Robinhood (HOOD) Stock: Wellington Management Increases Holding By 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock: Wellington Management's Significant Stake Increase Sparks Investor Interest

Robinhood Markets, Inc. (NASDAQ: HOOD) saw a notable boost in investor confidence this week as Wellington Management, a prominent investment firm, significantly increased its stake in the company. This strategic move has sent ripples through the financial markets, prompting analysts and investors alike to reassess the future trajectory of HOOD stock. The news comes at a crucial time for Robinhood, as the company navigates a challenging market landscape and strives to regain its footing after a period of volatility.

Wellington Management Adds Thousands of Shares

According to recent filings, Wellington Management boosted its holding in Robinhood by a substantial 15,775 shares. This represents a significant vote of confidence in the company's potential for future growth and profitability. While the precise reasoning behind this investment increase remains undisclosed, it suggests that Wellington Management sees untapped value in Robinhood's platform and its long-term prospects. This large-scale purchase isn't just a minor adjustment; it's a bold statement indicating a belief in Robinhood's recovery and future success.

What Does This Mean for HOOD Stock?

The impact of Wellington Management's increased stake on HOOD stock is multifaceted. Firstly, it provides a much-needed injection of positive sentiment into the market, potentially attracting other investors looking for opportunities in the discounted stock. Secondly, the move lends credibility to Robinhood's ongoing efforts to improve its financial performance and attract new users. Finally, it could signal a broader shift in market perception regarding Robinhood's long-term viability.

However, it's crucial to remember that this is just one piece of the puzzle. While positive, this development shouldn't be interpreted as a guaranteed indicator of immediate price surges. Other factors, including broader market trends and Robinhood's own performance, will continue to play a crucial role in shaping HOOD stock's price.

Analyzing Robinhood's Current Position

Robinhood has faced significant challenges in recent years, battling increased competition and regulatory scrutiny. The company has been actively working to diversify its revenue streams and improve its platform features. Recent initiatives include:

- Expansion of its product offerings: Robinhood is continuously adding new investment options and features to enhance user experience and attract a wider customer base.

- Focus on improved customer service: Addressing previous criticisms, the company has been prioritizing improvements in customer service and support.

- Strategic partnerships: Collaborations with other financial institutions are aimed at expanding reach and boosting overall growth.

These efforts, coupled with the increased investment from Wellington Management, suggest a concerted strategy to revitalize the company's performance and position itself for future growth.

Looking Ahead: Potential for HOOD Stock Growth?

While predicting the future of any stock is inherently uncertain, the recent investment by Wellington Management offers a glimmer of hope for HOOD investors. The increased stake, alongside Robinhood's ongoing efforts to improve its platform and expand its services, suggests a potential for future growth.

However, investors should always conduct thorough research and consider their own risk tolerance before making any investment decisions. Consulting a financial advisor is recommended before investing in any stock, including HOOD. This article is for informational purposes only and does not constitute financial advice.

Keywords: Robinhood, HOOD, HOOD stock, Wellington Management, stock market, investment, NASDAQ, stock price, financial news, investment strategy, market analysis, stock prediction, financial performance, investor confidence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock: Wellington Management Increases Holding By 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robinhood Reports Record 255 B In Assets Crypto Trading Fuels 108 Trading Volume Increase

Jun 14, 2025

Robinhood Reports Record 255 B In Assets Crypto Trading Fuels 108 Trading Volume Increase

