Should You Buy Hims & Hers (HIMS) Stock Now? A Prudent Investor's Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Hims & Hers (HIMS) Stock Now? A Prudent Investor's Guide

The telehealth industry is booming, and Hims & Hers (HIMS) is a major player. But is now the right time to invest? This prudent investor's guide will delve into the factors you should consider before buying HIMS stock. We'll explore the company's strengths and weaknesses, market position, and future prospects to help you make an informed decision.

Hims & Hers (HIMS): A Quick Overview

Hims & Hers is a telehealth company offering a wide range of health and wellness products and services, primarily focusing on men's and women's health. Their business model centers around convenient online consultations and direct-to-consumer sales of medications and other products. They cater to a growing market seeking accessible and discreet healthcare solutions, covering areas like hair loss, sexual health, skincare, and mental wellness.

Reasons to Consider Buying HIMS Stock:

- Strong Growth Potential: The telehealth market is experiencing explosive growth, and HIMS is well-positioned to capitalize on this trend. Their convenient online platform and diverse product offerings attract a broad customer base.

- Expanding Product Portfolio: HIMS continually expands its product offerings, adding new categories and services to cater to evolving consumer needs. This diversification mitigates risk and drives revenue growth.

- Strong Brand Recognition: HIMS has built a strong brand identity, associating itself with convenience, accessibility, and discretion – highly valuable in the sensitive areas they serve.

- Strategic Acquisitions: The company has shown a willingness to strategically acquire companies to enhance its product portfolio and market reach, furthering its growth trajectory.

Reasons to Hesitate Before Buying HIMS Stock:

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. HIMS faces pressure to maintain its competitive edge.

- Regulatory Risks: The telehealth industry is subject to evolving regulations, which could impact HIMS' operations and profitability. Staying abreast of regulatory changes is crucial.

- Profitability: While HIMS is experiencing significant revenue growth, achieving consistent profitability remains a key challenge. Investors should carefully analyze the company's financial statements.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. Changes in marketing effectiveness or increased competition could impact customer acquisition costs and profitability.

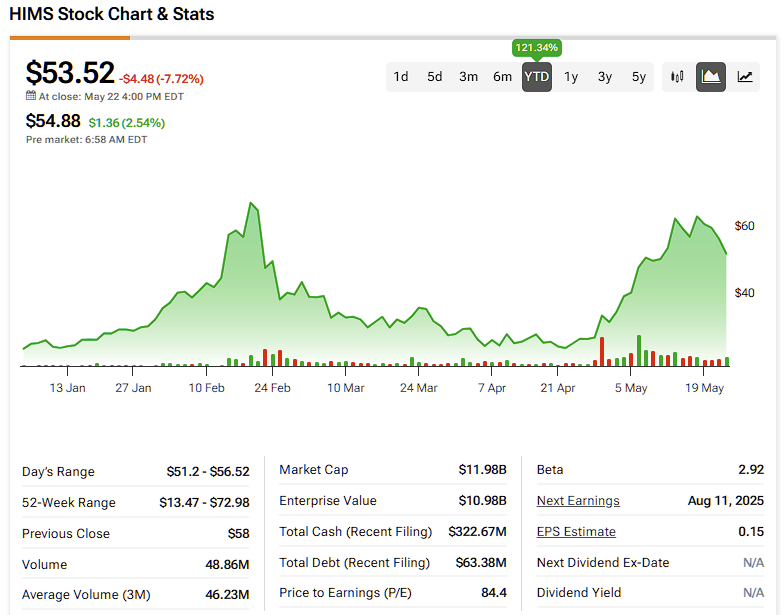

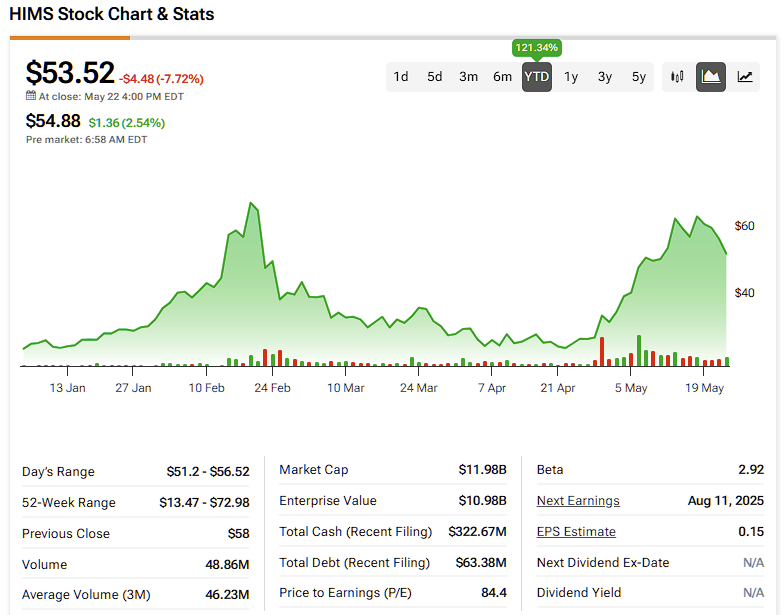

Analyzing HIMS' Financial Performance:

Before investing, meticulously analyze HIMS' financial statements, including revenue growth, profitability margins, and cash flow. Look for consistent trends and assess the company's ability to manage its expenses effectively. Consider comparing HIMS' key financial metrics to those of its competitors. Resources like and provide valuable data.

The Verdict: Is HIMS Stock Right for You?

Investing in HIMS stock involves inherent risks. The company operates in a rapidly evolving market, and its future performance is not guaranteed. While the long-term growth potential is promising, investors should carefully weigh the potential rewards against the risks before making a decision.

A Prudent Approach:

- Diversify your portfolio: Don't put all your eggs in one basket. Invest in a diversified portfolio to mitigate risk.

- Conduct thorough research: Don't rely solely on this article. Conduct independent research and consult with a qualified financial advisor before investing.

- Consider your risk tolerance: Investing in HIMS stock carries a degree of risk. Only invest what you can afford to lose.

- Long-term perspective: The telehealth market is projected for long-term growth. A long-term investment strategy may be beneficial.

This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions. The information provided here is for educational purposes only.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Hims & Hers (HIMS) Stock Now? A Prudent Investor's Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dte Energy Rate Increase Crushing Michigan Families Financially

Jun 03, 2025

Dte Energy Rate Increase Crushing Michigan Families Financially

Jun 03, 2025 -

Hims And Hers Hims Stock Market Update May 30th Performance Analysis

Jun 03, 2025

Hims And Hers Hims Stock Market Update May 30th Performance Analysis

Jun 03, 2025 -

New Report Miley And Billy Cyrus Relationship A Sources Perspective

Jun 03, 2025

New Report Miley And Billy Cyrus Relationship A Sources Perspective

Jun 03, 2025 -

Fresh Attack On Crimean Bridge Ukraine Claims New Underwater Sabotage Operation

Jun 03, 2025

Fresh Attack On Crimean Bridge Ukraine Claims New Underwater Sabotage Operation

Jun 03, 2025 -

Rising Dte Energy Costs Will Another Rate Hike Break Michigan Budgets

Jun 03, 2025

Rising Dte Energy Costs Will Another Rate Hike Break Michigan Budgets

Jun 03, 2025