NIO Q1 Earnings Looms: Stock Price Dip—Smart Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looms: Stock Price Dip—Smart Investment Opportunity or Risky Gamble?

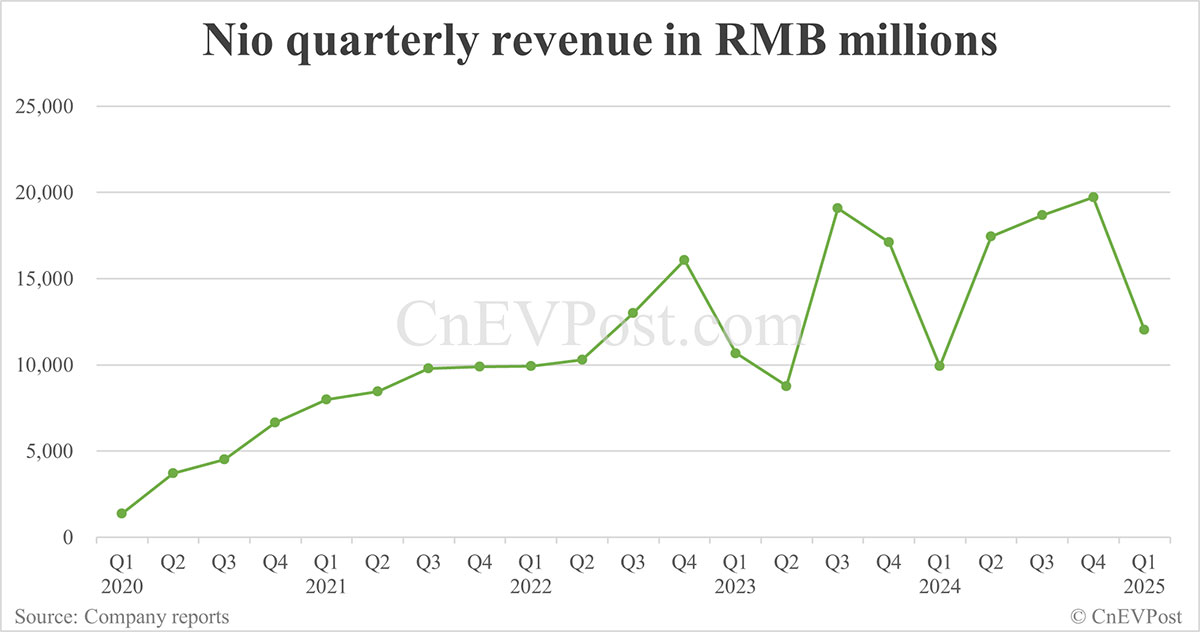

NIO, the Chinese electric vehicle (EV) maker, is on the cusp of releasing its Q1 2024 earnings report, and investors are on edge. A recent dip in the stock price has left many wondering: is this a buying opportunity, or a sign of trouble ahead for the ambitious EV manufacturer? Let's delve into the factors influencing NIO's current market position and explore whether this dip presents a smart investment strategy.

NIO's Recent Performance and Market Challenges:

NIO, along with other EV players like Tesla and BYD, has faced headwinds in recent months. The global chip shortage, persistent supply chain disruptions, and increased competition within the burgeoning Chinese EV market have all contributed to a period of uncertainty. Furthermore, macroeconomic factors, including inflation and interest rate hikes, have dampened investor sentiment across the broader tech sector, impacting NIO's stock price.

The recent price drop, while concerning, isn't entirely unexpected given these broader economic pressures. However, the upcoming earnings report will be crucial in determining the company's future trajectory. Analysts will be keenly scrutinizing NIO's delivery numbers, revenue growth, and profitability margins. Any significant deviation from expectations could trigger further volatility in the stock price.

Key Factors to Watch in the Q1 Earnings Report:

- Delivery Numbers: The number of vehicles delivered in Q1 will be a key indicator of NIO's market share and overall sales performance. Any substantial increase would likely boost investor confidence.

- Revenue Growth: Sustained revenue growth is crucial for demonstrating the company's ability to scale its operations and achieve long-term profitability. A slowdown in revenue growth could raise concerns.

- Gross Margins: Improving gross margins will be vital in showcasing NIO's ability to manage costs and increase its profitability. Pressure on margins due to increased competition or rising input costs could negatively affect the stock price.

- Guidance for Future Quarters: NIO's guidance for the remainder of 2024 will provide insight into the company's expectations and its outlook for the year. Positive guidance could help restore investor confidence.

Is This Dip a Buying Opportunity?

The current dip in NIO's stock price presents a complex scenario. While the challenges are undeniable, NIO remains a significant player in the rapidly expanding Chinese EV market. Its innovative technology, stylish designs, and growing battery-swap network continue to be attractive selling points.

However, before considering an investment, potential investors should carefully analyze the Q1 earnings report and assess the company's long-term prospects against the backdrop of the competitive landscape and broader economic conditions. Conduct thorough due diligence, consult with a financial advisor, and carefully consider your personal risk tolerance.

Beyond the Numbers: Long-Term Potential and Risks

NIO's long-term success will depend on several factors, including its ability to:

- Maintain its competitive edge: This requires continuous innovation in technology and design, along with effective marketing and sales strategies.

- Expand its international presence: Success in markets beyond China will be critical for long-term growth.

- Manage costs effectively: Achieving profitability amidst increasing competition is a significant challenge.

Investing in NIO carries inherent risks. The EV market is highly competitive, and the company's success is not guaranteed. Geopolitical factors related to China also add an element of uncertainty.

Conclusion:

The upcoming NIO Q1 earnings report will be a pivotal moment for the company and its investors. The recent stock price dip might present an opportunity for some investors, but it's crucial to proceed with caution and conduct thorough research before making any investment decisions. Remember to consult with a financial professional to make informed choices that align with your individual financial goals and risk tolerance. Stay tuned for the Q1 earnings release and subsequent market reaction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looms: Stock Price Dip—Smart Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

21 Revenue Surge Nios Q1 2024 Financial Results

Jun 03, 2025

21 Revenue Surge Nios Q1 2024 Financial Results

Jun 03, 2025 -

Crimean Bridge Hit Ukraine Claims Successful Underwater Strike

Jun 03, 2025

Crimean Bridge Hit Ukraine Claims Successful Underwater Strike

Jun 03, 2025 -

Scientists Investigate Strange Pulses From Distant Star

Jun 03, 2025

Scientists Investigate Strange Pulses From Distant Star

Jun 03, 2025 -

Increased Steel And Aluminum Tariffs Trumps Justification And Expert Concerns

Jun 03, 2025

Increased Steel And Aluminum Tariffs Trumps Justification And Expert Concerns

Jun 03, 2025 -

Hims And Hers Hims Risks And Rewards Of Investing In The Telehealth Giant

Jun 03, 2025

Hims And Hers Hims Risks And Rewards Of Investing In The Telehealth Giant

Jun 03, 2025