StubHub IPO: $22-$25 Per Share, Targeting $9.2 Billion Valuation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

StubHub IPO: Aiming for $9.2 Billion Valuation with $22-$25 Share Price

StubHub, the popular online ticket marketplace, is gearing up for its highly anticipated Initial Public Offering (IPO), aiming for a valuation between $9 billion and $9.2 billion. The company has set a price range of $22 to $25 per share, signaling strong investor confidence in the secondary ticket market's continued growth. This move marks a significant moment for StubHub and the broader ticketing industry, promising potential returns for investors and raising questions about the future of ticket sales.

The IPO, expected to generate substantial capital, will allow StubHub to further invest in its technology, expand its global reach, and potentially acquire smaller competitors. This influx of cash could significantly boost the company’s already impressive market share in the secondary ticket market.

A Look at StubHub's Strengths and Challenges

StubHub's success is largely attributed to its user-friendly platform, extensive ticket inventory, and robust buyer protection policies. These factors have helped solidify its position as a leading player in the secondary ticketing arena. However, the company faces considerable challenges, including:

- Competition: The secondary ticket market is becoming increasingly competitive, with rivals such as Vivid Seats and Ticketmaster actively vying for market share. StubHub will need to continue innovating and enhancing its platform to maintain its competitive edge.

- Regulatory Scrutiny: The secondary ticket market is subject to increasing regulatory scrutiny regarding ticket pricing and the prevention of scalping. StubHub must navigate this complex regulatory landscape effectively to avoid legal challenges and maintain a positive public image.

- Technological Advancements: The company needs to continually invest in technology to improve its user experience, enhance security measures, and adapt to changing consumer preferences. Failure to do so could lead to a loss of market share to more technologically advanced competitors.

What the IPO Means for Investors

The projected valuation of $9.2 billion reflects investors' belief in StubHub's long-term growth potential. However, it's crucial for potential investors to carefully weigh the risks alongside the potential rewards. The success of the IPO will depend on various factors, including market conditions, investor sentiment, and the company's ability to execute its growth strategy. A successful IPO could significantly boost StubHub's resources, allowing for expansion and further innovation within the ticketing industry.

The Future of Ticket Sales: A Post-IPO Perspective

The StubHub IPO marks a pivotal moment for the secondary ticket market. The success of this offering will likely influence the strategies of other players in the industry, potentially leading to increased competition and innovation. The event also underscores the growing demand for convenient and secure platforms for buying and selling tickets, highlighting the significant shift in how consumers access entertainment events.

Call to Action: Stay Informed

This IPO is a significant event impacting the online ticket resale market. Stay informed about developments by following reputable financial news sources and industry blogs for updates on StubHub's performance following its public listing. Understanding the intricacies of this IPO and its broader implications can prove valuable for investors and anyone interested in the evolution of the entertainment industry. Further analysis and expert commentary will be crucial in understanding the long-term effects of this significant market entry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on StubHub IPO: $22-$25 Per Share, Targeting $9.2 Billion Valuation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Addresses Venezuela Denies Regime Change Pursuit Amid Increased Military Activity

Sep 09, 2025

Trump Addresses Venezuela Denies Regime Change Pursuit Amid Increased Military Activity

Sep 09, 2025 -

Understanding The Potential Mortgage Rate Reductions Following A September Fed Decision

Sep 09, 2025

Understanding The Potential Mortgage Rate Reductions Following A September Fed Decision

Sep 09, 2025 -

Cbss Gamble On J J Watt Learning From Past Mistakes With Tony Romo

Sep 09, 2025

Cbss Gamble On J J Watt Learning From Past Mistakes With Tony Romo

Sep 09, 2025 -

Wall Street Soars S And P 500 Nasdaq And Dow Jump On Inflation Anticipation

Sep 09, 2025

Wall Street Soars S And P 500 Nasdaq And Dow Jump On Inflation Anticipation

Sep 09, 2025 -

Bluegrass Night Two Strings Sutton And Masat Honor Genre Legends At Woodward Theatre

Sep 09, 2025

Bluegrass Night Two Strings Sutton And Masat Honor Genre Legends At Woodward Theatre

Sep 09, 2025

Latest Posts

-

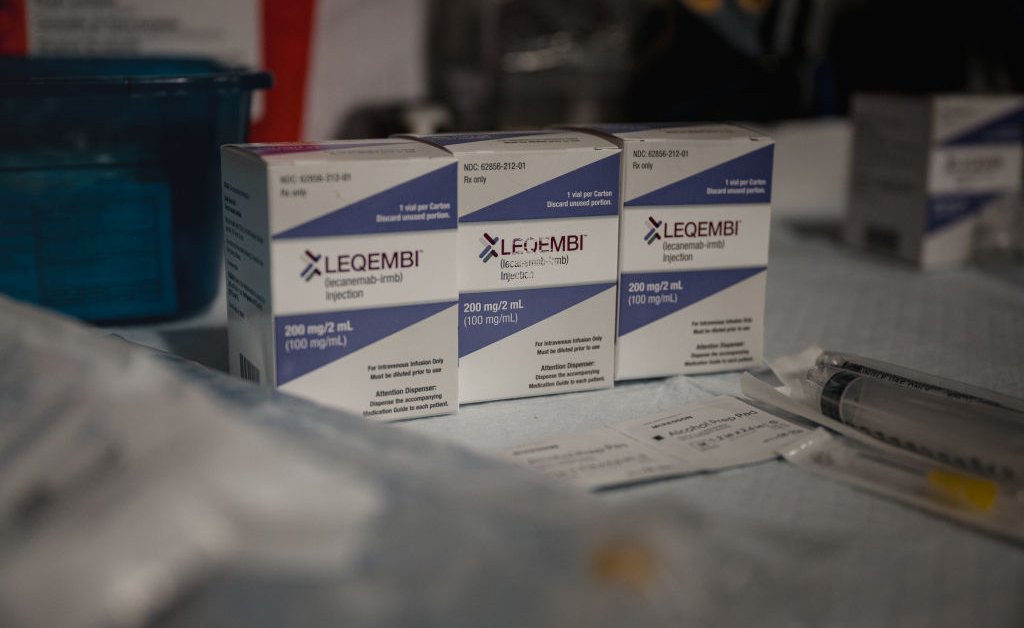

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025 -

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025