One Rate Cut In 2025? Fed's Outlook Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025? Fed's Outlook Impacts U.S. Treasury Yields

The Federal Reserve's (Fed) latest projections have sent ripples through the financial markets, with the suggestion of only one interest rate cut in 2025 significantly impacting U.S. Treasury yields. This more hawkish stance than previously anticipated has investors re-evaluating their strategies and raises questions about the future trajectory of the American economy.

The Fed's updated "dot plot," which illustrates individual policymakers' interest rate expectations, showed a marked shift. While previous forecasts hinted at multiple rate cuts next year, the new projections point to a single reduction, leaving rates relatively high for a prolonged period. This change reflects the Fed's ongoing battle against persistent inflation, despite recent signs of cooling price pressures.

Why the Shift in Outlook?

Several factors contributed to the Fed's more conservative outlook:

- Persistent Inflation: Although inflation has cooled from its peak, it remains stubbornly above the Fed's 2% target. Core inflation, which excludes volatile food and energy prices, is also proving sticky.

- Strong Labor Market: The U.S. labor market continues to show remarkable resilience, with low unemployment and strong wage growth. This strength, while positive for the economy, fuels inflationary pressures.

- Uncertainty Around Economic Growth: While the economy has shown resilience, there's considerable uncertainty regarding future growth. Global economic headwinds and potential further interest rate hikes could impact economic performance.

Impact on U.S. Treasury Yields:

The revised Fed projections immediately impacted U.S. Treasury yields. The expectation of higher interest rates for longer pushed yields upward, particularly on longer-term Treasuries. Investors, anticipating higher returns from holding government bonds for a longer period, are demanding higher yields. This rise in yields reflects the market's assessment of increased risk and higher borrowing costs in the future.

What This Means for Investors:

This shift in the Fed's outlook presents several challenges and opportunities for investors:

- Bond Investors: Higher yields on Treasury bonds might be attractive to some, but the risk of further yield increases remains. Investors need to carefully consider their risk tolerance and time horizon. Diversification within a portfolio remains crucial.

- Stock Investors: Higher interest rates can impact corporate borrowing costs and potentially dampen economic growth, leading to increased volatility in the stock market. Careful portfolio management and a long-term perspective are key.

Looking Ahead:

The Fed's decision to project only one rate cut in 2025 highlights the ongoing uncertainty in the economic landscape. While the fight against inflation is showing progress, the path to a sustained soft landing remains challenging. Investors will need to closely monitor economic data and the Fed's future communications for further guidance. The coming months will be crucial in determining the accuracy of the Fed's projections and their ultimate impact on the financial markets.

Further Resources:

- – Stay updated on the latest Fed announcements and economic data.

- – Access in-depth analysis and market commentary.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025? Fed's Outlook Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Qualcomm Targets Data Centers Processors Designed For Nvidia Gpu Synergy

May 20, 2025

Qualcomm Targets Data Centers Processors Designed For Nvidia Gpu Synergy

May 20, 2025 -

Pectra Upgrade Fuels Ethereum Investment 200 Million In New Funding

May 20, 2025

Pectra Upgrade Fuels Ethereum Investment 200 Million In New Funding

May 20, 2025 -

Mma World Reacts Jon Jones Controversial Comments On Tom Aspinall

May 20, 2025

Mma World Reacts Jon Jones Controversial Comments On Tom Aspinall

May 20, 2025 -

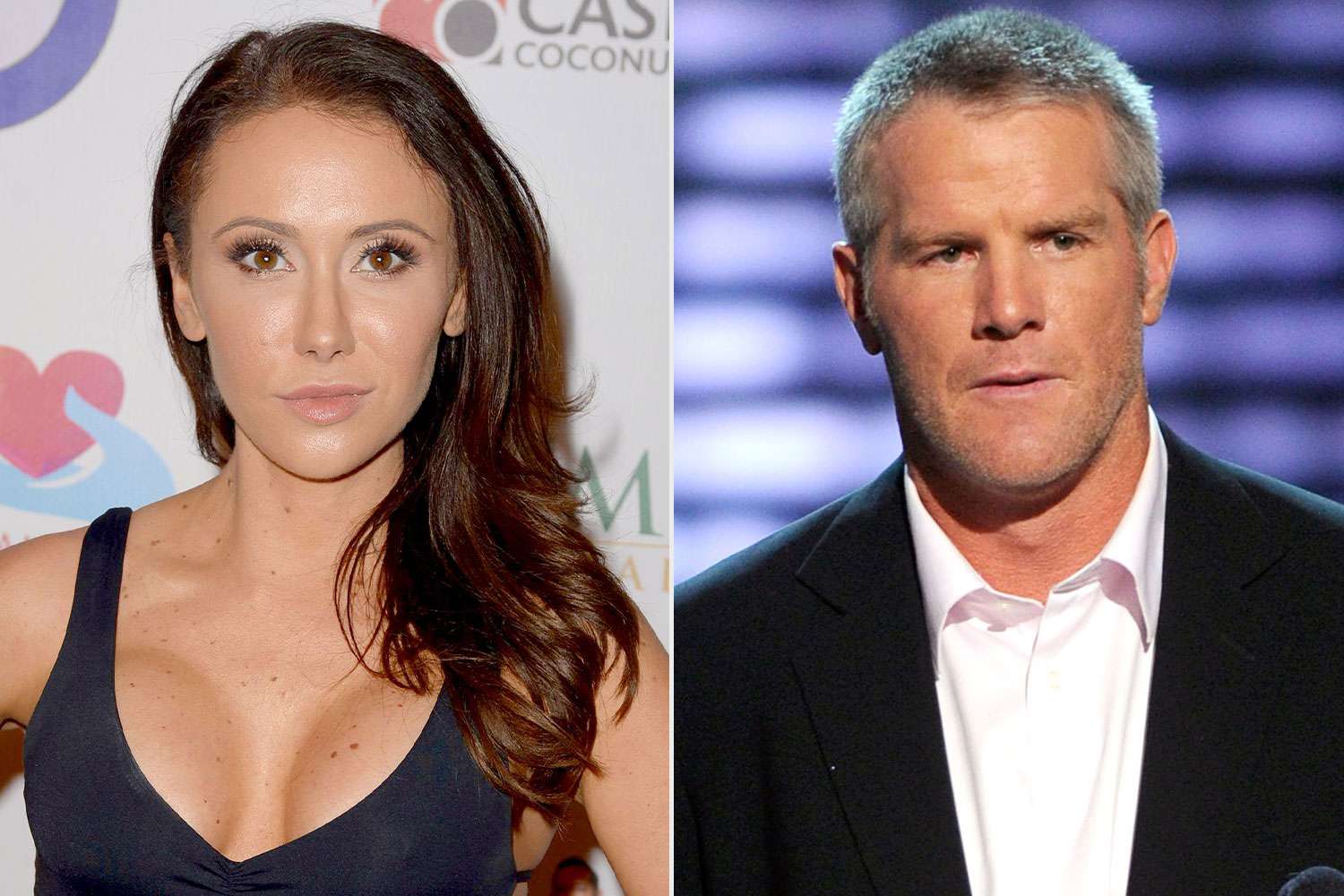

Jenn Stergers Powerful Account Of The Brett Favre Scandal And Its Emotional Toll

May 20, 2025

Jenn Stergers Powerful Account Of The Brett Favre Scandal And Its Emotional Toll

May 20, 2025 -

Extreme Heat Pollution And Pregnancy Understanding Climate Changes Influence

May 20, 2025

Extreme Heat Pollution And Pregnancy Understanding Climate Changes Influence

May 20, 2025