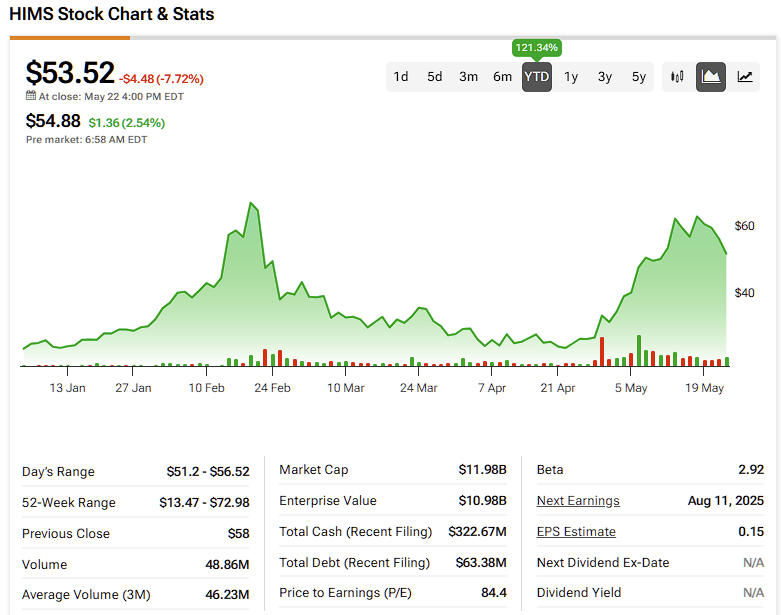

Hims & Hers (HIMS): Risks And Rewards Of Investing In The Telehealth Giant

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Hims & Hers (HIMS): Risks and Rewards of Investing in the Telehealth Giant

The telehealth industry is booming, and Hims & Hers (HIMS) is at the forefront. This innovative company offers a convenient and accessible platform for various health and wellness products and services, from hair loss treatments to sexual health solutions. But is investing in HIMS a smart move? Let's delve into the potential risks and rewards.

The Allure of Hims & Hers: A Convenient Healthcare Model

Hims & Hers has disrupted the traditional healthcare landscape by offering a user-friendly online platform. This accessibility is a major draw, attracting a broad customer base seeking discreet and convenient access to healthcare solutions. Their business model focuses on:

- Direct-to-consumer approach: Eliminating the need for in-person doctor visits, reducing costs and increasing convenience.

- Subscription model: Providing recurring revenue streams and fostering customer loyalty.

- Diverse product offerings: Catering to a wide range of health and wellness needs, minimizing reliance on any single product line.

Potential Rewards for Investors:

- Market Growth: The telehealth market is experiencing explosive growth, driven by increased consumer demand and technological advancements. HIMS is well-positioned to capitalize on this expansion.

- Strong Brand Recognition: Hims & Hers has built a recognizable and trusted brand, attracting a loyal customer base and fostering brand loyalty.

- Diversification: Their diverse product offerings mitigate risk associated with reliance on a single product or service.

- Scalability: The online platform's scalable nature allows for significant growth potential with minimal additional overhead.

Navigating the Risks:

While the potential rewards are significant, investors should carefully consider the risks involved:

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. Maintaining a competitive edge will be crucial for HIMS' long-term success.

- Regulatory Hurdles: The healthcare industry is heavily regulated, and navigating these regulations can be complex and costly. Changes in regulations could significantly impact HIMS' operations.

- Reliance on Technology: HIMS' business model is heavily reliant on technology. Any technological disruptions or cybersecurity breaches could have severe consequences.

- Dependence on Marketing and Advertising: A significant portion of HIMS' success depends on effective marketing and advertising. Reduced marketing effectiveness could negatively impact customer acquisition.

- Profitability: While revenue is growing, achieving consistent profitability remains a challenge for HIMS, a factor investors should carefully monitor.

Financial Performance and Future Outlook:

Investors should thoroughly analyze HIMS' financial statements, paying close attention to key metrics such as revenue growth, customer acquisition costs, and operating margins. Analyzing industry trends and competitor performance is also crucial for assessing the company's long-term prospects. Consider consulting with a financial advisor before making any investment decisions.

