Investing In Hims & Hers (HIMS): Risks And Rewards For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Hims & Hers (HIMS): Risks and Rewards for Investors

Hims & Hers Health, Inc. (HIMS), a telehealth company offering personalized healthcare products and services, has attracted significant attention from investors since its IPO. But is investing in HIMS a smart move? This article delves into the potential risks and rewards for investors considering adding HIMS to their portfolio.

The Allure of Hims & Hers: A Growing Market

The telehealth industry is booming, and HIMS is a major player. Their direct-to-consumer model, focusing on convenient and accessible healthcare solutions for men and women, addresses a significant market need. This business model, coupled with their diverse product offerings – ranging from hair loss treatments and skincare products to sexual health solutions and mental health services – positions them for potential growth. Their strong brand recognition and marketing strategies further contribute to their appeal.

Key Growth Drivers for HIMS:

- Expanding Product Portfolio: HIMS continuously expands its product line, catering to a wider range of healthcare needs. This diversification minimizes reliance on single product categories and increases revenue streams.

- Strategic Acquisitions: Acquisitions can accelerate growth and expand market reach. HIMS' history of strategic acquisitions showcases their ambition for market leadership.

- Technological Advancements: Leveraging technology for improved customer experience and operational efficiency is vital. HIMS' investments in telehealth technology offer a competitive advantage.

- Growing Demand for Telehealth: The convenience and accessibility of telehealth are driving increased adoption, benefiting companies like HIMS.

H2: Navigating the Risks: Potential Pitfalls for Investors

Despite the potential for growth, investing in HIMS carries inherent risks.

- Intense Competition: The telehealth market is becoming increasingly competitive. Established players and new entrants constantly challenge HIMS' market share.

- Regulatory Scrutiny: The healthcare industry is heavily regulated. Changes in regulations could negatively impact HIMS' operations and profitability.

- Dependence on Marketing and Advertising: HIMS' success relies heavily on marketing and advertising. Decreased marketing effectiveness could hurt revenue growth.

- Profitability Concerns: While revenue is growing, HIMS' path to sustained profitability remains a key concern for investors. Analyzing their financial statements is crucial before investing.

H3: Financial Performance and Valuation: A Closer Look

Before making any investment decision, thorough due diligence is crucial. Review HIMS' financial statements, including revenue growth, profitability margins, and debt levels. Compare its valuation to competitors and industry benchmarks. Consider factors like price-to-earnings ratio (P/E) and revenue growth rates to assess its potential. You can find this information through reputable financial news sources and the company's investor relations website.

H2: Is HIMS Right for Your Portfolio?

Investing in HIMS presents both exciting opportunities and significant risks. The company operates in a rapidly growing market, but faces stiff competition and regulatory hurdles. Before investing, carefully weigh the potential rewards against the risks. Consider your overall investment strategy, risk tolerance, and financial goals. Diversifying your portfolio is always a prudent approach to mitigate risk. Consult with a qualified financial advisor to determine if HIMS aligns with your individual investment objectives.

Call to Action: Conduct thorough research and consider seeking professional financial advice before making any investment decisions. Remember that past performance is not indicative of future results. Stay informed about HIMS' progress and the evolving telehealth landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Hims & Hers (HIMS): Risks And Rewards For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Source Reveals Positive Update On Miley And Billy Ray Cyrus Relationship

Jun 03, 2025

Source Reveals Positive Update On Miley And Billy Ray Cyrus Relationship

Jun 03, 2025 -

Chinese Ev Maker Nio Q1 Earnings Preview And Tariff Concerns

Jun 03, 2025

Chinese Ev Maker Nio Q1 Earnings Preview And Tariff Concerns

Jun 03, 2025 -

Lu Pones Apology Broadway Star Addresses Controversial Comments

Jun 03, 2025

Lu Pones Apology Broadway Star Addresses Controversial Comments

Jun 03, 2025 -

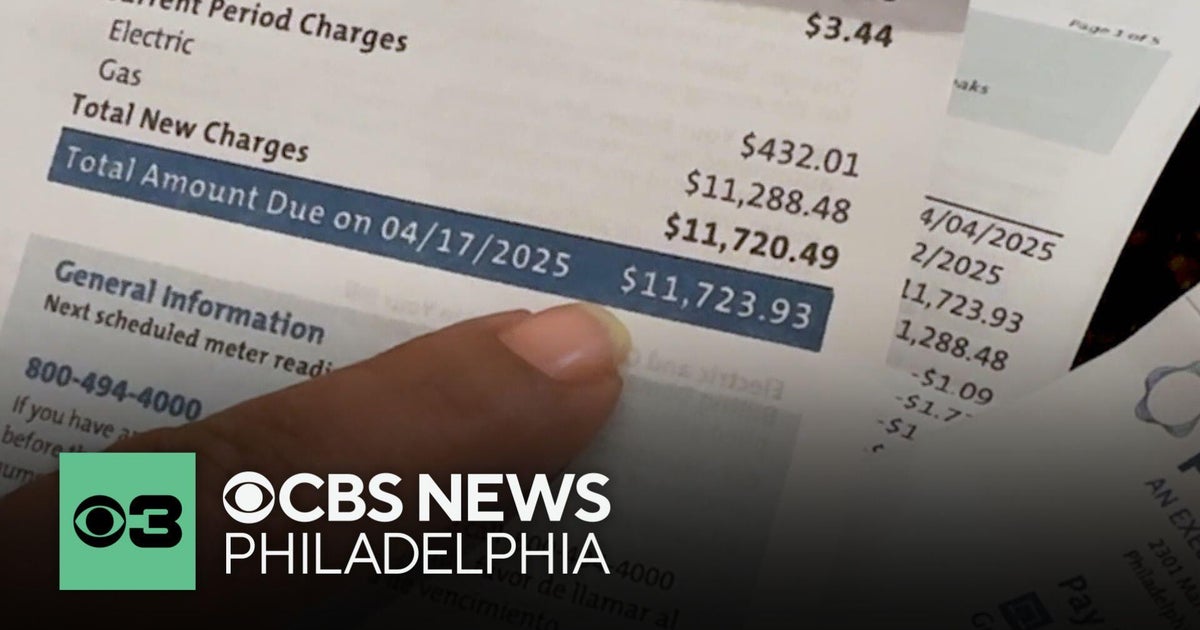

Pennsylvania Peco Customer Faces 12 000 Bill Following Months Without Billing

Jun 03, 2025

Pennsylvania Peco Customer Faces 12 000 Bill Following Months Without Billing

Jun 03, 2025 -

Veteran Joe Root Shows Improvement According To Brook

Jun 03, 2025

Veteran Joe Root Shows Improvement According To Brook

Jun 03, 2025