Institutional Investors Embrace Alliant Energy (LNT): 83% Ownership Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Embrace Alliant Energy (LNT): A Massive 83% Ownership Stake Signals Strong Confidence

Alliant Energy (LNT), a leading provider of energy services across the Midwest, is experiencing a surge in institutional investor confidence, with a staggering 83% ownership stake now held by these major players. This significant investment signifies a strong belief in Alliant's future growth and stability within the evolving energy sector. The move underscores the company's strategic positioning and its commitment to sustainable energy practices.

This unprecedented level of institutional ownership highlights several key aspects of Alliant Energy's appeal to sophisticated investors:

H2: Alliant Energy's Attractive Investment Profile

Several factors contribute to the dramatic increase in institutional investment in Alliant Energy (LNT). These include:

-

Strong Financial Performance: Alliant Energy consistently delivers robust financial results, showcasing steady revenue growth and a healthy dividend yield, making it an attractive option for investors seeking both capital appreciation and income. Recent quarterly reports have exceeded analyst expectations, further bolstering confidence.

-

Commitment to Renewable Energy: In an increasingly environmentally conscious world, Alliant Energy's significant investments in renewable energy sources like wind and solar power are a major draw for ESG (Environmental, Social, and Governance) focused investors. This commitment aligns with the growing global demand for sustainable energy solutions. You can learn more about their sustainability initiatives on their .

-

Strategic Acquisitions and Growth: Alliant Energy's history of strategic acquisitions and expansion into new markets demonstrates a proactive approach to growth and market share expansion. This aggressive yet calculated strategy has clearly resonated with institutional investors.

-

Stable and Regulated Business Model: Alliant Energy operates primarily within a regulated environment, providing a degree of stability and predictability that is highly valued by institutional investors seeking lower-risk investments. This regulated model mitigates some of the volatility inherent in the broader energy market.

H2: What This Means for Investors

The substantial institutional ownership in Alliant Energy (LNT) suggests a positive outlook for the company's future performance. While past performance is not indicative of future results, this level of confidence from large institutional investors is a significant indicator of potential growth and stability.

However, it’s important to remember that investing in the stock market always carries inherent risks. Individual investors should conduct thorough research and consider their own risk tolerance before making any investment decisions. Consulting with a qualified financial advisor is always recommended.

H2: Looking Ahead for Alliant Energy

Alliant Energy is well-positioned to navigate the challenges and opportunities presented by the evolving energy landscape. Their focus on renewable energy, strategic acquisitions, and a stable business model positions them for continued growth and success. The significant increase in institutional ownership is a clear vote of confidence in this strategy.

H3: Key Takeaways:

- 83% of Alliant Energy (LNT) is now owned by institutional investors.

- This signifies strong confidence in the company's future prospects.

- Alliant's commitment to renewable energy and stable business model are key factors.

- While promising, investors should always conduct thorough research before investing.

This significant investment by institutional investors in Alliant Energy (LNT) is a compelling development in the energy sector. It highlights the growing recognition of Alliant's strengths and its potential for long-term growth. The company's strategic direction and commitment to sustainability appear to be resonating strongly with the market. Keep an eye on Alliant Energy – this is a story worth watching.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Embrace Alliant Energy (LNT): 83% Ownership Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

