NIO Stock's Post-Earnings Performance: A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock's Post-Earnings Performance: A Buying Opportunity?

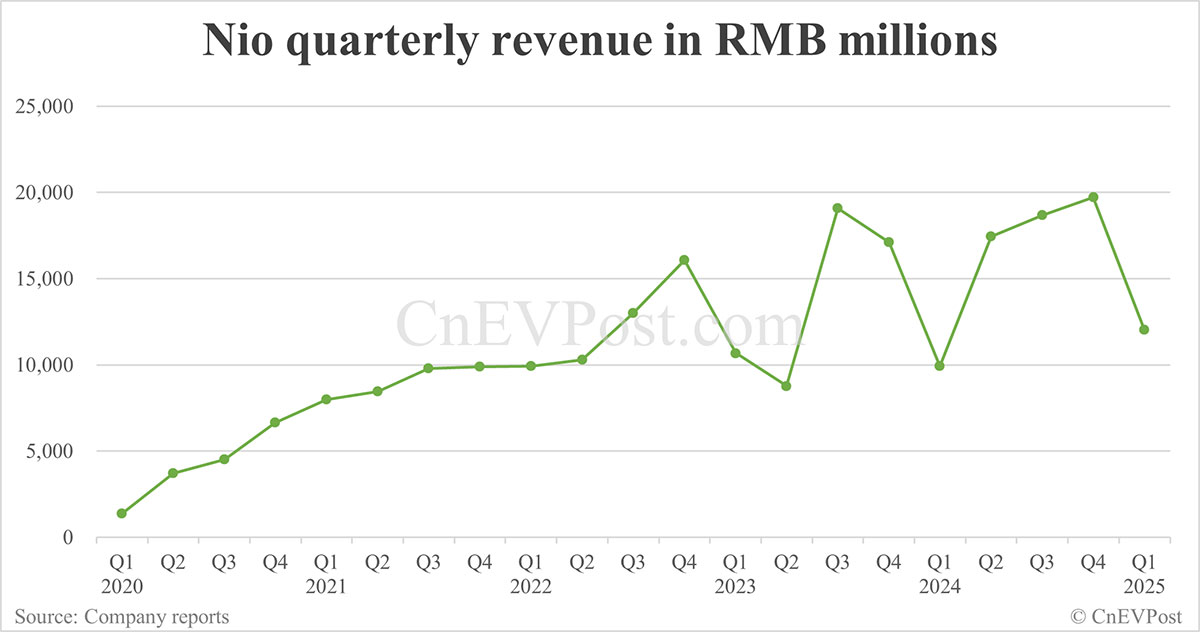

NIO, the Chinese electric vehicle (EV) maker, recently released its quarterly earnings report, sending ripples through the investment world. The post-earnings market reaction has left many investors wondering: is this a buying opportunity, or should investors remain cautious? This analysis delves into NIO's performance, exploring the factors influencing its stock price and assessing the potential for future growth.

NIO's Earnings Report: A Mixed Bag

NIO's latest earnings report presented a mixed picture. While the company delivered impressive vehicle deliveries, exceeding analysts' expectations, certain key metrics fell short. Profitability remains a challenge, and the competitive landscape in the burgeoning Chinese EV market continues to intensify. This ambiguity has created uncertainty among investors, leading to fluctuating stock prices.

Factors Influencing NIO Stock Price

Several factors contribute to the volatility of NIO's stock price:

- Delivery Numbers: Strong vehicle delivery figures consistently boost investor confidence. NIO's ability to meet and exceed delivery targets is crucial for maintaining positive market sentiment. [Link to NIO's investor relations page]

- Competition: The Chinese EV market is incredibly competitive, with established players like BYD and emerging startups vying for market share. NIO's ability to differentiate itself through innovation and brand building is vital.

- Government Regulations: Changes in government policies and regulations related to the EV industry in China can significantly impact NIO's operations and profitability.

- Global Economic Conditions: Macroeconomic factors, including inflation and interest rates, also play a role in influencing investor sentiment towards growth stocks like NIO.

- Supply Chain Issues: The ongoing impact of global supply chain disruptions can affect NIO's production capacity and ultimately its financial performance.

Is NIO Stock a Buy? A Cautious Assessment

Determining whether NIO stock is currently a buy requires a nuanced approach. While the company demonstrates significant potential for long-term growth in the rapidly expanding EV market, several risks remain.

Potential Upsides:

- Innovation: NIO consistently invests in research and development, pushing boundaries in battery technology, autonomous driving, and vehicle design. This focus on innovation positions the company for future success.

- Expanding Market: The global demand for electric vehicles continues to grow exponentially, presenting significant opportunities for expansion and market penetration.

- Brand Recognition: NIO has cultivated a strong brand image, particularly amongst younger, tech-savvy consumers.

Potential Downsides:

- Profitability Concerns: NIO's persistent struggle with profitability remains a significant concern for investors.

- Intense Competition: The competitive landscape necessitates continuous innovation and effective marketing strategies to maintain market share.

- Geopolitical Risks: Operating in China exposes NIO to geopolitical risks and regulatory uncertainties.

Conclusion: A Long-Term Perspective

NIO's post-earnings performance highlights the inherent volatility of investing in growth stocks within a dynamic and competitive market. While the short-term outlook might be uncertain, NIO's long-term prospects remain promising, contingent on its ability to address profitability challenges, navigate the competitive landscape, and capitalize on the global shift towards electric mobility. Investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. This analysis is not financial advice; always consult with a qualified financial advisor. [Link to reputable financial advice website]

Keywords: NIO, NIO stock, electric vehicle, EV, Chinese EV market, earnings report, stock price, investment, buying opportunity, growth stock, competition, profitability, supply chain, risk, analysis, investor relations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock's Post-Earnings Performance: A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

China Tariffs Jp Morgan Ceo Jamie Dimon Sounds The Alarm

Jun 03, 2025

China Tariffs Jp Morgan Ceo Jamie Dimon Sounds The Alarm

Jun 03, 2025 -

The 2 C Threshold A Business Imperative For Climate Change Action

Jun 03, 2025

The 2 C Threshold A Business Imperative For Climate Change Action

Jun 03, 2025 -

Us Economic Outlook Under Threat Jp Morgan Ceo Highlights Internal Challenges

Jun 03, 2025

Us Economic Outlook Under Threat Jp Morgan Ceo Highlights Internal Challenges

Jun 03, 2025 -

Electric Vehicle Maker Nio Announces 21 Revenue Jump In Q1 2024

Jun 03, 2025

Electric Vehicle Maker Nio Announces 21 Revenue Jump In Q1 2024

Jun 03, 2025 -

Sheinelle Jones And Family A Time Of Healing After Loss

Jun 03, 2025

Sheinelle Jones And Family A Time Of Healing After Loss

Jun 03, 2025