The Clean Energy Tax Debate: Shaping Economic Growth And Jobs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Shaping Economic Growth and Jobs

The debate surrounding clean energy tax policies is heating up, sparking fierce discussions about economic growth, job creation, and the future of our planet. Proposed tax credits, deductions, and potential penalties are at the heart of this complex issue, impacting businesses, consumers, and the environment in profound ways. Understanding the nuances of this debate is crucial for anyone interested in the future of our economy and the planet's health.

The Arguments for Clean Energy Tax Incentives:

Proponents argue that investing in clean energy through tax incentives is an economic engine, creating high-paying jobs in manufacturing, installation, and maintenance of renewable energy technologies like solar, wind, and geothermal. These incentives, they contend, stimulate innovation and competition, driving down the cost of clean energy and making it more accessible to consumers. Furthermore, a shift towards cleaner energy sources is vital for mitigating climate change and reducing our dependence on fossil fuels – a move that offers long-term economic and environmental security.

- Job Creation: The clean energy sector is a rapidly growing field, with potential for millions of new jobs in manufacturing, installation, research, and development. Tax credits incentivize companies to invest in this sector, leading to significant employment opportunities.

- Economic Growth: Investing in clean energy infrastructure creates economic activity across multiple sectors, boosting GDP and stimulating overall economic growth. This is a departure from traditional, environmentally damaging industries.

- Environmental Benefits: Transitioning to clean energy sources helps reduce greenhouse gas emissions, improving air quality and mitigating the effects of climate change. This leads to long-term cost savings related to healthcare and environmental remediation.

The Counterarguments: Concerns and Criticisms

Opponents raise concerns about the cost of these tax incentives, arguing that they may disproportionately benefit wealthy individuals and corporations, widening the economic gap. There are also concerns about the potential for government overreach and market distortion, arguing that the free market should determine the best path for energy development. Furthermore, some critics question the effectiveness of certain clean energy technologies and the overall feasibility of a rapid transition away from fossil fuels.

- Cost to Taxpayers: The financial burden of these tax incentives falls on taxpayers, raising questions about their overall efficiency and whether the benefits outweigh the costs. Careful analysis of cost-benefit ratios is crucial.

- Market Distortion: Some argue that government intervention through tax incentives distorts the free market, potentially hindering innovation and economic efficiency in the long run. A balanced approach is needed to avoid unnecessary market manipulation.

- Technological Viability: Questions remain about the reliability and scalability of some clean energy technologies, particularly concerning intermittency issues with solar and wind power. Investing in grid modernization and energy storage solutions is vital.

Finding a Balanced Approach: Navigating the Future of Energy

The clean energy tax debate is not simply about environmental protection; it's a complex economic equation. Finding a balanced approach that fosters innovation, creates jobs, and protects the environment requires careful consideration of all viewpoints. This includes exploring innovative financing mechanisms, supporting research and development, and implementing policies that ensure a just and equitable transition for workers and communities affected by the shift away from fossil fuels. Further research into the economic impacts of different policies is crucial to inform effective decision-making. The future of our energy sector depends on our ability to navigate this complex debate effectively.

Call to Action: Stay informed about the latest developments in clean energy policy and engage in respectful dialogue to shape a sustainable and prosperous future for all. Learn more about the economic impacts of clean energy by researching reports from organizations like the and the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Shaping Economic Growth And Jobs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

