Understanding The Potential: Mortgage Rate Reductions Following A September Fed Decision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Potential: Mortgage Rate Reductions Following a September Fed Decision

The Federal Reserve's September meeting holds significant weight for the housing market, with many homeowners and prospective buyers anxiously awaiting potential mortgage rate reductions. Will the Fed's decisions translate into lower rates, offering relief to a struggling sector? Let's delve into the potential implications.

The current housing market is grappling with high mortgage rates, impacting affordability and slowing sales. This slowdown is partly due to the aggressive interest rate hikes implemented by the Federal Reserve throughout 2022 and earlier this year to combat inflation. However, recent economic indicators suggest a potential shift in the Fed's strategy. A cooling inflation rate and softening economic data could pave the way for a pause, or even a reduction, in interest rate hikes.

What to Expect from the September Fed Meeting

The September meeting is crucial. Economists and market analysts are closely scrutinizing inflation data, employment figures, and overall economic growth to predict the Fed's next move. Several scenarios are possible:

- Rate Cut: A rate cut is considered less likely by many experts at this juncture, given lingering inflationary pressures. However, the possibility remains if inflation continues to cool significantly and economic growth slows considerably.

- Rate Pause: A pause in rate hikes is the most widely anticipated outcome. This would signal a period of observation, allowing the Fed to assess the impact of previous rate increases on the economy.

- Continued Rate Hikes (though smaller): If inflation remains stubbornly high, the Fed may opt for another rate hike, although it's anticipated that any such hike would be smaller than those seen earlier this year.

How a Fed Decision Impacts Mortgage Rates

The Federal Reserve's actions directly influence the federal funds rate – the target rate banks charge each other for overnight loans. This rate acts as a benchmark for other interest rates, including those for mortgages. While not a direct one-to-one correlation, a reduction in the federal funds rate generally leads to lower mortgage rates over time. This is because lenders adjust their rates based on their borrowing costs and the overall market environment.

However, it's crucial to remember that mortgage rates aren't solely determined by the Fed. Other factors, including investor sentiment, economic conditions, and the performance of the broader financial markets, all play a role.

What Homebuyers and Homeowners Should Do

Regardless of the September Fed decision, proactive steps can benefit homeowners and prospective buyers:

- Stay Informed: Keep abreast of economic news and Federal Reserve announcements to understand the evolving market landscape. Reliable sources like the Federal Reserve's website and reputable financial news outlets are essential.

- Shop Around for Mortgages: Even with potentially lower rates, comparing offers from different lenders remains crucial to secure the best possible terms.

- Consult a Financial Advisor: A financial advisor can offer personalized guidance based on your individual financial situation and goals.

The Bottom Line: Cautious Optimism

While a significant reduction in mortgage rates following the September Fed decision isn't guaranteed, the possibility of a rate pause or smaller hikes offers a glimmer of hope for the housing market. Homebuyers and homeowners should remain informed, proactive, and prepared to navigate the evolving landscape. The coming weeks will provide clarity, offering a clearer picture of what the future holds for mortgage rates. For more in-depth analysis, consider exploring resources from the [link to a relevant financial website - e.g., the National Association of Realtors].

Keywords: Mortgage rates, Federal Reserve, September Fed meeting, interest rates, housing market, homebuyers, homeowners, inflation, economic growth, rate hike, rate cut, rate pause, financial advisor, mortgage lending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Potential: Mortgage Rate Reductions Following A September Fed Decision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

California Housing Breakthrough Impact On Single Family Neighborhood Density

Sep 09, 2025

California Housing Breakthrough Impact On Single Family Neighborhood Density

Sep 09, 2025 -

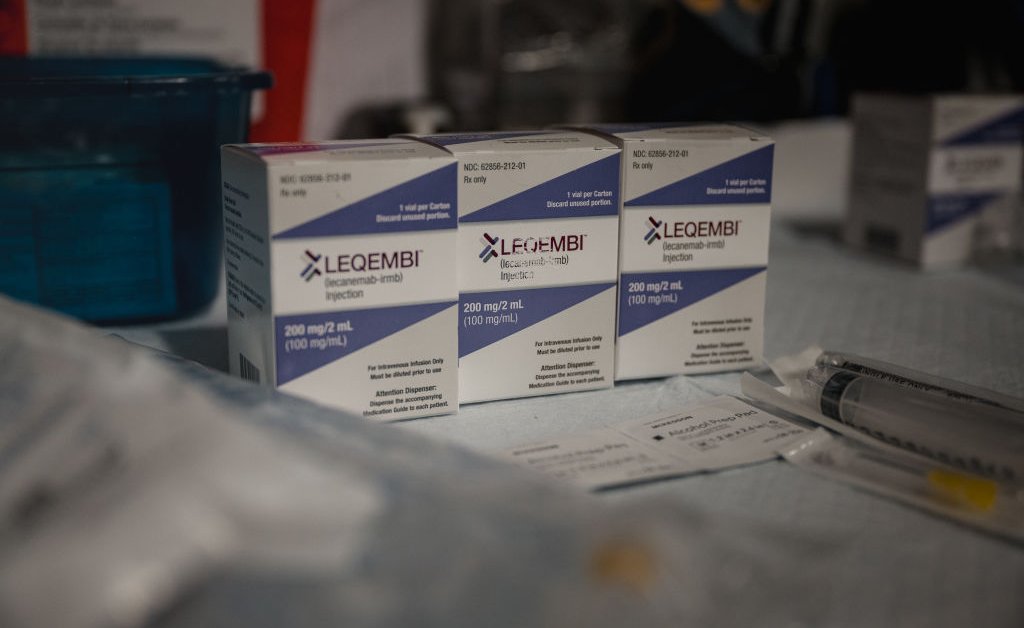

Home Administration Of Alzheimers Medication Is It Right For You

Sep 09, 2025

Home Administration Of Alzheimers Medication Is It Right For You

Sep 09, 2025 -

World Cup 2023 Ticket Presale Everything You Need To Know To Buy Tickets

Sep 09, 2025

World Cup 2023 Ticket Presale Everything You Need To Know To Buy Tickets

Sep 09, 2025 -

Armanis Iconic Aesthetic Analyzing Its Influence On Fashion

Sep 09, 2025

Armanis Iconic Aesthetic Analyzing Its Influence On Fashion

Sep 09, 2025 -

Former Churchgoer A Christian Influencers Journey Away From Traditional Worship

Sep 09, 2025

Former Churchgoer A Christian Influencers Journey Away From Traditional Worship

Sep 09, 2025

Latest Posts

-

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025 -

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025