Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Analyzing the Market Trend

The cryptocurrency market is buzzing! A massive surge in investment into Bitcoin exchange-traded funds (ETFs) has surpassed $5 billion, signaling a significant shift in institutional and retail investor sentiment towards Bitcoin. This unprecedented influx of capital begs the question: what does this mean for the future of Bitcoin and the broader cryptocurrency market?

This article delves into the reasons behind this investment boom, analyzes the current market trends, and explores the potential implications for both investors and the cryptocurrency landscape.

The Rise of Bitcoin ETFs: A Game Changer?

The approval of the first Bitcoin futures ETF in the US marked a watershed moment for the cryptocurrency industry. Prior to this, institutional investors faced significant barriers to entry, hindering widespread adoption. ETFs, however, offer a more accessible and regulated pathway for investors to gain exposure to Bitcoin's price movements without directly holding the asset. This accessibility has undoubtedly fueled the recent surge in investment.

Several factors contribute to this increased interest:

- Increased Regulatory Clarity: While regulatory frameworks are still evolving, the approval of Bitcoin ETFs signifies a step towards greater regulatory clarity and acceptance of cryptocurrencies in traditional financial markets. This increased legitimacy reassures many investors.

- Institutional Adoption: Large institutional investors, including hedge funds and pension funds, are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential hedge against inflation and a diversifier within their asset allocation strategies.

- Retail Investor Demand: The ease of access via ETFs has attracted a significant number of retail investors, who previously found direct Bitcoin investment cumbersome or risky.

Analyzing the Market Trend: Bullish or Bearish?

The over $5 billion invested in Bitcoin ETFs reflects a largely bullish sentiment. However, it's crucial to remember that the cryptocurrency market is inherently volatile. While this investment signifies a positive trend, it doesn't guarantee continued upward momentum.

Several factors could influence future price movements:

- Macroeconomic Conditions: Global economic conditions, including inflation rates and interest rate hikes, significantly impact Bitcoin's price. A recessionary environment could negatively affect investor appetite for riskier assets like Bitcoin.

- Regulatory Scrutiny: While regulatory clarity is increasing, ongoing regulatory scrutiny and potential future regulations could impact the market.

- Bitcoin's Technological Development: Further advancements in Bitcoin's underlying technology, such as the Lightning Network, could enhance its scalability and adoption, potentially leading to price appreciation.

The Future of Bitcoin and ETFs: What to Expect

The long-term implications of this investment surge are still unfolding. However, the trend suggests increasing mainstream acceptance of Bitcoin as a legitimate asset class. The continued development and approval of Bitcoin ETFs globally will likely play a crucial role in shaping the future of the cryptocurrency market. Experts predict continued growth in this sector, though with inherent volatility.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money.

Call to action: Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and conducting thorough research before making any investment decisions. Consider consulting with a qualified financial advisor to discuss your investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The Game Exploring Key Differences In Joel And Ellies Relationship In The Last Of Us Season 2

May 20, 2025

Beyond The Game Exploring Key Differences In Joel And Ellies Relationship In The Last Of Us Season 2

May 20, 2025 -

The Economic Fallout Analyzing The Clean Energy Tax Debate In The Us

May 20, 2025

The Economic Fallout Analyzing The Clean Energy Tax Debate In The Us

May 20, 2025 -

Climate Changes Impact On Maternal Health Risks To Pregnancy And Childbearing

May 20, 2025

Climate Changes Impact On Maternal Health Risks To Pregnancy And Childbearing

May 20, 2025 -

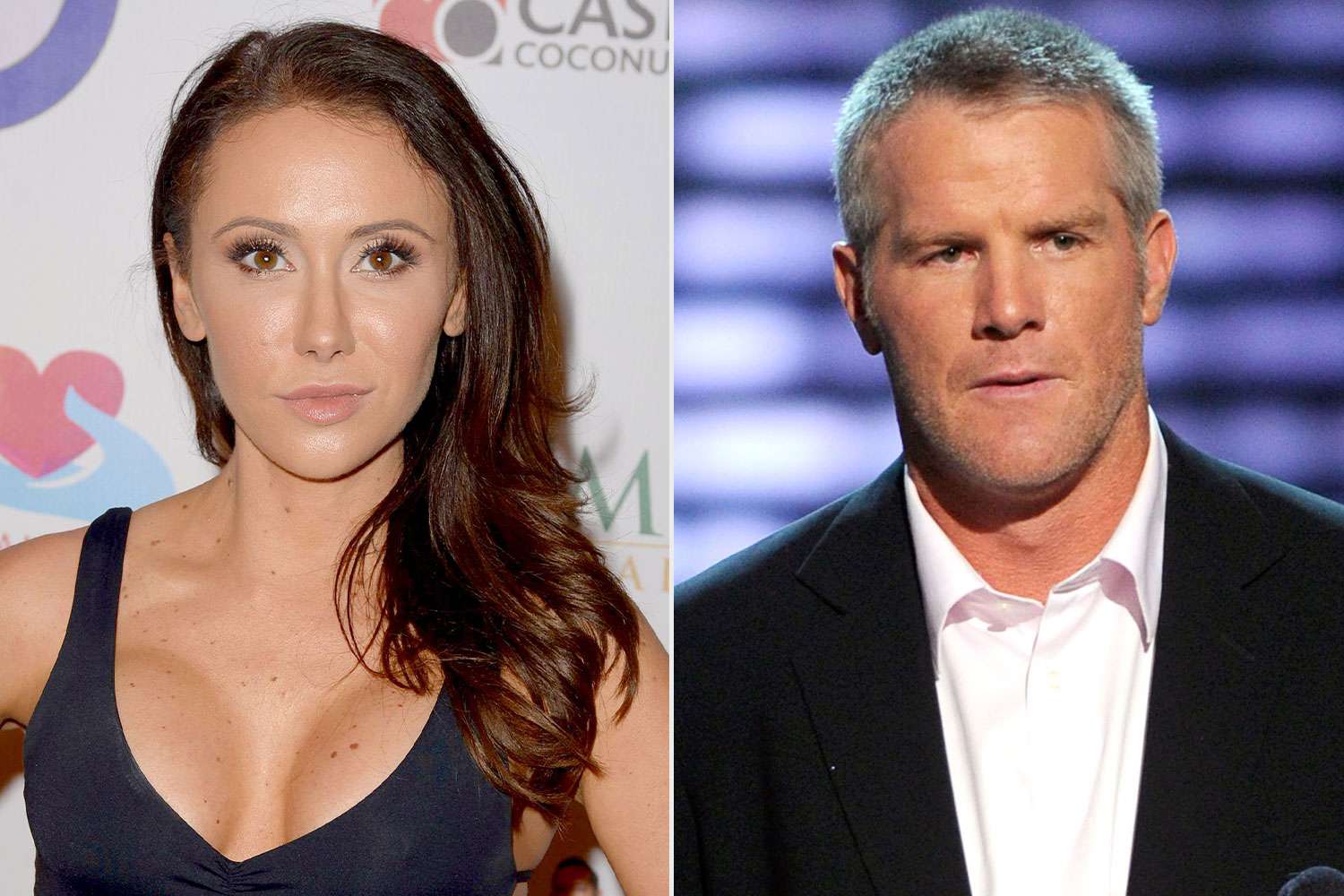

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Neglect

May 20, 2025

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Neglect

May 20, 2025 -

Ethereums Shanghai Upgrade Fuels 200 Million Investment Spree

May 20, 2025

Ethereums Shanghai Upgrade Fuels 200 Million Investment Spree

May 20, 2025