S&P 500, Dow, Nasdaq Climb: Stock Market Ignites Despite Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, Nasdaq Climb: Stock Market Ignites Despite Moody's Negative Outlook

Wall Street defies Moody's downgrade warning, surging higher on positive economic indicators and corporate earnings.

The US stock market defied expectations on Tuesday, with the major indices—the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite—all posting significant gains. This upward trend comes in stark contrast to Moody's recent decision to downgrade the credit ratings of several small and mid-sized US banks and its negative outlook on the broader banking sector. The seemingly contradictory market behavior highlights the complex interplay of factors influencing investor sentiment.

While Moody's warning cast a shadow over the financial landscape, several positive developments propelled the market higher. Stronger-than-expected corporate earnings reports from key players across various sectors played a significant role. Furthermore, recent economic data, including positive consumer confidence indicators and robust retail sales figures, bolstered investor optimism.

This unexpected surge showcases the market's resilience and its ability to absorb negative news when positive economic fundamentals remain in place. It also underscores the importance of diversified investment strategies and the need to look beyond short-term market fluctuations.

A Deeper Dive into the Market's Ascent

-

S&P 500: The S&P 500, a broad market index representing 500 large-cap US companies, closed up [insert percentage]% on Tuesday, reaching [insert closing value]. This gain was driven by strong performances across multiple sectors, including technology, consumer discretionary, and healthcare.

-

Dow Jones Industrial Average: The Dow Jones Industrial Average, a price-weighted average of 30 prominent US companies, also experienced a robust increase, climbing [insert percentage]% to close at [insert closing value]. This indicates significant strength amongst some of the nation's largest and most influential corporations.

-

Nasdaq Composite: The Nasdaq Composite, heavily weighted towards technology stocks, saw a particularly impressive surge of [insert percentage]%, closing at [insert closing value]. This reflects investor confidence in the continued growth potential of the tech sector, despite concerns about rising interest rates and potential economic slowdown.

Moody's Downgrade and its Limited Impact

Moody's recent downgrade of several US banks and its negative outlook on the banking sector were initially expected to trigger a sell-off. However, the market's reaction suggests that investors are focusing on the broader economic picture and the strong performance of many non-financial companies. This may indicate a degree of compartmentalization in the market, where concerns about specific sectors are not necessarily translating into widespread panic. For a detailed analysis of Moody's report, you can visit their website [link to Moody's website].

What This Means for Investors

The market's response to Moody's warning presents a mixed message. While the overall market performance was positive, investors should remain vigilant and diversify their portfolios. The current environment underscores the need for a long-term investment strategy that takes into account both positive and negative market signals. Understanding economic indicators and carefully analyzing corporate earnings reports remains crucial for informed investment decisions. Consider consulting with a qualified financial advisor to discuss your individual investment strategy.

Looking Ahead

The coming days and weeks will be crucial in determining whether this upward trend will continue. Further economic data releases and corporate earnings announcements will significantly influence market sentiment. Geopolitical events and any further developments in the banking sector will also play a key role. Keep an eye on these factors to stay informed about potential market shifts.

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, Nasdaq Climb: Stock Market Ignites Despite Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jones Vs Ufc Controversy Erupts Over Aspinalls Injury Disclosure

