Record Highs In Sight? Wall Street And The Stock Market's Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Highs in Sight? Wall Street and the Stock Market's Meteoric Rise

Is the bull market back? Recent surges on Wall Street have investors buzzing, with many wondering if record highs are within reach. The stock market's impressive climb has sparked both excitement and apprehension, leaving many questioning the sustainability of this upward trend. This article delves into the factors driving the current market rally and explores the potential risks and rewards ahead.

The past few months have witnessed a remarkable resurgence in investor confidence. Major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite have all seen significant gains, fueled by a confluence of factors. Let's break them down:

H2: Key Drivers of the Market's Ascent

-

Strong Corporate Earnings: Despite economic headwinds, many companies have reported better-than-expected earnings, demonstrating resilience and fueling investor optimism. This positive earnings season suggests that businesses are navigating the current economic climate more effectively than previously anticipated. [Link to a reputable source on recent corporate earnings reports]

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential slowdown, prompting the Federal Reserve to consider a less aggressive approach to interest rate hikes. This easing of monetary policy is injecting much-needed confidence into the market. [Link to a reputable source on inflation data and Fed policy]

-

Technological Advancements: Continued innovation in sectors like artificial intelligence (AI) and renewable energy continues to attract significant investment, driving growth and boosting market sentiment. The potential for disruptive technologies to reshape various industries is a significant driver of the current bull market. [Link to an article discussing AI and market impact]

-

Increased Investor Sentiment: A shift in investor sentiment, moving from pessimism to cautious optimism, is contributing to the rise. This change is reflected in increased trading volume and a renewed appetite for riskier assets.

H2: Navigating the Potential Risks

While the current market surge is encouraging, it's crucial to acknowledge the potential risks:

-

Persistent Inflation: Despite recent signs of easing inflation, the possibility of persistent high inflation remains a significant threat. Sustained inflation could force the Federal Reserve to maintain a hawkish monetary policy, potentially dampening economic growth and impacting market performance.

-

Geopolitical Uncertainty: Global geopolitical tensions, including the ongoing war in Ukraine and escalating trade disputes, introduce uncertainty and volatility into the market. These factors can quickly impact investor confidence and trigger market corrections.

-

Overvaluation Concerns: Some analysts express concerns about potential overvaluation in certain sectors, raising the possibility of a market correction. A thorough evaluation of individual stocks and sectors is crucial to mitigate this risk.

H3: What Does This Mean for Investors?

The current market rally presents both opportunities and challenges. Investors should:

- Diversify their portfolios: Spreading investments across different asset classes helps mitigate risk.

- Conduct thorough research: Before making any investment decisions, thoroughly research individual companies and market trends.

- Consider long-term investment strategies: Focusing on long-term goals and avoiding impulsive decisions is crucial for successful investing.

- Consult with a financial advisor: Seeking professional advice tailored to your individual circumstances is highly recommended.

H2: Conclusion: A Cautiously Optimistic Outlook

The recent surge in the stock market is undeniably impressive. However, it's crucial to approach this upward trend with a balanced perspective, acknowledging both the potential for continued growth and the inherent risks involved. Careful analysis, diversification, and a long-term investment strategy are essential for navigating this dynamic market landscape. Stay informed, remain vigilant, and make well-informed decisions based on your individual risk tolerance and financial goals. Are you prepared for what the future holds?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Highs In Sight? Wall Street And The Stock Market's Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roving Immigration Patrols Legal Supreme Court Ruling On Los Angeles

Sep 09, 2025

Roving Immigration Patrols Legal Supreme Court Ruling On Los Angeles

Sep 09, 2025 -

Stock Market Today Positive Gains For S And P 500 Nasdaq And Dow Despite Inflation Concerns

Sep 09, 2025

Stock Market Today Positive Gains For S And P 500 Nasdaq And Dow Despite Inflation Concerns

Sep 09, 2025 -

Stub Hub Ipo 22 25 Per Share Targeting 9 2 Billion Valuation

Sep 09, 2025

Stub Hub Ipo 22 25 Per Share Targeting 9 2 Billion Valuation

Sep 09, 2025 -

Christian Influencer Explains Her Decision To Leave Church

Sep 09, 2025

Christian Influencer Explains Her Decision To Leave Church

Sep 09, 2025 -

Recent Mortgage Rate Decreases Impact On Your Monthly Payment

Sep 09, 2025

Recent Mortgage Rate Decreases Impact On Your Monthly Payment

Sep 09, 2025

Latest Posts

-

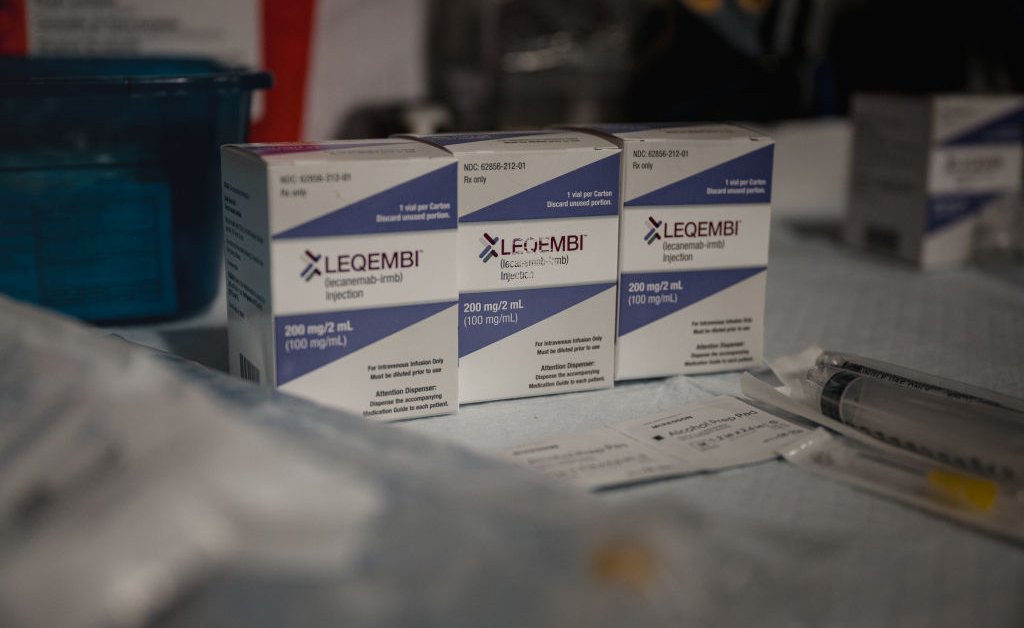

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025 -

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025