Jun 14, 2025 -

Institutional Investing Wellington Managements Stake In Robinhood Hood Grows

Jun 14, 2025

Institutional Investing Wellington Managements Stake In Robinhood Hood Grows

Jun 14, 2025 -

Tragedy Strikes Air India Flight Down In London Extensive Casualties

Jun 14, 2025

Tragedy Strikes Air India Flight Down In London Extensive Casualties

Jun 14, 2025 -

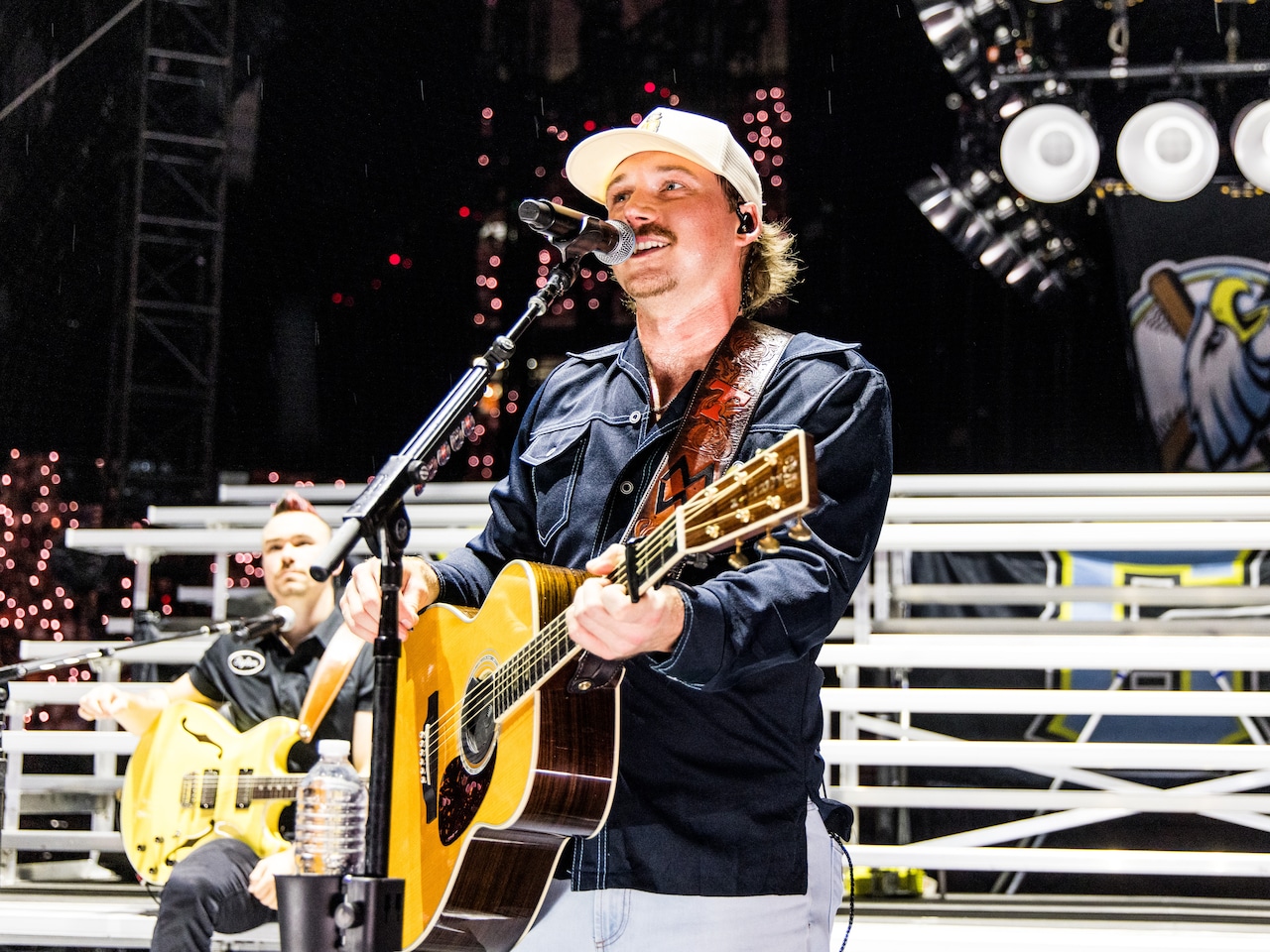

Houston Morgan Wallen Concert Affordable Tickets For June 20 21

Jun 14, 2025

Houston Morgan Wallen Concert Affordable Tickets For June 20 21

Jun 14, 2025 -

255 Billion In Assets Robinhoods Trading Volume Soars On Crypto Boom

Jun 14, 2025

255 Billion In Assets Robinhoods Trading Volume Soars On Crypto Boom

Jun 14, 2025