Institutional Investing: Wellington Management's Stake In Robinhood (HOOD) Grows

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Boosts Robinhood (HOOD) Stake: A Sign of Confidence or Calculated Risk?

Institutional investors are constantly scrutinizing the market, making strategic moves that can significantly impact stock prices. Recently, Wellington Management, a prominent global investment firm, increased its stake in the popular trading app, Robinhood Markets, Inc. (HOOD). This move has sparked considerable interest, prompting questions about the future trajectory of HOOD and the reasoning behind Wellington's increased investment. This article delves into the details of Wellington Management's growing stake in Robinhood, exploring the potential implications for investors and the broader market.

Wellington Management's Growing Footprint in Robinhood:

According to recent SEC filings, Wellington Management significantly boosted its holdings in Robinhood during the [Insert Quarter/Period]. The exact figures vary depending on the source, but the increase represents a substantial commitment to the company. This strategic move follows a period of fluctuating performance for HOOD, making Wellington's decision all the more noteworthy. This isn't just a minor adjustment; it signifies a deliberate and substantial increase in their belief in Robinhood's long-term prospects.

What's Driving Wellington's Confidence in HOOD?

Several factors could be contributing to Wellington Management's bullish stance on Robinhood:

- Growth Potential in a Competitive Market: Despite facing stiff competition from established players like Charles Schwab and Fidelity, Robinhood maintains a significant user base, particularly among younger investors. Wellington may see untapped potential for growth through expanded services and market penetration.

- Technological Innovation: Robinhood continues to innovate its platform, adding new features and improving the user experience. This ongoing investment in technology could be a key factor influencing Wellington's decision.

- Long-Term Vision: Wellington Management is known for its long-term investment strategy. They may be betting on Robinhood's ability to overcome current challenges and establish itself as a major player in the fintech industry over the next several years.

- Valuation: The current market valuation of HOOD might be seen by Wellington as an attractive entry or accumulation point, presenting a compelling risk-reward profile.

Risks and Challenges Facing Robinhood:

While Wellington Management's increased investment signals a degree of optimism, it's crucial to acknowledge the significant challenges facing Robinhood:

- Increased Regulatory Scrutiny: The fintech sector faces increasing regulatory scrutiny, which could impact Robinhood's operations and profitability.

- Competition: The competitive landscape remains fierce, with established players constantly vying for market share.

- Market Volatility: The overall market's volatility can significantly impact Robinhood's performance and investor sentiment.

What Does This Mean for Investors?

Wellington Management's increased investment in Robinhood doesn't guarantee future success. However, it provides a valuable data point for investors considering their own positions. It's a strong indication that at least one major institutional investor sees significant long-term potential in the company. This should be considered alongside your own due diligence and risk tolerance before making any investment decisions.

Conclusion:

Wellington Management's increased stake in Robinhood (HOOD) is a significant development, highlighting the ongoing debate surrounding the company's future. While challenges remain, the move suggests that at least one major player sees considerable potential in Robinhood's long-term growth trajectory. As always, investors should conduct thorough research and consider their own risk tolerance before making any investment decisions. This situation warrants close monitoring as the narrative around HOOD continues to unfold.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investing: Wellington Management's Stake In Robinhood (HOOD) Grows. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

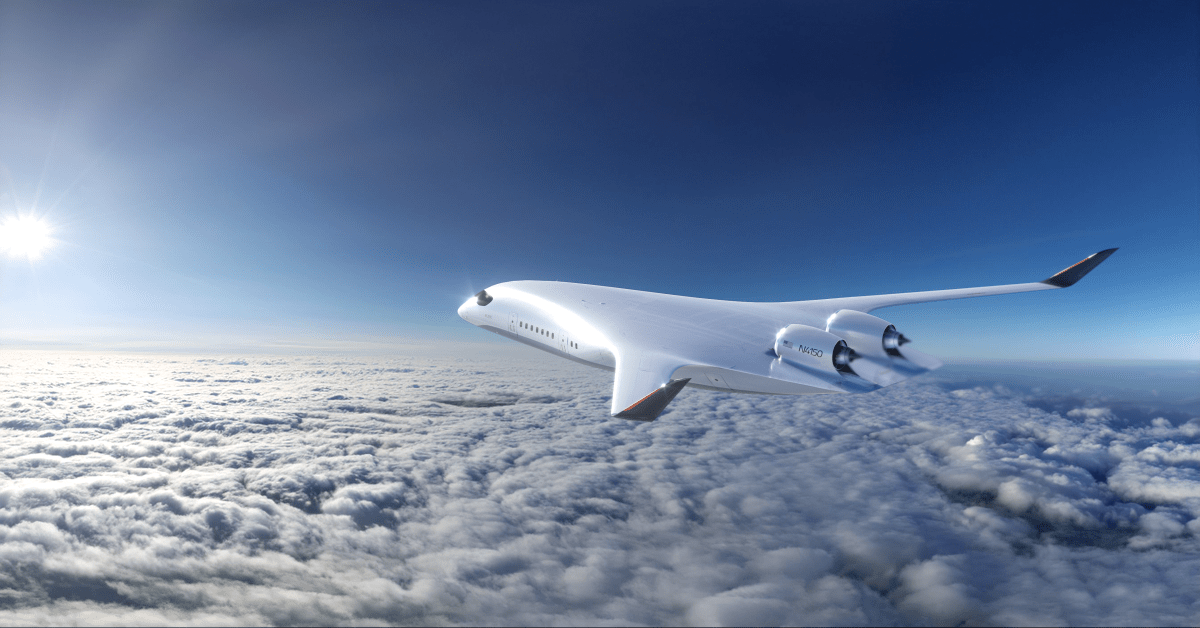

The Promise Of Green Skies Examining This Companys Low Carbon Technology

Jun 14, 2025

The Promise Of Green Skies Examining This Companys Low Carbon Technology

Jun 14, 2025 -

Film Festival Unveils Finding Faith In World Premiere Screening

Jun 14, 2025

Film Festival Unveils Finding Faith In World Premiere Screening

Jun 14, 2025 -

Air India Crash A Survivors Tale Of Resilience And Hope

Jun 14, 2025

Air India Crash A Survivors Tale Of Resilience And Hope

Jun 14, 2025 -

Us Open Contender Robert Mac Intyres Bold Wild Horse Approach

Jun 14, 2025

Us Open Contender Robert Mac Intyres Bold Wild Horse Approach

Jun 14, 2025 -

Barry Sanders Heart Attack The Nfl Icon Speaks Out

Jun 14, 2025

Barry Sanders Heart Attack The Nfl Icon Speaks Out

Jun 14, 2025