NIO Q1 Earnings Preview: Analyzing Delivery Numbers And Tariff Impacts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Preview: Delivery Numbers and Tariff Impacts Under the Microscope

NIO, the Chinese electric vehicle (EV) maker, is gearing up to release its first-quarter 2024 earnings report, and investors are on the edge of their seats. This preview analyzes the key factors likely to shape the results, focusing on delivery numbers and the impact of potential tariff adjustments. Understanding these elements is crucial for gauging NIO's performance and future prospects within the increasingly competitive EV market.

Delivery Numbers: A Crucial Indicator of Growth

NIO's Q1 2024 delivery figures will be a major focus for analysts. Strong delivery numbers would signal sustained demand for its vehicles, particularly its flagship ET7 and ET5 models, and its newer models like the ES8. Any significant deviation from expectations, either positive or negative, could significantly impact investor sentiment. Factors influencing these numbers include:

- Supply Chain Resilience: The ongoing global chip shortage and supply chain disruptions continue to pose challenges. NIO's ability to navigate these complexities and secure necessary components will directly affect its production capacity and delivery capabilities.

- Market Competition: The Chinese EV market is fiercely competitive, with established players like BYD and new entrants constantly vying for market share. NIO's ability to differentiate itself through innovative technology, design, and customer service will be vital in maintaining its position.

- Pricing Strategies: Adjustments to pricing strategies in response to market conditions and competitive pressures could influence sales volume. Finding the right balance between affordability and maintaining profitability will be crucial.

Tariff Impacts: Navigating Global Trade Dynamics

The impact of potential tariffs on imported components or exported vehicles is another significant factor to consider. Any changes in trade policies, particularly between China and key markets like the US and Europe, could significantly impact NIO's profitability and global expansion plans. These impacts could manifest in:

- Increased Production Costs: Higher tariffs on imported components would increase NIO's production costs, potentially squeezing profit margins. This could necessitate price increases, affecting consumer demand.

- Reduced Export Competitiveness: Tariffs on exported vehicles could make NIO's cars less competitive in international markets, limiting its potential for growth beyond China.

- Strategic Adjustments: NIO might need to adjust its supply chain strategy, potentially sourcing more components locally to mitigate tariff impacts. This could involve significant investment and time.

Beyond Delivery Numbers and Tariffs: Other Key Considerations

While delivery figures and tariff impacts are paramount, other factors will also influence NIO's Q1 performance:

- Research & Development Investments: NIO's ongoing investment in research and development, particularly in battery technology and autonomous driving capabilities, will be closely scrutinized.

- Battery Swap Network Expansion: The continued growth and efficiency of NIO's battery swap network will be a key indicator of its long-term strategic success.

- Overall Market Sentiment: The overall sentiment in the global EV market and the broader macroeconomic environment will also influence investor perception of NIO's results.

Conclusion: A Crucial Quarter for NIO

NIO's Q1 2024 earnings report will be a crucial barometer of its performance and future trajectory. While strong delivery numbers are essential, the impact of tariffs and other macroeconomic factors cannot be overlooked. Investors should carefully analyze all these elements to form a comprehensive understanding of NIO's position within the dynamic EV landscape. Stay tuned for our post-earnings analysis, providing a comprehensive breakdown of the results and their implications. [Link to future post-earnings analysis article (if applicable)].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Preview: Analyzing Delivery Numbers And Tariff Impacts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

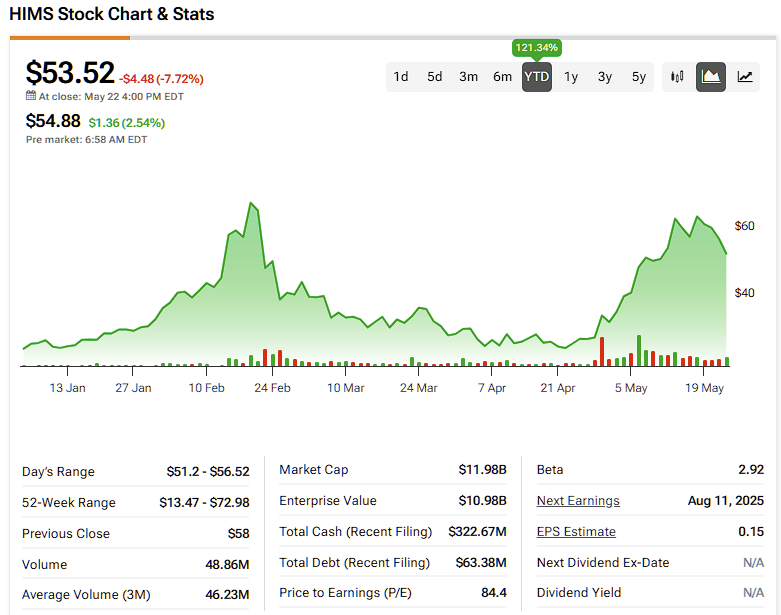

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025

Hims And Hers Hims Riding The Wave Or Facing A Crash Investor Concerns

Jun 03, 2025 -

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025

Can Nio Overcome Tariff Challenges Q1 Earnings Preview

Jun 03, 2025 -

Bondis Action Curbing The Abas Role In Trump Judge Confirmations

Jun 03, 2025

Bondis Action Curbing The Abas Role In Trump Judge Confirmations

Jun 03, 2025 -

New South Loop Soccer Stadium Planned For Chicago Fire

Jun 03, 2025

New South Loop Soccer Stadium Planned For Chicago Fire

Jun 03, 2025 -

Climate Change And Business Planning For A 2 C Future

Jun 03, 2025

Climate Change And Business Planning For A 2 C Future

Jun 03, 2025