NIO Q1 Earnings Preview: Examining Delivery Growth Amidst Tariff Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Preview: Examining Delivery Growth Amidst Tariff Uncertainty

NIO, the Chinese electric vehicle (EV) maker, is set to release its first-quarter 2024 earnings report soon, and investors are eagerly anticipating the results. The report will offer crucial insights into NIO's performance amidst a complex landscape of growing delivery numbers and lingering uncertainties surrounding international tariffs. This preview delves into the key factors investors should watch for in the upcoming announcement.

Record Deliveries, But Can the Momentum Continue?

NIO has consistently reported strong delivery growth in recent quarters. The company surpassed its own expectations in previous periods, setting new records for vehicle deliveries. However, maintaining this momentum in Q1 2024 requires careful analysis. Several factors could influence the final numbers, including:

- Supply Chain Stability: The global supply chain continues to face challenges. Any disruptions in the procurement of crucial components could impact production and ultimately, delivery figures.

- Raw Material Costs: Fluctuations in the prices of raw materials like lithium and cobalt directly affect EV manufacturing costs and profitability. Managing these costs efficiently is vital for NIO's margins.

- Competition: The Chinese EV market is incredibly competitive, with established players and new entrants vying for market share. NIO's ability to differentiate its products and maintain its competitive edge is key.

Tariff Uncertainty Casts a Shadow

The ongoing uncertainty surrounding international tariffs, particularly those impacting trade between China and other key markets, presents a significant challenge for NIO's international expansion plans. Any escalation in trade tensions could negatively affect the company's export strategies and global sales. Investors will be keen to understand NIO's mitigation strategies to address these potential headwinds.

Key Metrics to Watch:

- Vehicle Deliveries: The headline number – analysts will closely scrutinize the total number of vehicles delivered during Q1 2024 compared to previous quarters and analyst expectations. Any significant deviation will likely move the stock price.

- Revenue Growth: Examining the revenue growth rate provides insight into the overall financial health of the company. Sustained revenue growth is crucial for continued investment and expansion.

- Gross Margin: This metric highlights NIO's profitability. Maintaining healthy gross margins amidst rising input costs is a significant indicator of operational efficiency.

- Guidance: NIO's guidance for the upcoming quarters will offer crucial insights into the company's future expectations and outlook. This will provide investors with a clearer understanding of potential risks and opportunities.

What to Expect from the Earnings Call:

Beyond the raw numbers, the earnings call itself will provide invaluable insights into NIO's strategic direction. Investors should pay close attention to management's commentary on:

- New Product Launches: Any updates regarding upcoming model releases or significant product enhancements will impact market perception and investor sentiment.

- Expansion Plans: News regarding international expansion strategies and market penetration plans will be crucial for understanding long-term growth prospects.

- Battery Technology Advancements: NIO's battery technology is a key differentiator. Updates on battery technology advancements and improvements will be closely followed.

Conclusion:

NIO's Q1 2024 earnings report will be a significant event for investors. While the company has demonstrated impressive delivery growth, the challenges posed by supply chain issues, raw material costs, and tariff uncertainty cannot be ignored. By carefully examining the key metrics and management's commentary, investors can gain a clearer understanding of NIO's current position and future prospects in the dynamic and competitive EV market. Stay tuned for our post-earnings analysis following the official release. Learn more about investing in the EV market by exploring resources like [link to a reputable financial news site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Preview: Examining Delivery Growth Amidst Tariff Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brazils Finance Ministry A Green Economic Future

Jun 03, 2025

Brazils Finance Ministry A Green Economic Future

Jun 03, 2025 -

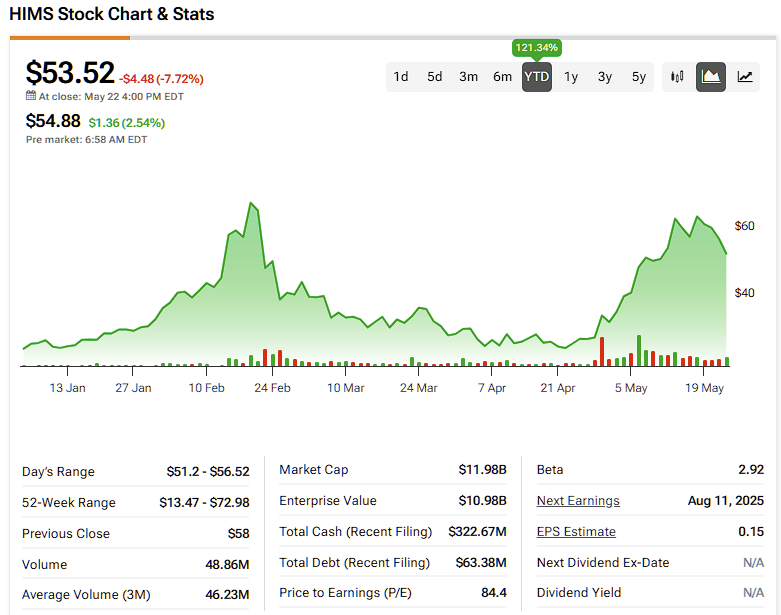

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025 -

From Hollywood To Heartland Roseanne Barrs Texas Journey

Jun 03, 2025

From Hollywood To Heartland Roseanne Barrs Texas Journey

Jun 03, 2025 -

Maintaining A 100 Pound Weight Loss Lessons From Al Rokers Journey

Jun 03, 2025

Maintaining A 100 Pound Weight Loss Lessons From Al Rokers Journey

Jun 03, 2025 -

The Impact Of Age On Miley Cyruss Relationship With Her Mom And Dad

Jun 03, 2025

The Impact Of Age On Miley Cyruss Relationship With Her Mom And Dad

Jun 03, 2025