China Tariffs: Jamie Dimon's Warning And The Implications For US Businesses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China Tariffs: Jamie Dimon's Warning and the Implications for US Businesses

JP Morgan Chase CEO Jamie Dimon's recent stark warning about the lingering effects of China tariffs on US businesses has sent shockwaves through the financial world. His comments, delivered during a time of increasing geopolitical tensions between the US and China, highlight the ongoing economic fallout from the trade war and underscore the need for a more nuanced approach to US-China relations. This isn't just about abstract economic theory; it's about real-world consequences for American companies and workers.

Dimon's warning isn't a new concern; the impact of tariffs imposed during the Trump administration has been a subject of ongoing debate. However, his prominent voice adds significant weight to existing anxieties and pushes the issue back into the spotlight. The implications are far-reaching and affect numerous sectors of the US economy.

The Lingering Shadow of Tariffs

The tariffs, initially implemented under the guise of protecting American industries, have had a complex and often contradictory impact. While some sectors might have experienced short-term gains, the overall effect has been a significant increase in costs for businesses relying on Chinese imports. This has led to:

- Increased prices for consumers: The cost of goods has risen, impacting household budgets and contributing to inflation.

- Reduced competitiveness: American companies facing higher input costs struggle to compete globally.

- Supply chain disruptions: The reliance on Chinese manufacturing has highlighted vulnerabilities in global supply chains, leaving many businesses scrambling to find alternative sources.

- Retaliatory tariffs: China's response to US tariffs further complicated the situation, creating a cycle of escalating trade tensions.

These consequences aren't merely theoretical; they translate into real losses for American businesses, job insecurity, and reduced economic growth.

Dimon's Call for a More Nuanced Approach

Dimon's concern isn't simply about the past impact of tariffs but also about the future. He advocates for a more strategic and less confrontational approach to trade relations with China. A prolonged period of trade friction could severely hamper US economic recovery and stifle future growth. This includes:

- A focus on de-risking, not decoupling: Dimon emphasizes the importance of reducing dependence on China where necessary, but cautions against a complete decoupling, which could prove economically disastrous. The aim should be to diversify supply chains, not sever ties entirely.

- Addressing specific trade concerns through negotiation: Instead of blanket tariffs, a targeted approach that addresses specific concerns through negotiation could be more effective.

- Collaboration on global challenges: China is a significant player in global issues like climate change. Cooperation on these fronts could help ease trade tensions.

What Does This Mean for US Businesses?

For US businesses, Dimon's warning serves as a crucial wake-up call. Companies need to:

- Diversify their supply chains: Reducing reliance on a single supplier is essential for resilience.

- Engage in strategic planning: Businesses must proactively assess their exposure to trade risks and develop contingency plans.

- Advocate for sensible trade policies: Companies should support policies that promote fair trade and avoid unnecessarily disruptive measures.

The ongoing trade relationship between the US and China remains a critical factor influencing the global economy. Jamie Dimon's warning is a powerful reminder of the long-term consequences of poorly managed trade relations, urging a more strategic and collaborative approach to avoid further economic hardship for US businesses. The future of this crucial relationship warrants careful consideration and proactive strategies from both governments and businesses alike. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China Tariffs: Jamie Dimon's Warning And The Implications For US Businesses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

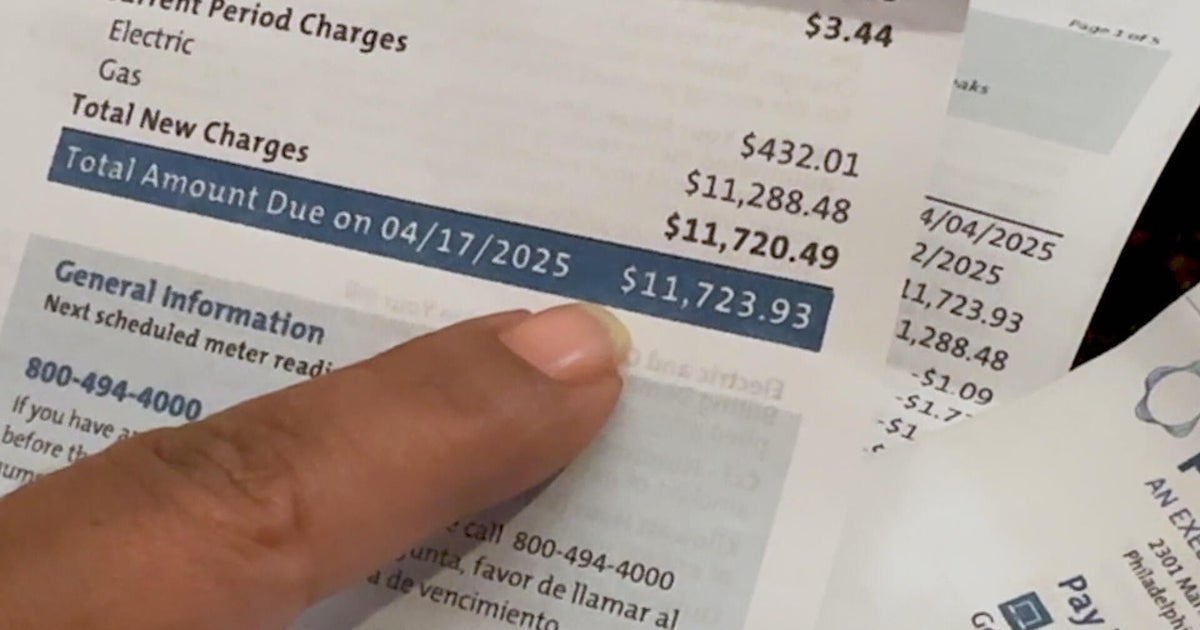

Pecos Billing System Under Fire 12 K Bill Highlights Customer Service Problems

Jun 03, 2025

Pecos Billing System Under Fire 12 K Bill Highlights Customer Service Problems

Jun 03, 2025 -

Veteran Joe Root Shows Improvement England Captains Observation

Jun 03, 2025

Veteran Joe Root Shows Improvement England Captains Observation

Jun 03, 2025 -

Jp Morgans Dimon China Tariffs Failing Us Needs New Approach

Jun 03, 2025

Jp Morgans Dimon China Tariffs Failing Us Needs New Approach

Jun 03, 2025 -

Tornado Throws The Wire Actors Son 300 Feet Familys Harrowing Account

Jun 03, 2025

Tornado Throws The Wire Actors Son 300 Feet Familys Harrowing Account

Jun 03, 2025 -

Police Apprehend North Texas Murder Suspect Following Extensive Search

Jun 03, 2025

Police Apprehend North Texas Murder Suspect Following Extensive Search

Jun 03, 2025