. Economists often point to the potential for revenue generation, which could be used to fund further clean energy initiatives or offset other taxes. The revenue neutrality argument – where carbon tax revenues are used to reduce other taxes – is frequently cited to mitigate potential regressive effects on lower-income households.

However, opposition to carbon taxes is significant. Concerns about increased energy prices, negative impacts on specific industries (e.g., manufacturing), and potential job losses are frequently voiced. Furthermore, the political challenges of implementing such a tax are substantial, requiring broad bipartisan support which has proven elusive.

The Jobs Debate: Green vs. Fossil Fuel Sectors

A key aspect of the clean energy tax debate revolves around job creation and displacement. While the clean energy sector offers significant job growth potential in areas like manufacturing, installation, and maintenance of renewable energy systems, concerns exist about potential job losses in the fossil fuel industry. This necessitates a comprehensive strategy that addresses the transition, including retraining programs and support for affected communities. A balanced approach focusing on a just transition is crucial for achieving broad public acceptance.

Navigating the Economic Uncertainties: The Path Forward

The economic ramifications of different clean energy tax policies are complex and multifaceted. Careful analysis is needed to weigh the benefits of stimulating clean energy growth against potential costs and negative economic impacts. This requires thorough cost-benefit analyses, robust modeling of economic impacts, and transparent public discourse. A well-designed policy framework should address concerns about affordability, equity, and the need for a smooth transition for affected workers and communities. The ultimate goal should be to achieve a sustainable, environmentally responsible, and economically viable energy future for the United States.

Call to Action: Stay informed about the evolving clean energy tax debate by following reputable sources and engaging in thoughtful discussions. Your informed participation is crucial in shaping a responsible energy policy for the nation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Economic Fallout: Analyzing The Clean Energy Tax Debate In The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Latonya Pottain My 600 Lb Life Star Dead At 40 Family Shares Heartbreaking Details

May 20, 2025

Latonya Pottain My 600 Lb Life Star Dead At 40 Family Shares Heartbreaking Details

May 20, 2025 -

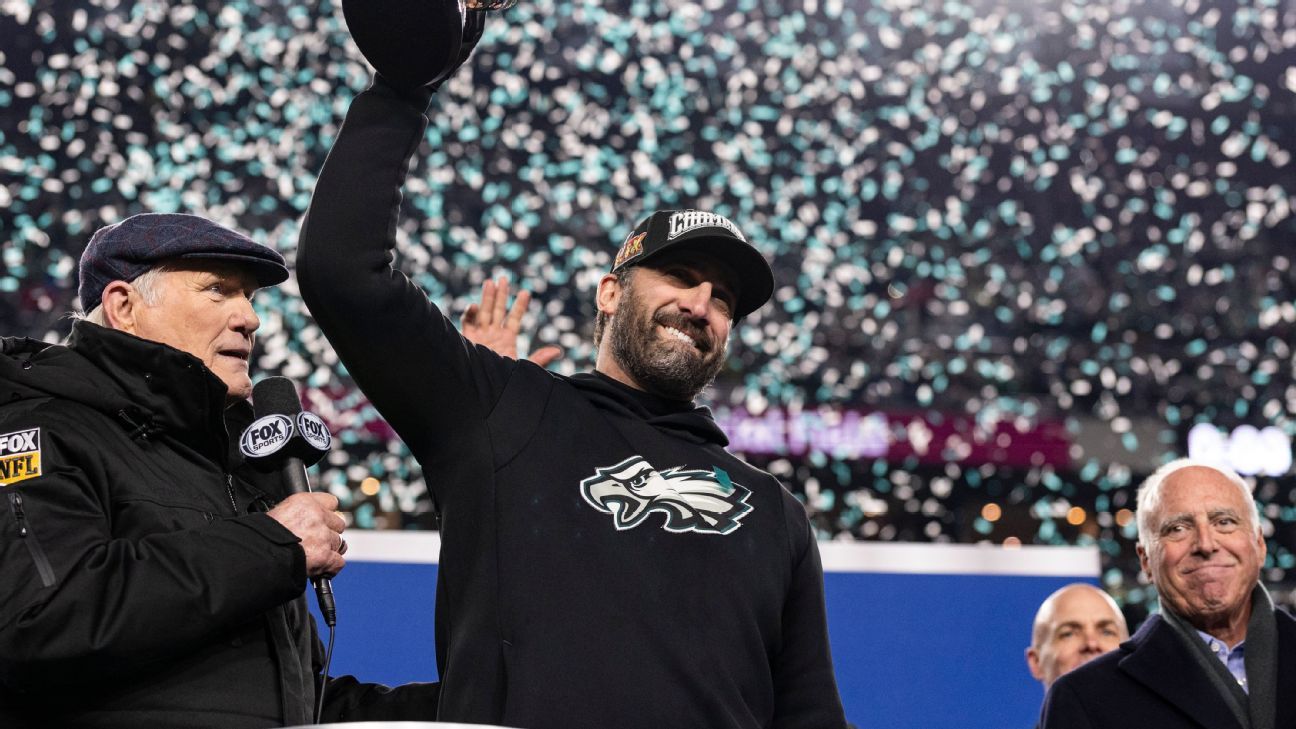

Nick Siriannis Contract Extension Eagles Reward Super Bowl Winning Coach

May 20, 2025

Nick Siriannis Contract Extension Eagles Reward Super Bowl Winning Coach

May 20, 2025 -

Overcompensating A Coming Out Comedy Thats Both Funny And Thought Provoking

May 20, 2025

Overcompensating A Coming Out Comedy Thats Both Funny And Thought Provoking

May 20, 2025 -

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025

Nfl News Philadelphia Eagles Reward Sirianni With Contract Extension

May 20, 2025 -

The Unexpected Friendship Between Jamie Lee Curtis And Lindsay Lohan

May 20, 2025

The Unexpected Friendship Between Jamie Lee Curtis And Lindsay Lohan

May 20, 2025