Should You Buy NIO Stock After Its Recent Price Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy NIO Stock After its Recent Price Drop? Navigating the Electric Vehicle Market's Volatility

The electric vehicle (EV) market is a rollercoaster, and NIO, a prominent player in the Chinese EV sector, has recently experienced a significant price drop. This naturally leaves investors wondering: is now the time to buy, or should they steer clear? This article will delve into the factors influencing NIO's stock price, analyzing the potential risks and rewards before you decide whether to invest.

NIO's Recent Performance: A Rollercoaster Ride

NIO's stock price has seen considerable fluctuation in recent months. While the company has shown impressive growth in vehicle deliveries and technological innovation, external factors like macroeconomic headwinds in China and increased competition within the EV market have contributed to the price decline. Understanding these underlying causes is crucial before making any investment decisions.

Factors Affecting NIO's Stock Price:

- Macroeconomic Conditions in China: China's economic growth significantly impacts NIO's performance. Slowdowns in the Chinese economy can directly affect consumer spending, impacting EV sales. Keeping an eye on China's economic indicators is essential for any NIO investor.

- Intense Competition: The EV market is becoming increasingly competitive, with both established automakers and new entrants vying for market share. Competition from Tesla, BYD, and other Chinese EV manufacturers puts pressure on NIO's pricing and market position.

- Supply Chain Disruptions: Global supply chain issues continue to pose challenges for the automotive industry, including NIO. Delays in obtaining essential components can impact production and delivery timelines, affecting investor confidence.

- Technological Innovation and Product Launches: NIO's success hinges on its ability to continually innovate and launch compelling new models. Successful new product launches can boost investor sentiment and drive stock prices upward, while delays or setbacks can have the opposite effect.

- Government Regulations and Subsidies: Government policies and regulations regarding EVs in China play a significant role. Changes in subsidies or stricter emission standards can impact NIO's profitability and market outlook.

Is NIO Stock a Buy? Weighing the Risks and Rewards:

The decision of whether to buy NIO stock after its recent price drop is a complex one, requiring careful consideration of both the potential upside and the inherent risks.

Potential Upside:

- Growth Potential in the Chinese EV Market: The Chinese EV market remains a significant growth opportunity. NIO's strong brand recognition and innovative technology position it well to capitalize on this growth.

- Technological Advancements: NIO is a leader in battery technology and autonomous driving capabilities. Continued advancements in these areas could significantly enhance its competitive advantage.

- Valuation: The recent price drop might present a more attractive entry point for long-term investors, offering a potentially lower valuation compared to previous highs.

Potential Risks:

- High Volatility: The EV market, and NIO's stock in particular, is known for its high volatility. Investors need to have a high risk tolerance.

- Competition: The intense competition in the EV market poses a significant threat to NIO's market share and profitability.

- Dependence on the Chinese Market: NIO's primary market is China, making it vulnerable to economic and political changes within the country.

Conclusion: Due Diligence is Key

Ultimately, the decision of whether to buy NIO stock after its recent price drop depends on your individual risk tolerance, investment horizon, and thorough research. Before investing, carefully consider the factors outlined above, conduct your own due diligence, and consult with a qualified financial advisor. The information provided here is for informational purposes only and does not constitute financial advice.

Learn More:

- (Replace with actual link)

- (Replace with actual link)

Remember, investing in the stock market always involves risk. Make informed decisions based on your own research and understanding.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy NIO Stock After Its Recent Price Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Wire Actor Recounts Sons Near Fatal Tornado Experience In Henry County

Jun 03, 2025

The Wire Actor Recounts Sons Near Fatal Tornado Experience In Henry County

Jun 03, 2025 -

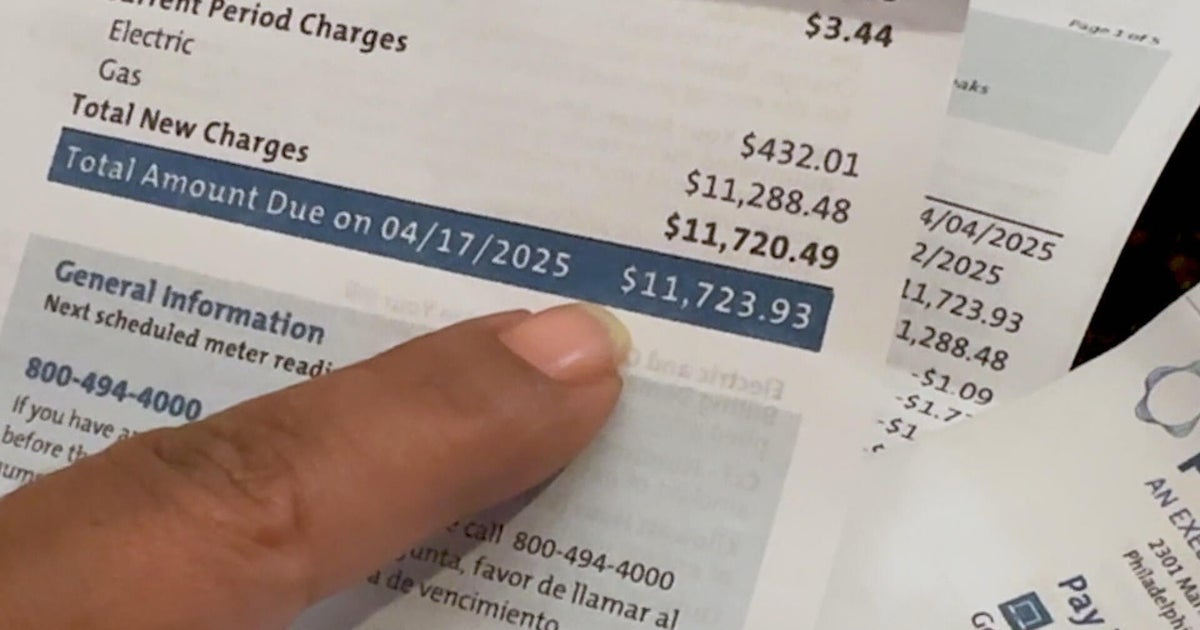

Months Without Bills Then A 12 000 Shock Investigating Pecos Billing System Failures

Jun 03, 2025

Months Without Bills Then A 12 000 Shock Investigating Pecos Billing System Failures

Jun 03, 2025 -

Jp Morgan Ceo Sounds Alarm Us China Tariff Strategy Failing

Jun 03, 2025

Jp Morgan Ceo Sounds Alarm Us China Tariff Strategy Failing

Jun 03, 2025 -

Nio Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 03, 2025

Nio Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 03, 2025 -

Walz On Trump And The Democrats A Call For A More Aggressive Approach

Jun 03, 2025

Walz On Trump And The Democrats A Call For A More Aggressive Approach

Jun 03, 2025