Is NIO Stock A Bargain After Recent Price Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is NIO Stock a Bargain After Recent Price Drop? Navigating the EV Market's Volatility

The electric vehicle (EV) market has been a rollercoaster ride lately, and Chinese EV maker NIO (NIO) is no exception. After a significant price drop, many investors are asking: is NIO stock now a bargain, or is further downside risk looming? This article delves into the current state of NIO, examining the factors contributing to its recent decline and assessing the potential for future growth.

NIO's Recent Dip: A Deeper Dive

NIO's stock price has experienced considerable volatility in recent months. Several factors have contributed to this downturn, including:

- Increased Competition: The EV market is becoming increasingly crowded, with both established automakers and new entrants vying for market share. This intense competition puts pressure on pricing and profitability for all players, including NIO.

- Economic Slowdown in China: China's economy has faced headwinds recently, impacting consumer spending and potentially slowing the demand for luxury EVs like those offered by NIO.

- Supply Chain Challenges: Persistent supply chain disruptions continue to affect the automotive industry globally, impacting production and delivery timelines for EV manufacturers.

- Geopolitical Risks: Geopolitical tensions between the US and China introduce an element of uncertainty for investors considering Chinese-based companies like NIO.

NIO's Strengths and Growth Potential

Despite these challenges, NIO possesses several key strengths that could propel its future growth:

- Innovative Technology: NIO is known for its technologically advanced vehicles and battery-swapping technology, which offers a faster and more convenient charging solution compared to traditional charging methods. This technological edge could attract customers seeking cutting-edge features.

- Expanding Market Presence: NIO is expanding its presence both domestically in China and internationally, aiming to tap into new markets and increase its sales volume. This expansion strategy represents a significant growth opportunity.

- Brand Loyalty: NIO has cultivated a strong and loyal customer base, indicating a degree of brand recognition and trust within the EV market.

- Government Support: The Chinese government's strong support for the development of the domestic EV industry provides a favorable regulatory environment for NIO and other Chinese EV makers.

Is it a Buy? Analyzing the Risk/Reward

Determining whether NIO stock is currently a bargain depends on an individual investor's risk tolerance and investment horizon. While the recent price drop presents a potentially attractive entry point for some, it's crucial to acknowledge the inherent risks associated with investing in the volatile EV market.

Factors to Consider Before Investing:

- Future Earnings Potential: Analyze NIO's financial reports and projections to assess its long-term profitability.

- Market Competition: Keep a close eye on the competitive landscape and how NIO is positioned to maintain its market share.

- Economic and Geopolitical Factors: Stay informed about economic developments in China and global geopolitical risks that could impact NIO's performance.

Conclusion:

NIO's recent price drop presents a complex investment scenario. While the company possesses significant strengths and growth potential, investors must carefully weigh the risks associated with the volatile EV market and the broader economic and geopolitical environment. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Further research into NIO's financial performance and future projections is strongly recommended before considering purchasing shares. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is NIO Stock A Bargain After Recent Price Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

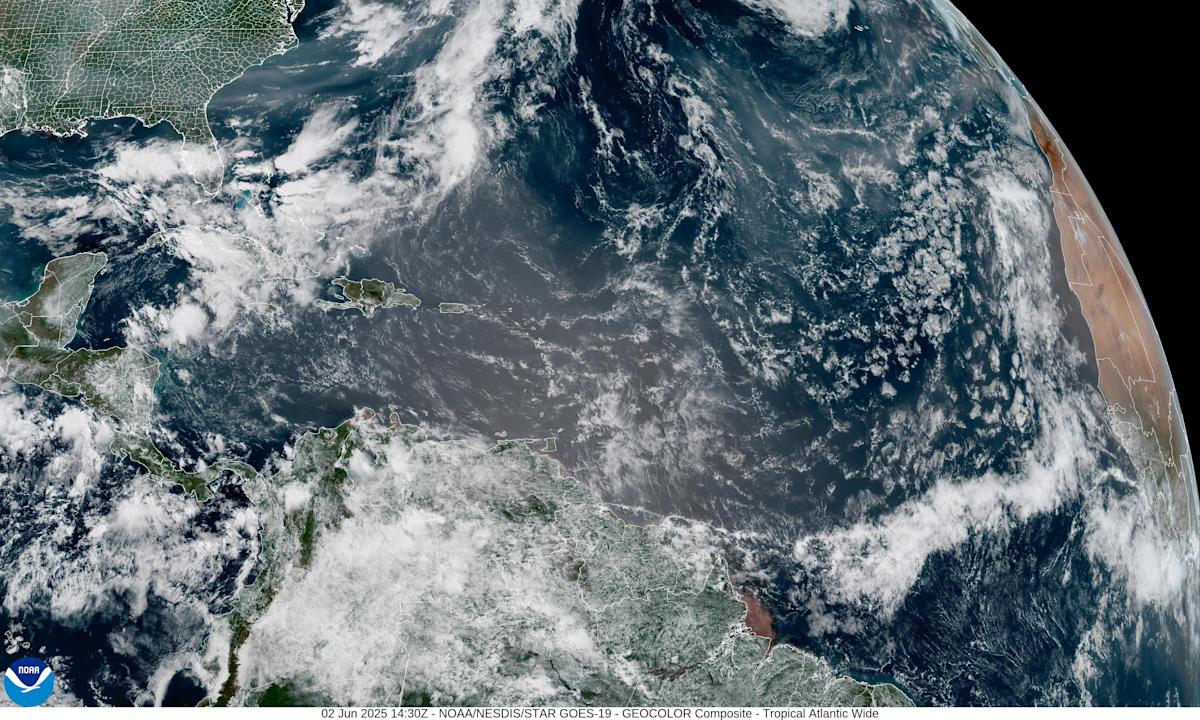

Saharan Dust Storm And Canadian Wildfire Smoke Converge Over Florida Assessing The Effects

Jun 03, 2025

Saharan Dust Storm And Canadian Wildfire Smoke Converge Over Florida Assessing The Effects

Jun 03, 2025 -

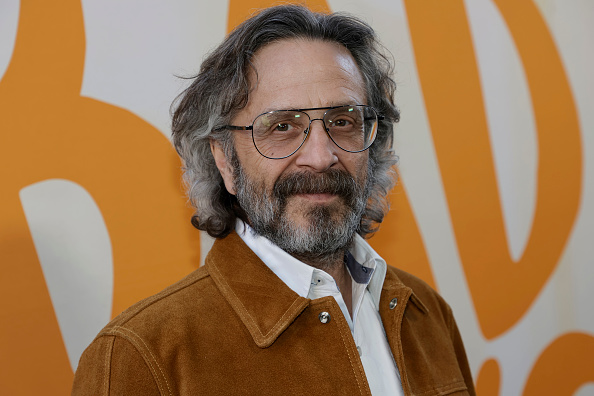

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025 -

Wtf With Marc Maron Podcast An End Of An Era

Jun 03, 2025

Wtf With Marc Maron Podcast An End Of An Era

Jun 03, 2025 -

Roseanne Barr Recovers Embraces Texas Life After Tractor Incident

Jun 03, 2025

Roseanne Barr Recovers Embraces Texas Life After Tractor Incident

Jun 03, 2025 -

Sydney Sweeney Launches Bathwater Soap Public Reaction And Sales

Jun 03, 2025

Sydney Sweeney Launches Bathwater Soap Public Reaction And Sales

Jun 03, 2025