Market Confidence In Bitcoin ETFs: Over $5 Billion In Recent Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Confidence in Bitcoin ETFs Soars: Over $5 Billion in Recent Investments Signals Bullish Sentiment

The cryptocurrency market is buzzing with excitement following a surge in investment into Bitcoin exchange-traded funds (ETFs). Recent figures reveal over $5 billion poured into Bitcoin ETFs, a significant indicator of growing market confidence and a potential bullish signal for the future of Bitcoin. This unprecedented influx of capital suggests institutional investors are increasingly comfortable with Bitcoin as an asset class, marking a pivotal moment in the cryptocurrency's journey towards mainstream adoption.

This massive investment isn't just a flash in the pan; it represents a sustained trend reflecting a shift in the perception of Bitcoin. For years, the cryptocurrency market was largely dominated by individual investors. Now, we're seeing a clear and significant move by institutional players, who are known for their thorough due diligence and risk assessment. This participation validates Bitcoin’s potential as a viable long-term investment, boosting its credibility in the eyes of both seasoned and novice investors.

What's Driving This Investment Boom?

Several factors contribute to this surge in Bitcoin ETF investment:

-

Regulatory Clarity: Gradual regulatory clarity in key markets, like the US, is playing a crucial role. While complete regulatory frameworks are still developing, the progress made in recent months has reduced uncertainty and encouraged greater institutional involvement. The potential approval of a spot Bitcoin ETF in the US is a major catalyst for this increased investment.

-

Increased Institutional Adoption: Major financial institutions are increasingly adding Bitcoin to their portfolios, signaling a shift in their investment strategies. This adoption legitimizes Bitcoin as an asset class and reduces the perceived risk associated with it.

-

Inflation Hedge: Many investors view Bitcoin as a hedge against inflation, particularly in times of economic uncertainty. Its limited supply and decentralized nature make it an attractive alternative to traditional assets.

-

Technological Advancements: Ongoing advancements in Bitcoin's underlying technology, including the Lightning Network for faster and cheaper transactions, further enhance its appeal to investors.

The Implications of this Investment Surge:

The $5 billion investment in Bitcoin ETFs has several significant implications:

-

Price Appreciation: The increased demand is likely to put upward pressure on Bitcoin's price, potentially leading to further price appreciation in the short to medium term.

-

Mainstream Adoption: This influx of capital significantly accelerates Bitcoin's journey towards mainstream acceptance, making it more accessible and recognizable to a wider audience.

-

Increased Liquidity: The growing number of Bitcoin ETFs increases liquidity in the market, making it easier for investors to buy and sell Bitcoin.

Looking Ahead:

The future of Bitcoin ETFs remains bright. Continued regulatory clarity, growing institutional adoption, and technological advancements are likely to further fuel investment in this asset class. While volatility remains inherent in the cryptocurrency market, the recent surge in investment into Bitcoin ETFs demonstrates a strong belief in its long-term potential. This is a significant milestone for Bitcoin, signaling a mature and evolving market ready for the next phase of growth.

Further Reading:

- [Link to a reputable article about Bitcoin ETF regulations]

- [Link to a reputable article about institutional Bitcoin adoption]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you should conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Confidence In Bitcoin ETFs: Over $5 Billion In Recent Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025

World War I Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 21, 2025 -

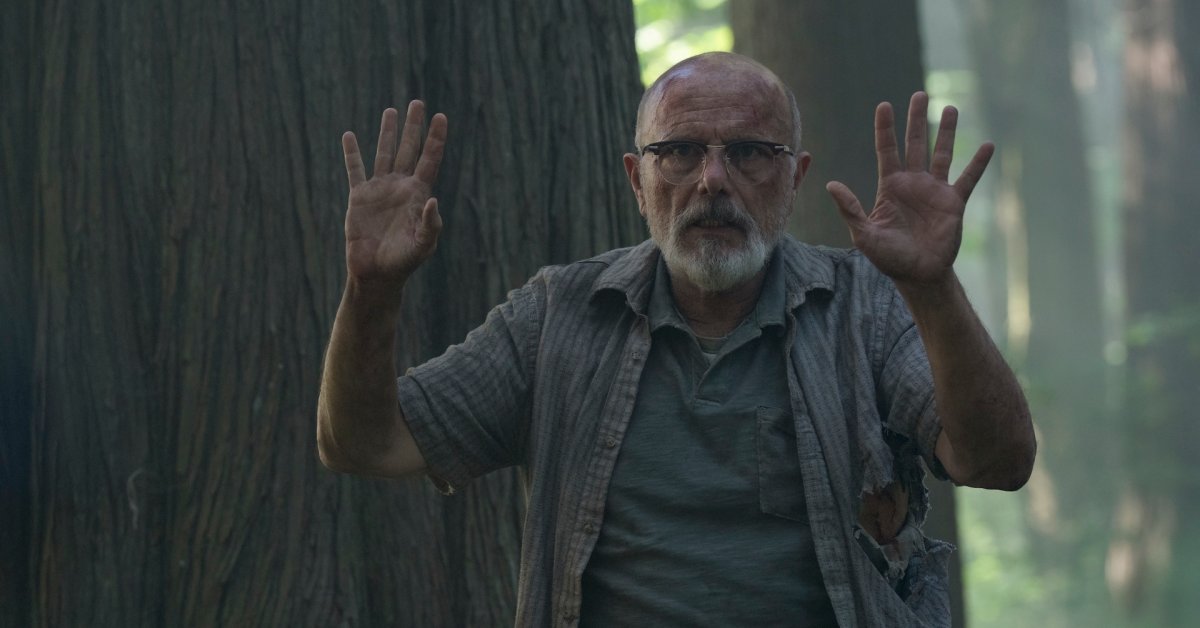

The Last Of Us Season 2 Exploring The Evolving Joel Ellie Bond Beyond The Video Game

May 21, 2025

The Last Of Us Season 2 Exploring The Evolving Joel Ellie Bond Beyond The Video Game

May 21, 2025 -

Cease Fire Hopes Rise Trump To Engage Putin And Zelensky Amidst Renewed Russian Strikes In Ukraine

May 21, 2025

Cease Fire Hopes Rise Trump To Engage Putin And Zelensky Amidst Renewed Russian Strikes In Ukraine

May 21, 2025 -

Balis Tourism Safety Initiative Seeking Global Collaboration

May 21, 2025

Balis Tourism Safety Initiative Seeking Global Collaboration

May 21, 2025 -

Fall Of Favre Director On The Challenges Of Portraying Brett Favres Complex Story

May 21, 2025

Fall Of Favre Director On The Challenges Of Portraying Brett Favres Complex Story

May 21, 2025