NIO's Q1 Earnings: Can Strong Deliveries Offset Tariff Concerns?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO's Q1 Earnings: Can Strong Deliveries Offset Tariff Concerns?

NIO, the Chinese electric vehicle (EV) maker, reported its first-quarter 2024 earnings recently, revealing strong vehicle deliveries but also highlighting ongoing concerns about potential US tariffs. The results paint a complex picture for the company, leaving investors wondering if its impressive growth can withstand the headwinds of a potentially volatile geopolitical landscape.

Record Deliveries, but at What Cost?

NIO announced record vehicle deliveries for Q1 2024, exceeding analysts' expectations. This impressive performance underscores the continued demand for their electric SUVs and sedans, particularly in the Chinese market. The success can be attributed to several factors, including the launch of new models, aggressive marketing campaigns, and a growing charging infrastructure network. This robust delivery figure is undoubtedly a positive sign, showcasing NIO's strong position within the competitive EV landscape. However, the celebration might be tempered by the looming shadow of potential US tariffs.

The Tariff Threat Looms Large

The possibility of increased US tariffs on Chinese-made goods, including EVs, remains a significant concern for NIO. These tariffs could significantly impact the company's profitability and its ability to compete effectively in the US market. While NIO has a presence in Norway and other European countries, the US market represents a significant potential growth area. The uncertainty surrounding tariffs creates a considerable risk factor for investors and potentially impacts future strategic planning. The company’s response to this uncertainty will be crucial for maintaining its trajectory.

Analyzing the Financial Results: Beyond the Headlines

Beyond the headline-grabbing delivery numbers, a deep dive into NIO's Q1 financial report reveals further nuances. Investors should pay close attention to:

- Gross margins: Were the record deliveries translated into improved profitability? Analyzing gross margins provides insight into NIO's pricing strategies and manufacturing efficiency.

- Research and development (R&D) spending: How much is NIO investing in future technologies and innovation? High R&D spending signals a commitment to long-term growth but also impacts short-term profitability.

- Operating expenses: Are operational costs under control? Efficient management of operational expenses is vital for sustained profitability.

Looking Ahead: Navigating Uncertain Waters

NIO’s future success hinges on its ability to navigate several key challenges. Besides the tariff uncertainty, the company faces intense competition from both established and emerging EV manufacturers. Maintaining its innovation edge, expanding its global presence strategically, and effectively managing costs will be crucial for sustained growth.

The Verdict: A Cautiously Optimistic Outlook?

While NIO's strong Q1 deliveries are undoubtedly positive, the threat of US tariffs casts a long shadow. Investors need to carefully weigh the positive delivery figures against the potential negative impacts of trade policy. The company's strategic response to these challenges will ultimately determine its long-term success. Further analysis of the full financial report is essential for a comprehensive understanding of NIO’s current financial standing and future prospects. The coming quarters will be critical in determining whether NIO can successfully offset the tariff concerns and maintain its impressive growth trajectory.

Keywords: NIO, NIO Q1 earnings, electric vehicles, EV, Chinese electric vehicles, US tariffs, EV market, vehicle deliveries, stock market, investment, automotive industry, NIO stock, Chinese economy, global automotive market, technology, innovation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO's Q1 Earnings: Can Strong Deliveries Offset Tariff Concerns?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bondis Actions Curtailing The Abas Judicial Nominee Review Process For Trump

Jun 03, 2025

Bondis Actions Curtailing The Abas Judicial Nominee Review Process For Trump

Jun 03, 2025 -

Actors Child Seriously Hurt In Henry County Tornado Fighting For Recovery

Jun 03, 2025

Actors Child Seriously Hurt In Henry County Tornado Fighting For Recovery

Jun 03, 2025 -

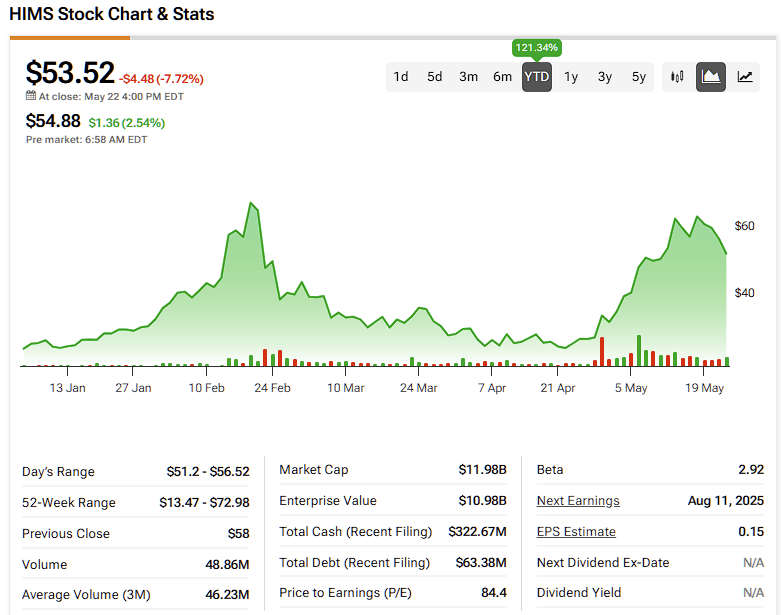

Should You Buy Hims And Hers Hims Stock Now A Prudent Investors Guide

Jun 03, 2025

Should You Buy Hims And Hers Hims Stock Now A Prudent Investors Guide

Jun 03, 2025 -

Dimons Blunt Assessment China Unafraid Of Us Tariffs

Jun 03, 2025

Dimons Blunt Assessment China Unafraid Of Us Tariffs

Jun 03, 2025 -

Trumps Tariff Decision A Deep Dive Into The Rationale And The Backlash

Jun 03, 2025

Trumps Tariff Decision A Deep Dive Into The Rationale And The Backlash

Jun 03, 2025