NIO Q1 Earnings: Analyzing Delivery Numbers And Tariff Challenges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings: Navigating Delivery Numbers and Tariff Headwinds

Chinese electric vehicle (EV) maker NIO reported its first-quarter 2024 earnings, revealing a mixed bag of results. While delivery numbers showed promising growth, the company faced significant challenges from increased tariffs and global economic uncertainty. This report delves into the key takeaways from NIO's Q1 performance, analyzing both the positive delivery trends and the hurdles the company encountered.

Record Deliveries, Yet Challenges Remain

NIO announced a record number of vehicle deliveries in Q1 2024, exceeding analyst expectations. This surge in deliveries, fueled by strong demand for their flagship models like the ET7 and ES7, points to the growing popularity of NIO's vehicles within the competitive Chinese EV market. However, this positive news was tempered by external factors impacting the company's bottom line.

Impact of Increased Tariffs

One of the most significant challenges facing NIO, and the broader EV industry, is the recent increase in import tariffs. These tariffs have directly impacted the cost of importing components and exporting vehicles, squeezing profit margins and potentially affecting future sales strategies. The company addressed these challenges in their earnings call, outlining their strategies to mitigate the impact of these increased costs. This includes exploring alternative sourcing options and potentially adjusting pricing strategies. The long-term effect of these tariffs remains to be seen, and investors are closely watching NIO's response.

Analyzing the Financial Performance

Beyond delivery numbers and tariff impacts, a thorough analysis of NIO's Q1 financial performance is crucial. Key metrics to consider include:

- Revenue: Did revenue meet or exceed expectations, considering the impact of increased tariffs?

- Gross Margin: How were gross margins affected by increased input costs and pricing strategies?

- Net Income (or Loss): What was the overall net income or loss for the quarter, and how does this compare to the same period last year?

- Research and Development (R&D) Spending: How much was invested in R&D, indicating NIO's commitment to innovation and future product development?

Accessing NIO's official financial reports and investor presentations is crucial for a comprehensive understanding of these figures. [Link to NIO Investor Relations].

Looking Ahead: NIO's Future Prospects

Despite the challenges, NIO remains optimistic about its future prospects. Their continued investment in R&D, along with the expansion of their charging infrastructure and battery swap technology, positions them for continued growth in the long term. However, navigating the complexities of the global economy, including fluctuating tariffs and supply chain disruptions, will be key to their success.

Key Takeaways:

- NIO delivered record vehicle numbers in Q1 2024, demonstrating strong market demand.

- Increased import tariffs significantly impacted NIO's profitability and operational efficiency.

- Future success depends on effectively managing these external challenges and continuing innovation.

- Investors should closely monitor NIO's strategies for mitigating tariff impacts and maintaining growth.

This analysis provides a preliminary overview of NIO's Q1 2024 earnings. For a detailed understanding, refer to NIO's official financial statements and accompanying investor presentations. Staying informed about the company's performance and strategic moves is crucial for anyone interested in the Chinese EV market and NIO's future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings: Analyzing Delivery Numbers And Tariff Challenges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Underwater Attack On Crimean Bridge Ukraines Latest Strike Claims

Jun 03, 2025

Underwater Attack On Crimean Bridge Ukraines Latest Strike Claims

Jun 03, 2025 -

Ukraines Underwater Assault Crimea Bridge Damaged By Explosives

Jun 03, 2025

Ukraines Underwater Assault Crimea Bridge Damaged By Explosives

Jun 03, 2025 -

Is Nio Stock A Bargain After Recent Price Drop

Jun 03, 2025

Is Nio Stock A Bargain After Recent Price Drop

Jun 03, 2025 -

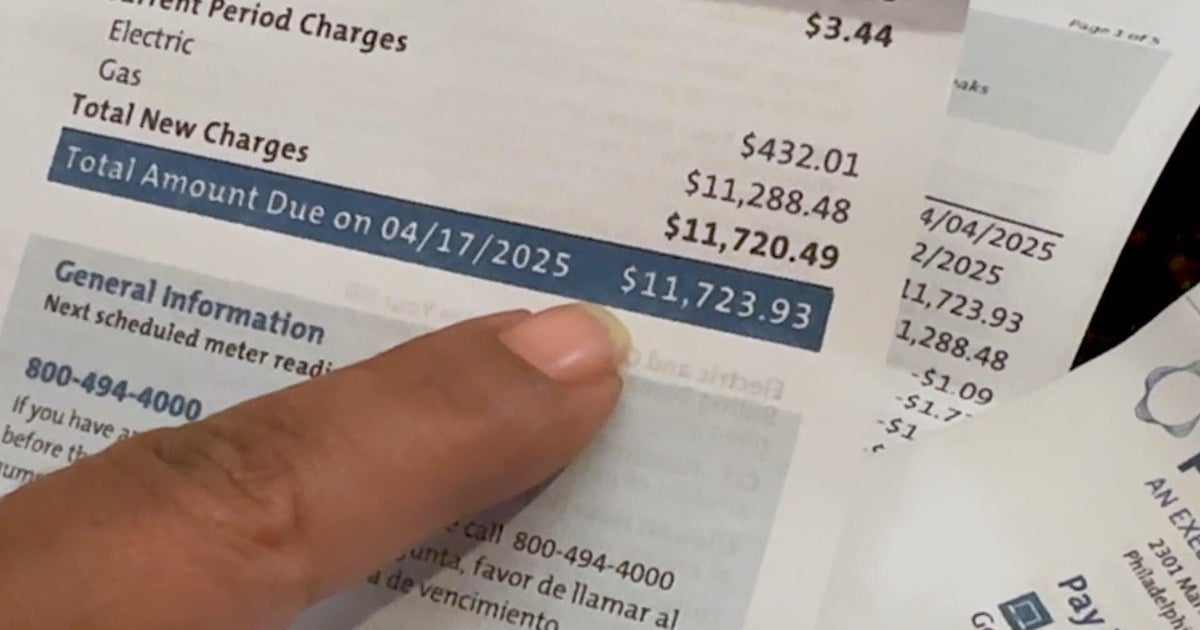

Peco Customer Service Under Fire After Massive Billing Discrepancies

Jun 03, 2025

Peco Customer Service Under Fire After Massive Billing Discrepancies

Jun 03, 2025 -

Another Dte Rate Hike Could Cripple Michigan Households Legislator Claims

Jun 03, 2025

Another Dte Rate Hike Could Cripple Michigan Households Legislator Claims

Jun 03, 2025