Hims & Hers Health (HIMS): Is The Stock Price Too High?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

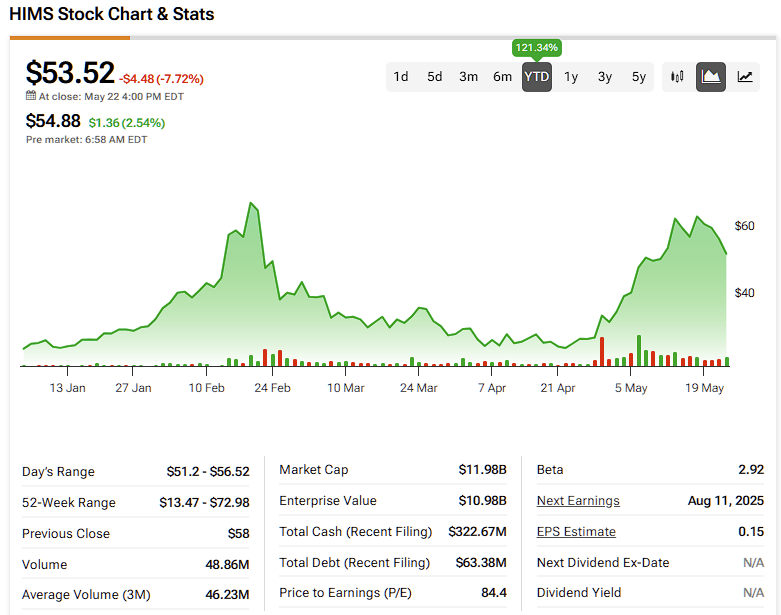

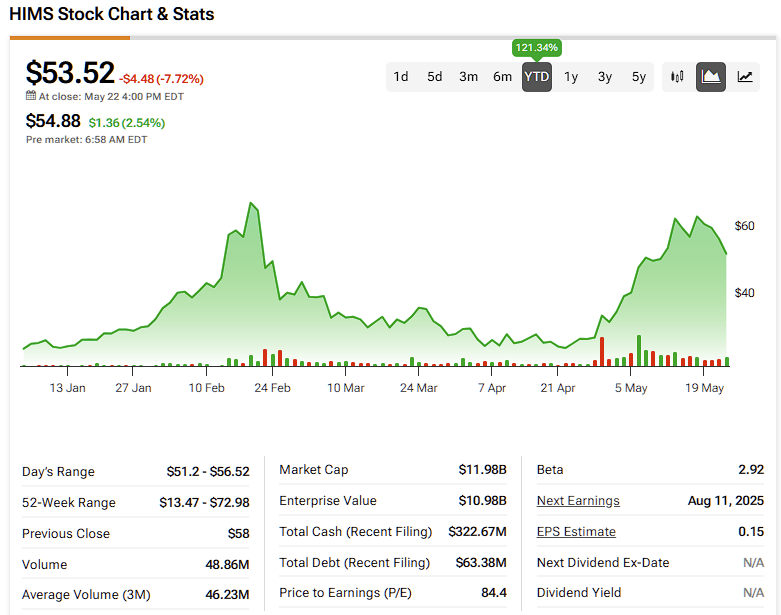

Hims & Hers Health (HIMS): Is the Stock Price Too High? A Deep Dive into Valuation and Future Prospects

Hims & Hers Health (HIMS) has captured the attention of investors with its telehealth platform offering convenient access to health and wellness products. But the stock's performance has been volatile, leading many to question: is the current price justified? This in-depth analysis examines HIMS's valuation, growth potential, and the factors influencing its stock price, helping you determine if it's a buy, sell, or hold.

Hims & Hers: A Disruptive Force in Telehealth?

Hims & Hers has carved a niche in the telehealth market by offering a user-friendly platform for various health concerns, including hair loss, sexual health, and skincare. Their direct-to-consumer model, emphasizing convenience and discretion, resonates with a tech-savvy generation. The company's success hinges on its ability to continue attracting and retaining subscribers, a key metric investors closely monitor. This subscription model, however, also presents challenges, as customer churn and acquisition costs significantly impact profitability.

Analyzing the Valuation: Is the Price Justified?

The current HIMS stock price reflects a complex interplay of factors. While the company exhibits impressive growth potential within the expanding telehealth sector, concerns about profitability and the competitive landscape need careful consideration. Several key metrics warrant scrutiny:

- Revenue Growth: While HIMS has shown strong revenue growth, investors need to analyze the sustainability of this growth. Is it driven by genuine market expansion or aggressive marketing strategies that may not be sustainable in the long term?

- Profitability: HIMS is currently not profitable. Analyzing its operating expenses, particularly marketing and customer acquisition costs, is crucial for assessing its path to profitability. A high customer acquisition cost (CAC) can significantly hinder long-term profitability.

- Market Competition: The telehealth market is becoming increasingly crowded. HIMS faces competition from established players and new entrants, putting pressure on pricing and market share. Understanding the competitive landscape is essential for evaluating the company's future prospects.

- Debt Levels: High debt levels can impact a company's financial health and ability to invest in future growth. Analyzing HIMS's debt-to-equity ratio and other relevant financial metrics is crucial.

Future Growth Potential: A Look Ahead

HIMS's potential for future growth depends on several key factors:

- Expansion into New Markets: Expanding its product offerings and targeting new demographics can fuel further growth. Strategic acquisitions could also play a significant role.

- Technological Advancements: Investing in technology and improving the user experience is critical for maintaining a competitive edge in the rapidly evolving telehealth space.

- Regulatory Landscape: The regulatory environment for telehealth is constantly changing. Navigating these changes effectively will be essential for continued success.

Should You Buy, Sell, or Hold?

Determining whether HIMS stock is overvalued requires a thorough assessment of the factors discussed above. Investors should conduct their own due diligence, considering their risk tolerance and investment horizon. While the company shows promise, the current high stock price may reflect a degree of optimism that may not be fully justified by its current financial performance. It's crucial to monitor key performance indicators (KPIs) and consider the potential impact of macroeconomic factors and competitive pressures before making any investment decisions.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Further Reading:

- [Link to a relevant financial news article about HIMS]

- [Link to HIMS investor relations page]

This detailed analysis provides a balanced perspective on Hims & Hers Health (HIMS) and its stock price, empowering investors to make informed decisions. Remember to always conduct thorough research before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers Health (HIMS): Is The Stock Price Too High?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

This Week In Entertainment John Wicks Ballerina And The Nintendo Switch 2 Arrive

Jun 04, 2025

This Week In Entertainment John Wicks Ballerina And The Nintendo Switch 2 Arrive

Jun 04, 2025 -

Analysis Hims And Hers Hims 3 02 Stock Rise On May 30th

Jun 04, 2025

Analysis Hims And Hers Hims 3 02 Stock Rise On May 30th

Jun 04, 2025 -

Steelers Player Beanie Bishop Faces Backlash For Pitt Logo Stunt

Jun 04, 2025

Steelers Player Beanie Bishop Faces Backlash For Pitt Logo Stunt

Jun 04, 2025 -

Mayor Spencer Addresses St Louis Donation Surge Announces New Warehouse Solution

Jun 04, 2025

Mayor Spencer Addresses St Louis Donation Surge Announces New Warehouse Solution

Jun 04, 2025 -

Trumps Disastrous Endorsement The Case Of Scott Walker

Jun 04, 2025

Trumps Disastrous Endorsement The Case Of Scott Walker

Jun 04, 2025