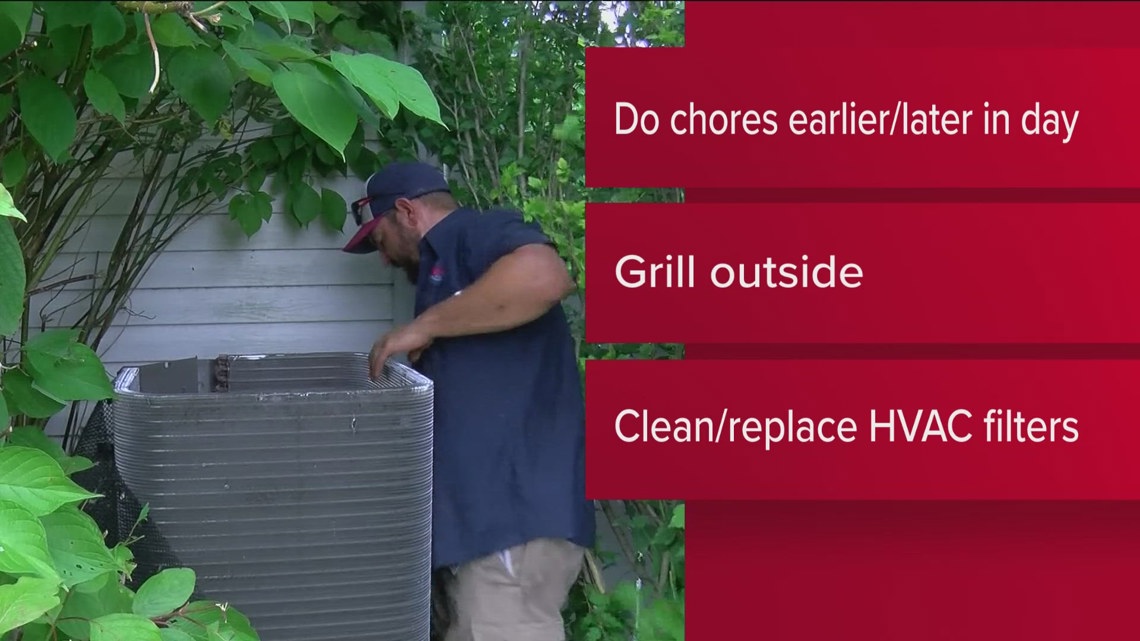

Summer Cooling On A Budget A List Of Money Saving Strategies

Jun 24, 2025

Summer Cooling On A Budget A List Of Money Saving Strategies

Jun 24, 2025 -

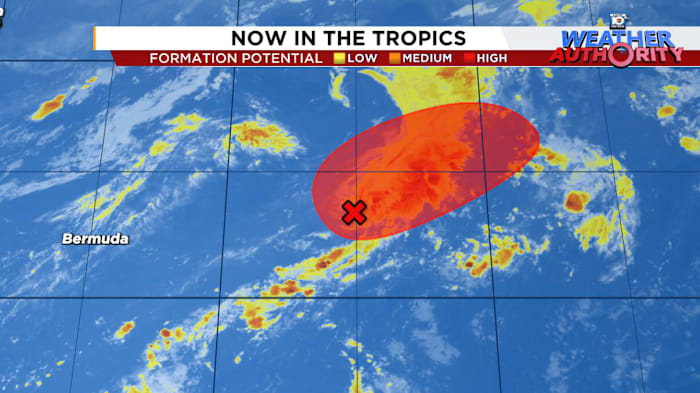

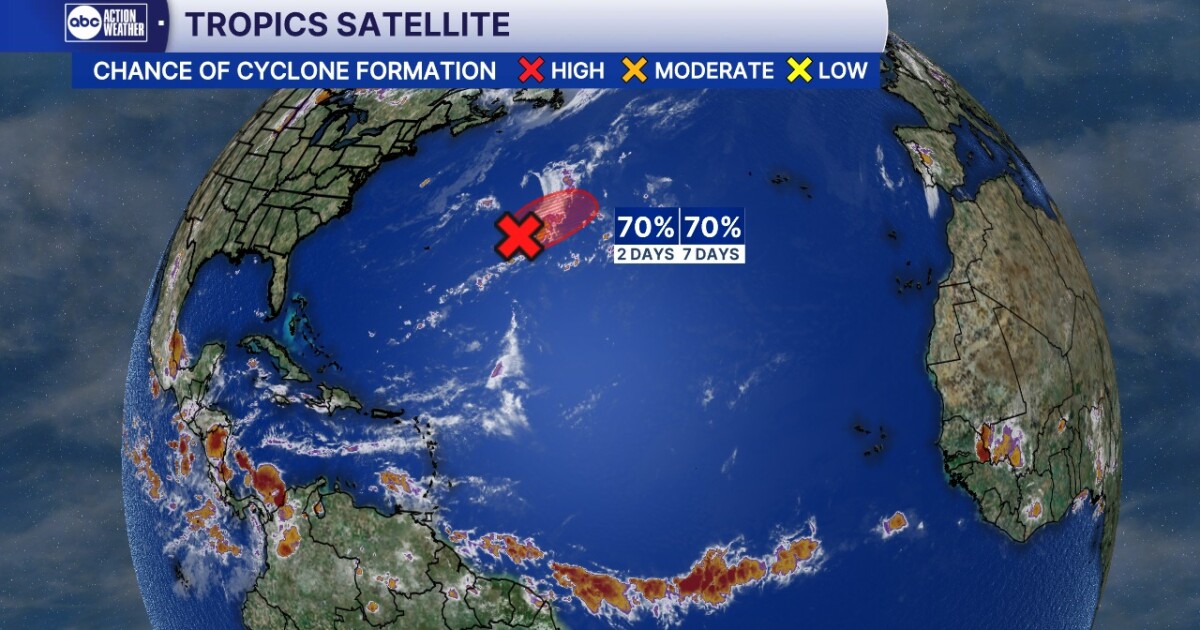

The Atlantic Speaks Unprecedented Ocean Event Imminent

Jun 24, 2025

The Atlantic Speaks Unprecedented Ocean Event Imminent

Jun 24, 2025 -

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025 -

Trump Administrations Climate Crackdown The Summer Showdown

Jun 24, 2025

Trump Administrations Climate Crackdown The Summer Showdown

Jun 24, 2025 -

Next Generation Broadway Talented High Schoolers Transition To The Big Stage

Jun 24, 2025

Next Generation Broadway Talented High Schoolers Transition To The Big Stage

Jun 24, 2025