NIO Q1 Earnings Looming: Stock Price Drop – Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looming: Stock Price Drop – Buying Opportunity?

NIO, the Chinese electric vehicle (EV) maker, is facing a period of uncertainty as investors anxiously await its Q1 2024 earnings report. The recent stock price drop has sparked a debate: is this a temporary dip, or a sign of deeper trouble? For savvy investors, the question becomes: is this a compelling buying opportunity, or a trap to avoid?

The recent decline in NIO's stock price isn't entirely unexpected. The broader EV market has experienced volatility in recent months, impacted by factors such as macroeconomic headwinds, intensifying competition, and concerns about slowing growth in China's EV sector. NIO, despite its innovative technology and stylish vehicles like the ET7 and ES7, hasn't been immune to these challenges.

What's Driving the NIO Stock Price Drop?

Several factors are contributing to the current market sentiment surrounding NIO:

- Increased Competition: The Chinese EV market is fiercely competitive, with established players like BYD and newer entrants constantly vying for market share. This intense competition puts pressure on pricing and profitability.

- Macroeconomic Concerns: Global economic uncertainty and concerns about a potential recession are impacting investor confidence across various sectors, including the automotive industry.

- Supply Chain Issues: While less prominent than in previous years, lingering supply chain disruptions can still impact production and delivery timelines, affecting revenue and profitability.

- Anticipation of Q1 Earnings: The upcoming Q1 earnings report is a major catalyst for the current price fluctuations. Investors are waiting to see if NIO can meet or exceed expectations, potentially influencing a positive or negative market reaction.

NIO's Strengths and Potential for Growth:

Despite the headwinds, NIO possesses several key strengths:

- Innovation: NIO consistently invests in research and development, pushing the boundaries of EV technology with features like battery swapping technology and advanced driver-assistance systems (ADAS).

- Brand Recognition: NIO has cultivated a strong brand image, particularly appealing to younger, tech-savvy consumers.

- Expanding Market Presence: NIO is expanding its presence both domestically and internationally, aiming for greater market penetration and diversification. Their recent expansion into Europe is a significant step in this direction.

Is This a Buying Opportunity?

The question of whether the current stock price drop presents a buying opportunity is complex and depends on individual risk tolerance and investment strategy. Some analysts believe the dip is a temporary correction, presenting a chance to buy shares at a discounted price, while others remain cautious.

Analyzing the Q1 Earnings Report:

The upcoming Q1 earnings report will be crucial. Investors should closely examine key metrics such as:

- Vehicle Deliveries: The number of vehicles delivered will be a key indicator of sales performance.

- Revenue Growth: Sustained revenue growth is essential for long-term viability.

- Profitability: Investors will be looking for signs of improved profitability or at least a clear path towards achieving it.

- Future Outlook: Management's guidance on future prospects and expectations will heavily influence investor sentiment.

Conclusion:

The recent decline in NIO's stock price creates a complex situation for investors. While the challenges are real, NIO's innovative technology and brand strength offer potential for future growth. Thoroughly analyzing the Q1 earnings report and carefully considering your own risk tolerance is crucial before making any investment decisions. Consulting with a financial advisor is always recommended before making significant investment choices. Stay tuned for the upcoming earnings release and further market analysis. This article is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looming: Stock Price Drop – Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Donald Trump And Scott Walker A Look At Their Tumultuous Relationship

Jun 03, 2025

Donald Trump And Scott Walker A Look At Their Tumultuous Relationship

Jun 03, 2025 -

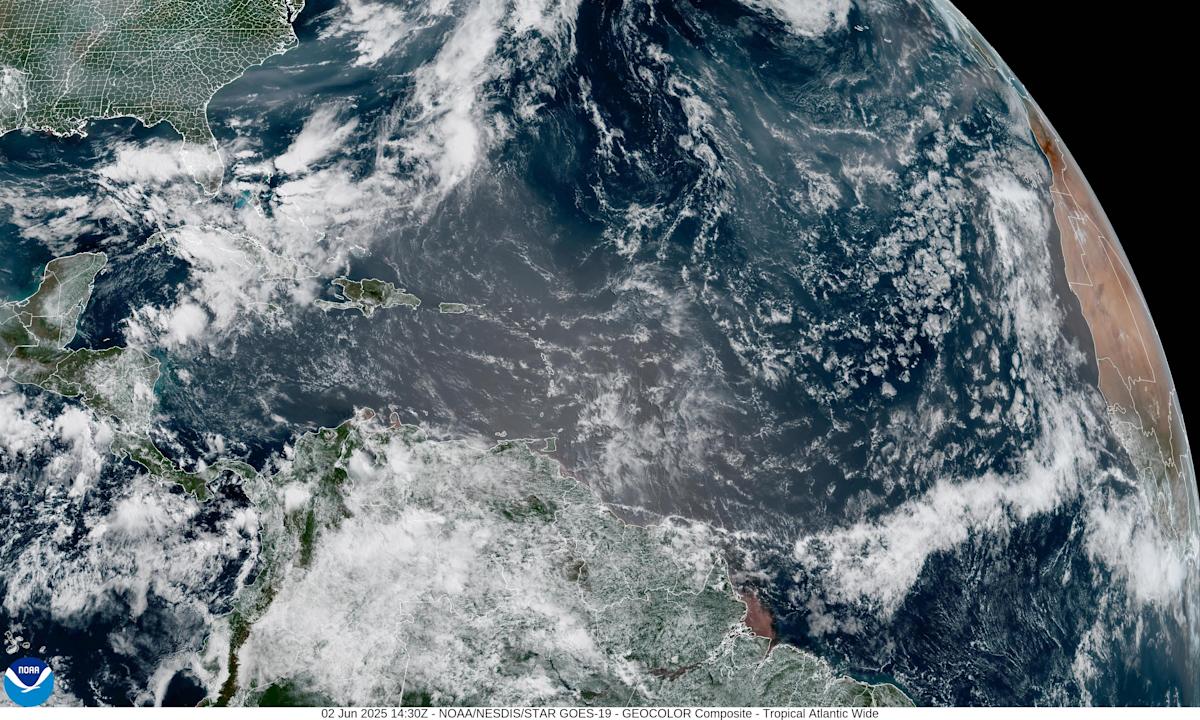

Florida Chokes On Saharan Dust And Canadian Wildfire Smoke Health And Environmental Concerns

Jun 03, 2025

Florida Chokes On Saharan Dust And Canadian Wildfire Smoke Health And Environmental Concerns

Jun 03, 2025 -

Walz On Trump A Cruel Man Provoking A Stronger Democratic Response

Jun 03, 2025

Walz On Trump A Cruel Man Provoking A Stronger Democratic Response

Jun 03, 2025 -

The Changing Dynamics Miley Cyruss Views On Family As She Gets Older

Jun 03, 2025

The Changing Dynamics Miley Cyruss Views On Family As She Gets Older

Jun 03, 2025 -

Nios Q1 Earnings Can Strong Deliveries Offset Tariff Concerns

Jun 03, 2025

Nios Q1 Earnings Can Strong Deliveries Offset Tariff Concerns

Jun 03, 2025