May 20, 2025

Jones Vs Ufc Controversy Erupts Over Aspinalls Injury Disclosure

May 20, 2025 -

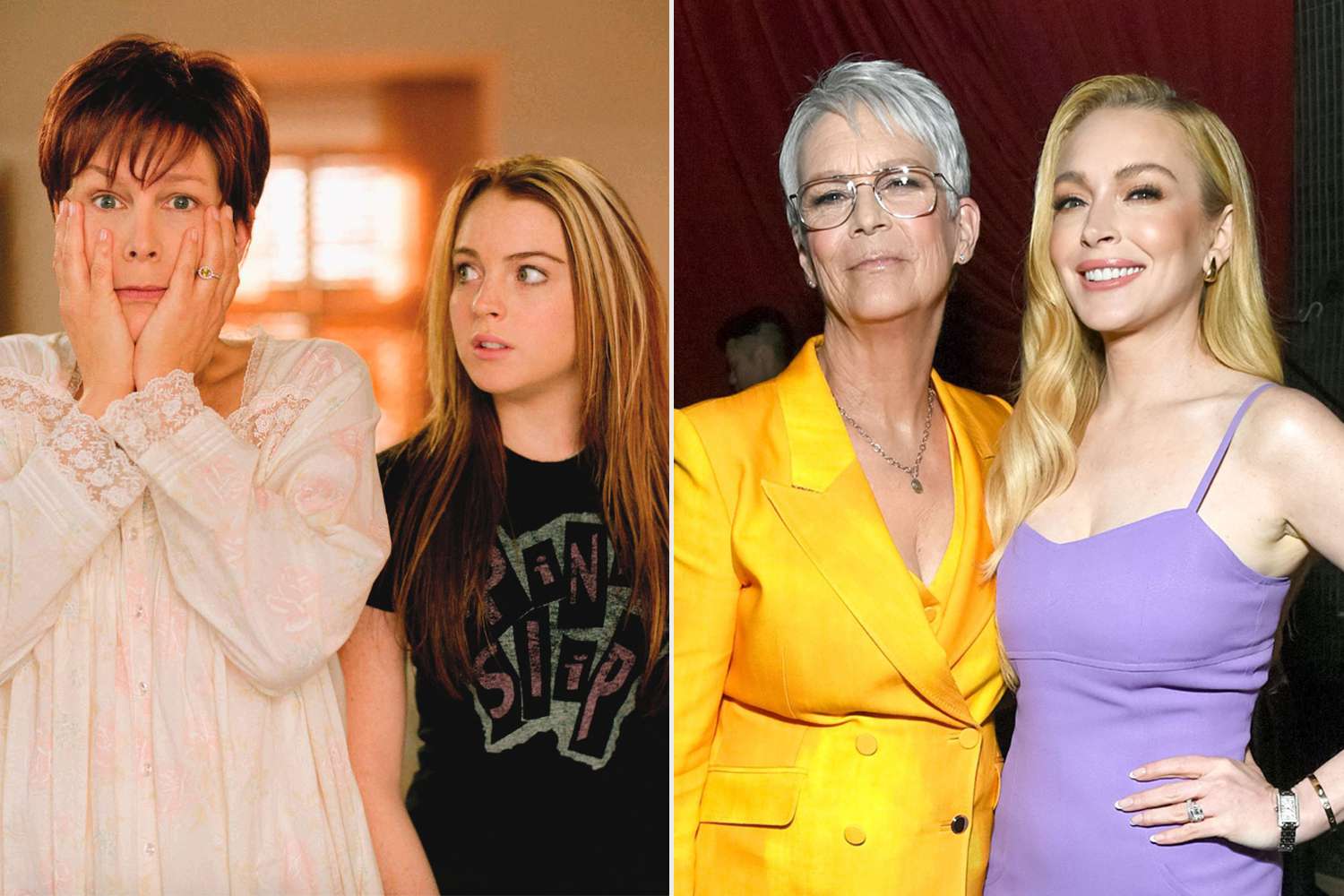

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan Following Freaky Friday

May 20, 2025

Exclusive Jamie Lee Curtis On Maintaining Her Bond With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 20, 2025

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 20, 2025 -

Indonesias Bali Island Implements Stricter Tourist Guidelines

May 20, 2025

Indonesias Bali Island Implements Stricter Tourist Guidelines

May 20, 2025 -

Over 5 Billion Inflows Bitcoin Etf Market Explodes

May 20, 2025

Over 5 Billion Inflows Bitcoin Etf Market Explodes

May 20, 2025