NIO Stock Price Falls: What To Expect From Q1 Results.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock Price Falls: What to Expect from Q1 2024 Results

NIO, a prominent player in the burgeoning electric vehicle (EV) market, has seen its stock price experience a recent downturn. Investors are now anxiously awaiting the release of the company's Q1 2024 financial results, hoping for clarity on the company's performance and future trajectory. This dip raises crucial questions about the future of NIO and its ability to compete in an increasingly crowded EV landscape. What factors contributed to the decline, and what can investors expect from the upcoming earnings report?

The Recent Stock Price Dip: A Closer Look

NIO's stock price has faced headwinds recently, largely attributed to several interconnected factors. Increased competition from established automakers and new EV startups, coupled with broader market concerns about the overall economy, has contributed to investor uncertainty. Furthermore, challenges related to supply chain disruptions and the evolving Chinese EV market have also played a role in the recent volatility.

Analyzing the Key Factors Impacting NIO's Performance:

Several key factors will likely influence NIO's Q1 2024 performance and, consequently, its stock price:

- Delivery Numbers: The number of vehicles delivered in Q1 will be a critical indicator of NIO's market share and growth. Any significant shortfall from expectations could put further pressure on the stock price.

- Revenue and Profitability: Investors will scrutinize NIO's revenue figures and profitability margins. Meeting or exceeding expectations in this area will be crucial for boosting investor confidence.

- New Model Launches and Market Expansion: The success of new model launches and expansion into new markets will be key indicators of NIO's long-term growth potential. Any significant breakthroughs in these areas could provide a much-needed boost to the stock.

- Battery Technology Advancements: NIO's battery technology and its innovative battery-as-a-service (BaaS) model are key differentiators. Any advancements or positive developments in this area could positively impact investor sentiment.

- Competition: The intense competition within the Chinese EV market and globally will continue to be a significant factor. NIO's ability to differentiate itself and maintain its market share will be closely watched.

What to Expect from the Q1 2024 Earnings Report:

The upcoming Q1 2024 earnings report will likely provide crucial insights into NIO's current financial health and future prospects. Investors will be looking for concrete evidence of the company's ability to navigate the challenges it faces and demonstrate sustained growth. While the recent stock price decline is concerning, the overall long-term prospects for the EV market remain positive. NIO's ability to adapt and innovate will be key to its future success.

Beyond the Q1 Results: A Long-Term Perspective

While the short-term outlook might be uncertain, the long-term potential of the EV industry remains strong. NIO's innovative approach, including its BaaS model and commitment to technological advancement, positions it for future growth. However, the company needs to demonstrate consistent performance and address investor concerns to regain market confidence and see its stock price recover.

Call to Action: Stay informed about NIO's Q1 2024 results and follow reputable financial news sources for insightful analysis. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Related Keywords: NIO stock, NIO earnings, NIO Q1 2024, electric vehicle stock, Chinese EV market, EV industry, NIO battery technology, NIO stock price prediction, NIO investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock Price Falls: What To Expect From Q1 Results.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

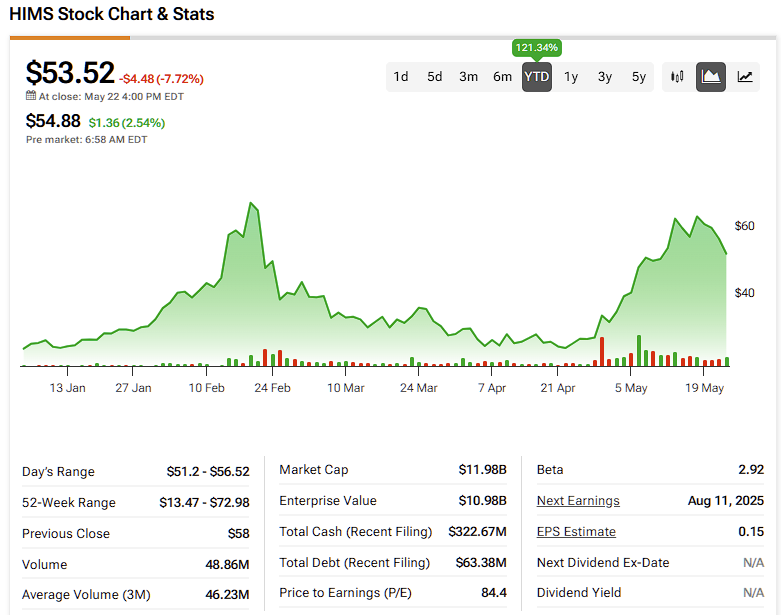

Hims And Hers Health Hims Is The Stock Price Too High

Jun 04, 2025

Hims And Hers Health Hims Is The Stock Price Too High

Jun 04, 2025 -

Beanie Bishop Defaces Pitt Logo After Steelers Practice Video Surfaces

Jun 04, 2025

Beanie Bishop Defaces Pitt Logo After Steelers Practice Video Surfaces

Jun 04, 2025 -

Pre Match Analysis Marquez On Personnel Changes For India Thailand Friendly

Jun 04, 2025

Pre Match Analysis Marquez On Personnel Changes For India Thailand Friendly

Jun 04, 2025 -

Addressing Donation Overflow Mayor Spencers St Louis Warehouse Plan

Jun 04, 2025

Addressing Donation Overflow Mayor Spencers St Louis Warehouse Plan

Jun 04, 2025 -

Analyzing Ukraines Drone Campaign A Precedent For Future Wars

Jun 04, 2025

Analyzing Ukraines Drone Campaign A Precedent For Future Wars

Jun 04, 2025