Conclusion:

Investing in Hims & Hers presents both significant opportunities and considerable risks. The company's innovative approach to healthcare delivery and its strong brand recognition offer compelling reasons for optimism. However, the competitive landscape, regulatory challenges, and reliance on technology all present potential downsides. A thorough due diligence process, including careful analysis of financial performance and industry trends, is essential before making any investment decisions. Remember to diversify your portfolio and consult with a financial professional for personalized advice. Staying informed about the company's progress and the evolving telehealth landscape is crucial for long-term investment success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Hims & Hers (HIMS): Risks And Rewards Of Investing In The Telehealth Giant. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

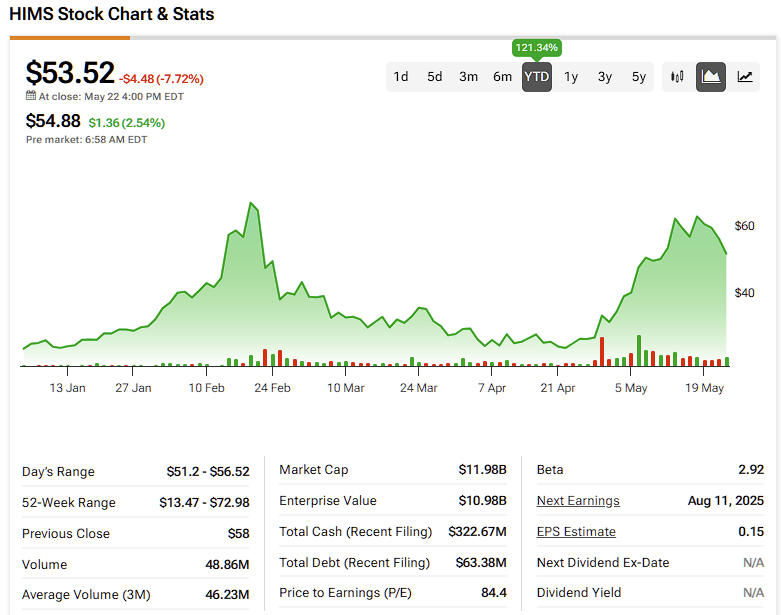

Gov Walz Calls For Stronger Democratic Approach Labels Trump A Cruel Man

Jun 03, 2025

Gov Walz Calls For Stronger Democratic Approach Labels Trump A Cruel Man

Jun 03, 2025 -

Controversy Resolved Patti Lu Pone Apologizes For Recent Broadway Incident

Jun 03, 2025

Controversy Resolved Patti Lu Pone Apologizes For Recent Broadway Incident

Jun 03, 2025 -

Sheinelle Jones Prioritizes Family Following Husbands Passing Source Reveals

Jun 03, 2025

Sheinelle Jones Prioritizes Family Following Husbands Passing Source Reveals

Jun 03, 2025 -

June 2nd 2025 Public Holiday Closures In China And New Zealand

Jun 03, 2025

June 2nd 2025 Public Holiday Closures In China And New Zealand

Jun 03, 2025 -

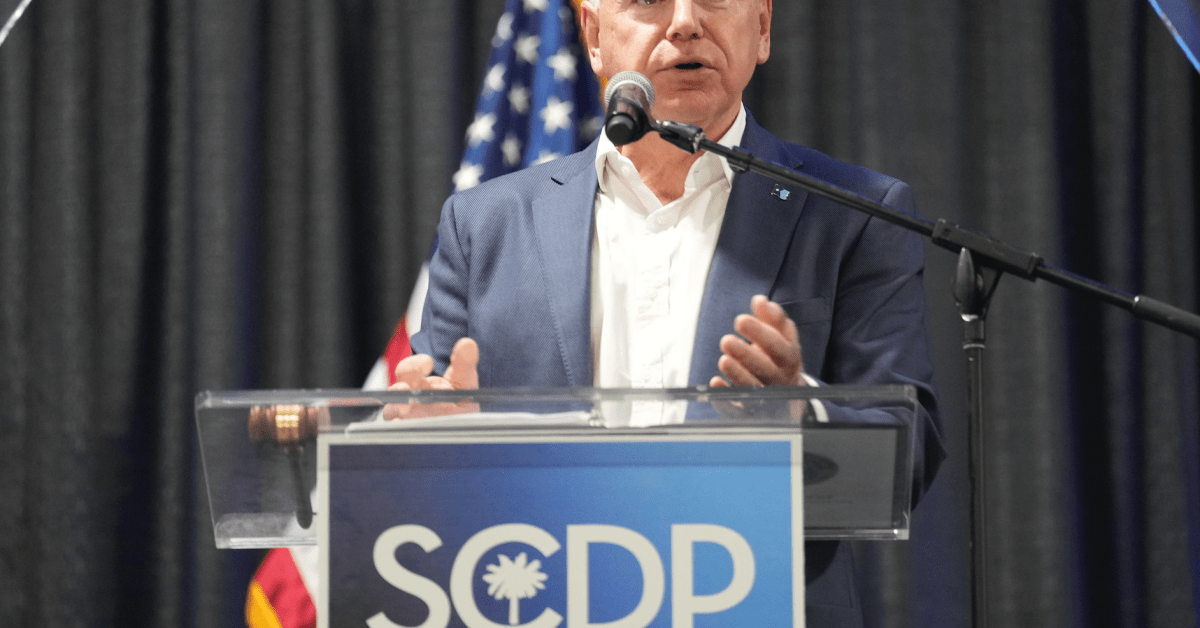

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025