NIO Q1 Earnings Looming: Is The Stock Dip A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looming: Is the Stock Dip a Buying Opportunity?

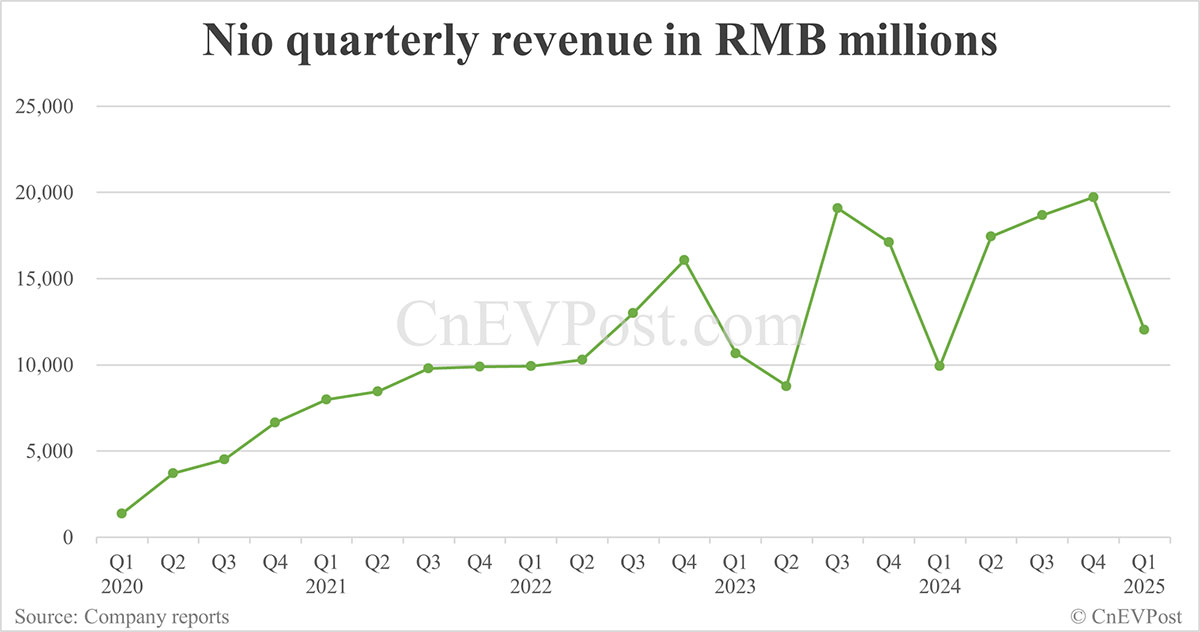

NIO, the Chinese electric vehicle (EV) maker, is on the precipice of releasing its Q1 2024 earnings report, and investors are on edge. The stock has experienced a recent dip, leaving many wondering if this presents a compelling buying opportunity or a sign of further trouble ahead. This article delves into the factors influencing NIO's performance and explores whether the current market sentiment justifies a purchase.

NIO's Recent Performance and Challenges:

NIO's journey hasn't been without its hurdles. The Chinese EV market remains fiercely competitive, with established players like BYD and newer entrants vying for market share. Furthermore, macroeconomic factors, including fluctuating battery raw material costs and ongoing supply chain disruptions, continue to impact profitability. The recent price war initiated by Tesla in China has added another layer of complexity, forcing NIO and its competitors to re-evaluate their pricing strategies. These challenges have contributed to the recent stock price volatility.

Analyzing the Dip: Is it a Buying Opportunity?

The recent dip in NIO's stock price presents a double-edged sword. On one hand, the lower price could signal a potential bargain for long-term investors who believe in NIO's long-term growth prospects. On the other hand, it could reflect genuine concerns about the company's ability to navigate the current market headwinds. Several factors need to be considered:

-

Q1 Earnings Report: The upcoming earnings report will be crucial. Investors will be closely scrutinizing delivery numbers, revenue growth, and profitability margins. Positive surprises could trigger a significant rebound in the stock price. Conversely, disappointing results could exacerbate the current downward trend.

-

Market Competition: The intense competition within the Chinese EV market remains a significant risk. NIO's ability to differentiate itself through innovation, superior technology, and effective marketing will be key to its future success.

-

Government Policies: Chinese government policies concerning the EV industry also play a crucial role. Changes in subsidies or regulations could significantly impact NIO's operations and profitability.

-

Global Macroeconomic Factors: Global economic uncertainty and inflationary pressures also add to the uncertainty surrounding NIO's stock performance.

What to Watch for in the Q1 Earnings Report:

Investors should focus on the following key metrics when the Q1 2024 earnings report is released:

- Vehicle Deliveries: A strong increase in vehicle deliveries compared to Q4 2023 would be a positive sign.

- Revenue Growth: Sustained revenue growth, demonstrating market share retention and expansion, is essential.

- Gross Margins: Improving gross margins indicate better cost control and pricing power.

- Guidance for Q2 and beyond: Management's outlook for the rest of the year will provide valuable insights into future expectations.

Conclusion: A Calculated Risk?

Whether the current dip in NIO's stock price presents a buying opportunity is ultimately a subjective decision. It requires careful consideration of the company's performance, market dynamics, and future outlook. While the risks are undeniable, the potential for significant long-term growth remains. Thorough due diligence, including a comprehensive review of the Q1 earnings report and an understanding of the broader market landscape, is crucial before making any investment decisions. Consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looming: Is The Stock Dip A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hims And Hers Health Inc Hims A 3 02 Stock Increase Reported On May 30th

Jun 03, 2025

Hims And Hers Health Inc Hims A 3 02 Stock Increase Reported On May 30th

Jun 03, 2025 -

Racial Disrespect Allegations Against Patti Lu Pone Spark Major Broadway Controversy

Jun 03, 2025

Racial Disrespect Allegations Against Patti Lu Pone Spark Major Broadway Controversy

Jun 03, 2025 -

China Tariffs Jamie Dimons Warning And The Implications For Us Businesses

Jun 03, 2025

China Tariffs Jamie Dimons Warning And The Implications For Us Businesses

Jun 03, 2025 -

Nio Q1 2024 Revenue 21 Yo Y Growth Reported

Jun 03, 2025

Nio Q1 2024 Revenue 21 Yo Y Growth Reported

Jun 03, 2025 -

Double Trouble Trumps Tariff Increase Sparks Economic Warnings

Jun 03, 2025

Double Trouble Trumps Tariff Increase Sparks Economic Warnings

Jun 03, 2025