Stock Market Reaction: Futures Jump After Trump's Iran-Israel Ceasefire Remarks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Reaction: Futures Jump After Trump's Iran-Israel Ceasefire Remarks

Global markets surged on a wave of optimism following former President Donald Trump's unexpected comments suggesting a potential ceasefire between Iran and Israel. Futures contracts for major US indices experienced significant gains, signaling a potential shift in investor sentiment regarding geopolitical risks in the volatile Middle East. This unexpected development comes amidst rising tensions in the region and offers a glimmer of hope for de-escalation.

The statement, made during a [link to source - e.g., a news interview or transcript], sparked immediate reactions across global financial markets. While the specifics of Trump's proposed ceasefire remain unclear, the mere suggestion of a potential de-escalation significantly reduced investor anxiety surrounding a potential wider conflict. This perceived reduction in risk proved to be a powerful catalyst for market gains.

Understanding the Market Reaction

The jump in futures contracts reflects a fundamental principle of market behavior: investors react positively to decreased uncertainty. The Middle East has long been a focal point of geopolitical risk, and any escalation in the region typically translates into market volatility. Trump's remarks, however improbable they may seem, offered a brief respite from this uncertainty.

- Reduced Geopolitical Risk: The primary driver behind the market surge was the perceived reduction in the risk of a larger conflict between Iran and Israel. This is a crucial factor for investors who assess geopolitical stability when making investment decisions.

- Oil Price Impact: Oil prices, often highly sensitive to Middle Eastern instability, also saw a slight dip following the news. The prospect of a ceasefire could potentially stabilize oil supplies, easing inflationary pressures on global markets.

- Investor Sentiment: The positive market reaction demonstrates the powerful influence of investor sentiment. Hope, however fragile, can significantly impact market behavior.

Analyzing Trump's Influence on Global Markets

Trump's comments, while unexpected, highlight his continued influence on global affairs and market sentiment. His past actions and statements have repeatedly shown the capacity to impact market movements, emphasizing the intricate relationship between politics and finance. This reinforces the importance of monitoring political developments for their potential impact on investment strategies.

Looking Ahead: Cautious Optimism

While the initial market reaction is overwhelmingly positive, it is crucial to maintain a degree of caution. The long-term implications of Trump's suggestion remain uncertain. The actual implementation of a ceasefire would depend on numerous factors, including the involvement of other regional players and the willingness of both Iran and Israel to engage in meaningful negotiations.

Experts urge investors to avoid overreacting to short-term market fluctuations. While this news is encouraging, further developments and confirmations are needed before drawing definitive conclusions. The situation remains fluid, and continued monitoring of the geopolitical landscape is essential.

Key Takeaways:

- Trump's remarks sparked a significant surge in stock market futures.

- The primary driver was a perceived reduction in the risk of a wider conflict in the Middle East.

- Oil prices also reacted positively to the news.

- Investors should remain cautious and monitor developments closely.

Disclaimer: This article provides information for educational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you should consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Reaction: Futures Jump After Trump's Iran-Israel Ceasefire Remarks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Escalation In Middle East Fordo Nuclear Site Hit Again Iran Retaliates

Jun 24, 2025

Escalation In Middle East Fordo Nuclear Site Hit Again Iran Retaliates

Jun 24, 2025 -

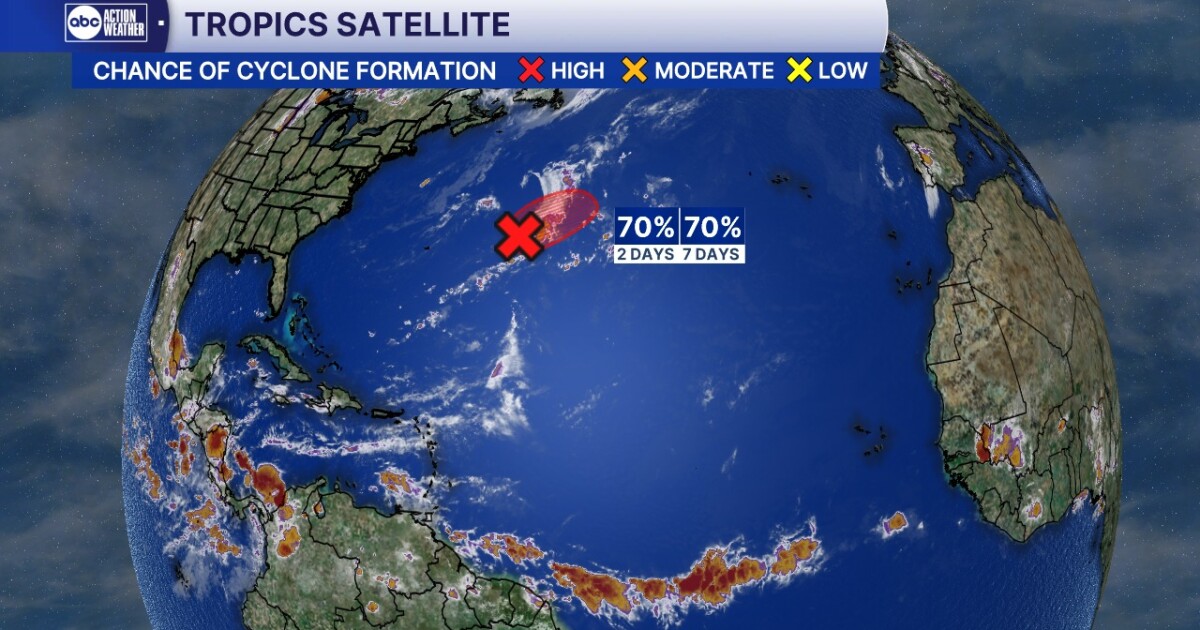

Atlantic Hurricane Season Begins Early Tropical Storm Andrea Threat Looms

Jun 24, 2025

Atlantic Hurricane Season Begins Early Tropical Storm Andrea Threat Looms

Jun 24, 2025 -

From School Plays To Broadway Stages Top High School Talent Makes The Leap

Jun 24, 2025

From School Plays To Broadway Stages Top High School Talent Makes The Leap

Jun 24, 2025 -

Institutional Investors Embrace Alliant Energy Lnt 83 Ownership Stake

Jun 24, 2025

Institutional Investors Embrace Alliant Energy Lnt 83 Ownership Stake

Jun 24, 2025 -

The Jaws Effect A Look At The Films Impact On Marine Life Protection

Jun 24, 2025

The Jaws Effect A Look At The Films Impact On Marine Life Protection

Jun 24, 2025