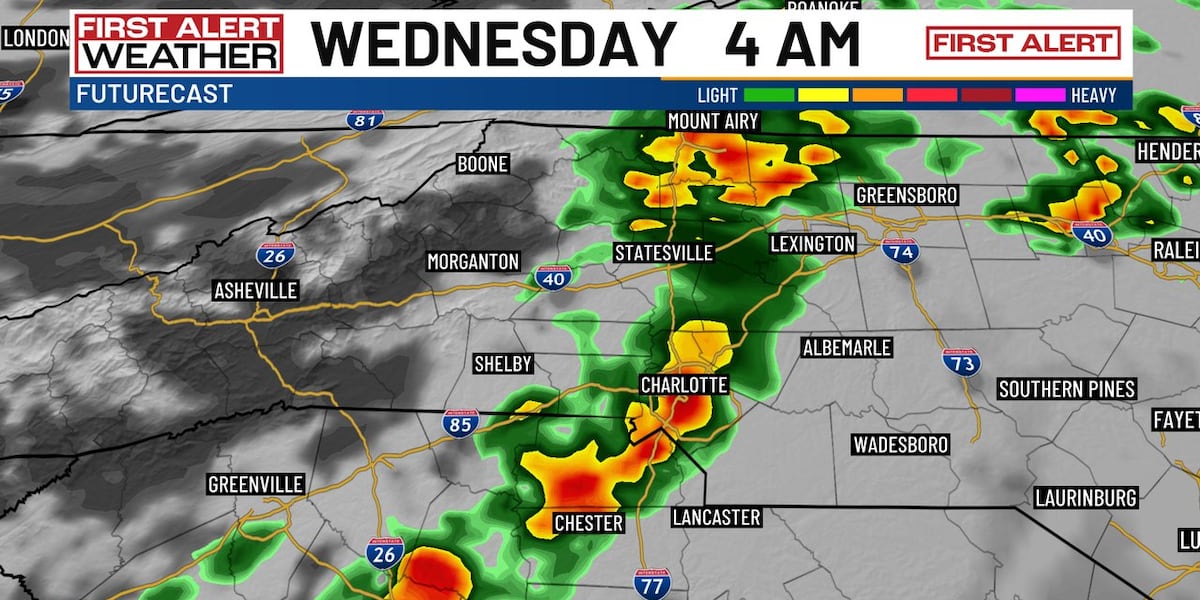

Incoming Storms And Chilly Temperatures Charlotte Weather Update

May 21, 2025

Incoming Storms And Chilly Temperatures Charlotte Weather Update

May 21, 2025 -

Addressing Tourist Misconduct Bali Implements New Behavioral Guidelines

May 21, 2025

Addressing Tourist Misconduct Bali Implements New Behavioral Guidelines

May 21, 2025 -

Juvenile Arrests Follow Church Break In And Bathroom Defilement

May 21, 2025

Juvenile Arrests Follow Church Break In And Bathroom Defilement

May 21, 2025 -

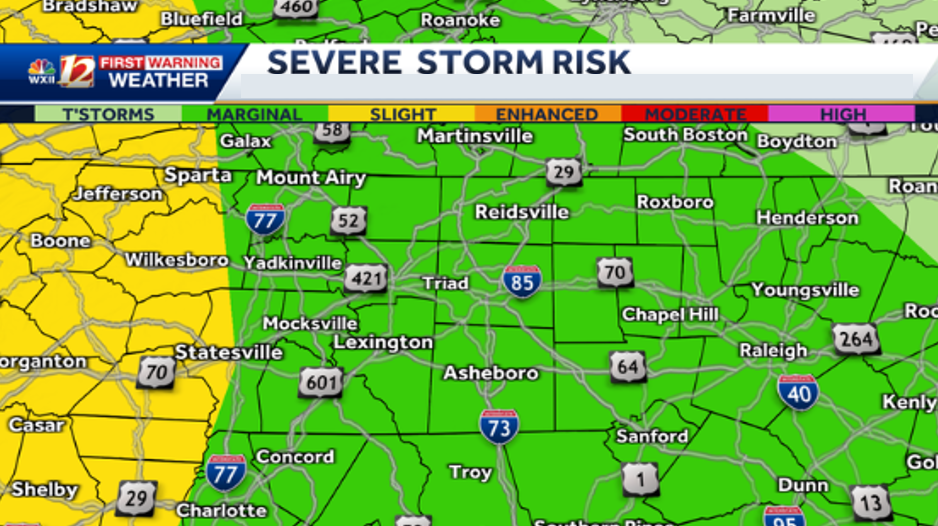

Overnight Storms And Heavy Rain Severe Weather Warning For North Carolina

May 21, 2025

Overnight Storms And Heavy Rain Severe Weather Warning For North Carolina

May 21, 2025 -

Police Investigate Church Bathroom Desecrated By Two Youths

May 21, 2025

Police Investigate Church Bathroom Desecrated By Two Youths

May 21, 2025