NIO Q1 Earnings Looming: Stock Drop Presents Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looming: Stock Drop Presents Opportunity?

NIO's stock has taken a hit recently, leaving investors wondering if the upcoming Q1 earnings report will bring a rebound or further decline. Could this dip be a strategic entry point for savvy investors?

Chinese electric vehicle (EV) maker NIO is gearing up to release its Q1 2024 earnings report, a moment that's been met with considerable anticipation – and anxiety. The company's stock price has experienced a downturn recently, prompting questions about the future of this prominent player in the burgeoning EV market. But for those willing to navigate the volatility, this dip could present a unique investment opportunity.

This article delves into the factors influencing NIO's current stock performance, explores the potential implications of the upcoming earnings report, and examines whether the recent decline offers a compelling entry point for investors.

Factors Contributing to NIO's Stock Decline

Several factors have contributed to NIO's recent stock price slump. These include:

- Increased Competition: The Chinese EV market is incredibly competitive, with established players like BYD and newer entrants constantly vying for market share. This intense rivalry puts pressure on NIO's pricing strategies and profitability.

- Global Economic Uncertainty: Macroeconomic headwinds, including inflation and potential recessionary pressures, have negatively impacted investor sentiment across various sectors, including the EV industry.

- Supply Chain Disruptions: Ongoing challenges in the global supply chain continue to impact the production and delivery of EVs, potentially affecting NIO's production targets and financial performance.

- Investor Sentiment: Negative news cycles and overall bearish market sentiment have further exacerbated the decline in NIO's stock price.

What to Expect from the Q1 Earnings Report

NIO's Q1 2024 earnings report will be closely scrutinized by analysts and investors alike. Key metrics to watch include:

- Vehicle Deliveries: The number of vehicles delivered will be a crucial indicator of NIO's market performance and growth trajectory. Any significant deviation from expectations could significantly impact the stock price.

- Revenue Growth: Sustained revenue growth is essential for demonstrating NIO's financial stability and long-term viability. A strong revenue figure would likely bolster investor confidence.

- Gross Margins: Improving gross margins signify increasing efficiency and profitability, a key factor in attracting investors.

- Guidance for Future Quarters: NIO's outlook for the remainder of 2024 will be closely examined for signs of future growth and potential challenges.

Is this a Buying Opportunity?

The recent stock drop presents a complex scenario for potential investors. While the risks are evident, the potential rewards could be significant for those with a long-term perspective. Several factors suggest this might be a buying opportunity:

- Undervalued Stock: Some analysts believe NIO's current stock price undervalues the company's long-term potential.

- Innovation and Technology: NIO continues to invest heavily in research and development, particularly in battery technology and autonomous driving capabilities, positioning itself for future growth.

- Growing Chinese EV Market: Despite the competition, the Chinese EV market remains a significant growth opportunity, offering considerable potential for NIO's expansion.

However, investors should proceed with caution. Thorough due diligence is essential before making any investment decisions. Consider consulting with a financial advisor to assess your risk tolerance and investment goals.

Conclusion: Proceed with Informed Caution

The upcoming Q1 earnings report will be pivotal for NIO. While the recent stock drop presents a potential opportunity, it's crucial to approach this situation with informed caution. Carefully analyze the earnings report, consider the risks involved, and consult with a financial professional before making any investment decisions. The long-term outlook for NIO depends on its ability to navigate the challenges within the competitive Chinese EV market and successfully execute its growth strategy. Keep an eye on the news following the earnings release for further insights.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looming: Stock Drop Presents Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investing In Hims And Hers Hims Risks And Rewards For Investors

Jun 03, 2025

Investing In Hims And Hers Hims Risks And Rewards For Investors

Jun 03, 2025 -

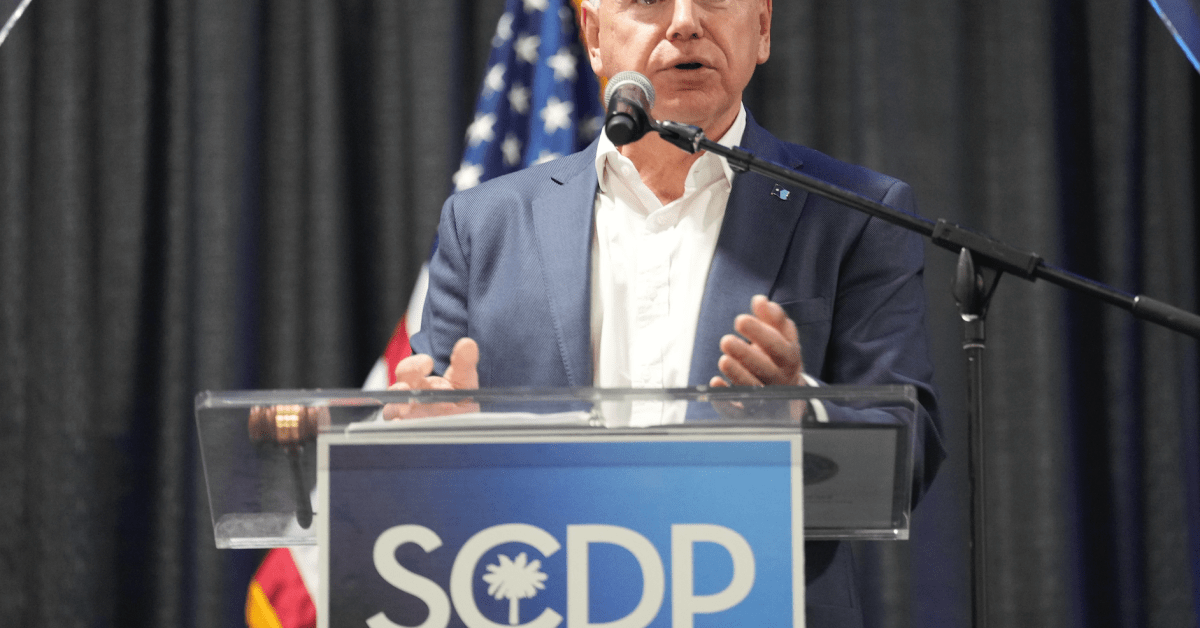

Be A Little Meaner Walz Challenges Democrats Criticizes Trump

Jun 03, 2025

Be A Little Meaner Walz Challenges Democrats Criticizes Trump

Jun 03, 2025 -

Racial Disrespect Allegations Against Patti Lu Pone Spark Broadway Outrage

Jun 03, 2025

Racial Disrespect Allegations Against Patti Lu Pone Spark Broadway Outrage

Jun 03, 2025 -

Donald Trump And Scott Walker Examining A Key Political Moment

Jun 03, 2025

Donald Trump And Scott Walker Examining A Key Political Moment

Jun 03, 2025 -

Rising Dte Energy Costs A Crushing Blow To Michigan Households

Jun 03, 2025

Rising Dte Energy Costs A Crushing Blow To Michigan Households

Jun 03, 2025