NIO Q1 2024 Financial Results: A Deep Dive Into Deliveries And Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 2024 Financial Results: A Deep Dive into Deliveries and Tariffs

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its financial results for the first quarter of 2024, revealing a mixed bag of successes and challenges. While vehicle deliveries showed promising growth, the impact of tariffs and global economic uncertainty cast a shadow on the overall performance. This deep dive analyzes the key takeaways from NIO's Q1 2024 report, focusing on vehicle deliveries and the significant influence of tariffs.

Record Deliveries Despite Headwinds:

NIO reported a significant increase in vehicle deliveries for Q1 2024, exceeding analyst expectations. This surge can be attributed to several factors, including the successful launch of new models like the ET7 and the strong demand for its existing lineup. The company's expanding charging network and battery swap technology also contributed to its sales momentum.

- Increased Model Diversity: The introduction of new models catering to different market segments played a crucial role in driving sales growth. NIO's strategy of offering a variety of EVs, from sedans to SUVs, has proven effective in capturing a wider customer base.

- Enhanced Charging Infrastructure: NIO's commitment to expanding its battery swap stations and charging network has significantly improved the overall user experience, reducing range anxiety and boosting consumer confidence. This robust infrastructure is a key differentiator in the competitive EV market.

- Strong Brand Loyalty: Despite challenges, NIO has cultivated a loyal customer base, evident in the sustained demand for its vehicles. This brand loyalty is a testament to the quality and innovation of its products and services.

The Impact of Tariffs:

However, the positive impact of increased deliveries was partially offset by the ongoing impact of tariffs. While NIO didn't explicitly disclose the exact financial burden, the company acknowledged the negative effect of tariffs on its profitability margins. This highlights the ongoing challenges faced by Chinese EV manufacturers navigating the complexities of global trade. The ongoing trade tensions between China and other major markets remain a significant risk factor for NIO's future performance.

Looking Ahead: Challenges and Opportunities:

NIO's Q1 2024 results present a complex picture. While the strong delivery numbers are encouraging, the lingering impact of tariffs and the uncertain global economic climate pose significant challenges. The company's success in navigating these challenges will depend on several factors:

- Strategic Pricing: Adapting pricing strategies to remain competitive while mitigating the impact of tariffs will be crucial for maintaining profitability.

- Technological Innovation: Continuous innovation in battery technology, autonomous driving capabilities, and other key areas will be essential for sustaining competitive advantage.

- Global Expansion: Further expansion into international markets will help diversify revenue streams and reduce reliance on any single market.

Conclusion:

NIO's Q1 2024 financial results reveal a company navigating a challenging but potentially rewarding landscape. While strong deliveries signal a healthy demand for its EVs, the impact of tariffs remains a significant concern. The company's future success hinges on its ability to effectively manage these challenges and capitalize on the growing global demand for electric vehicles. Investors and industry analysts will be closely watching NIO's performance in the coming quarters to gauge its long-term prospects. For more in-depth analysis, you can visit the official NIO investor relations website. [Link to NIO Investor Relations]

Keywords: NIO, NIO Q1 2024, Electric Vehicles, EV, China, Tariffs, Vehicle Deliveries, Financial Results, Stock Market, Automotive Industry, Battery Swap, Charging Infrastructure, ET7, Global Trade, Profitability, Economic Uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 2024 Financial Results: A Deep Dive Into Deliveries And Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

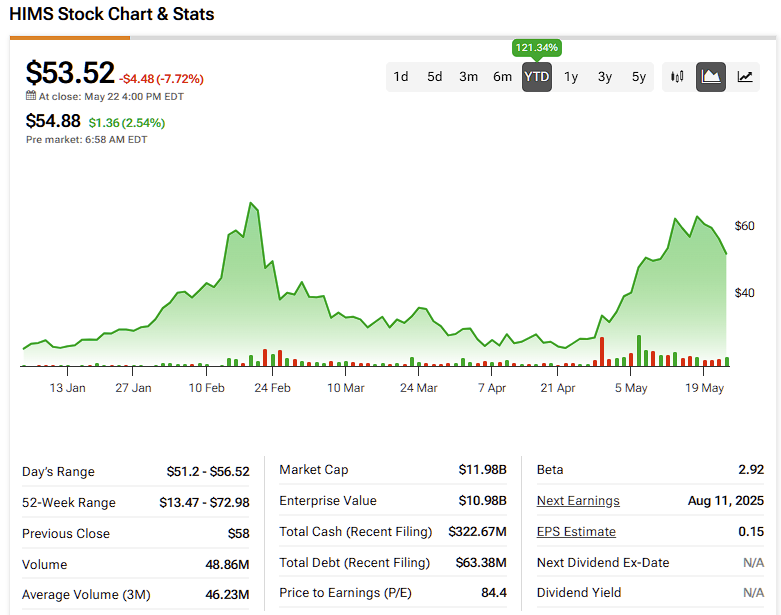

Is Hims And Hers Hims Stock A Buy Or Sell A Realistic Look

Jun 04, 2025

Is Hims And Hers Hims Stock A Buy Or Sell A Realistic Look

Jun 04, 2025 -

Private Sector Hiring Plummets To Two Year Low Adp Data Reveals 37 000 New Jobs

Jun 04, 2025

Private Sector Hiring Plummets To Two Year Low Adp Data Reveals 37 000 New Jobs

Jun 04, 2025 -

Roseanne Barrs Texas Ranch A New Chapter After The Accident

Jun 04, 2025

Roseanne Barrs Texas Ranch A New Chapter After The Accident

Jun 04, 2025 -

Assessing Bulgarias Readiness For Eurozone Membership

Jun 04, 2025

Assessing Bulgarias Readiness For Eurozone Membership

Jun 04, 2025 -

St Louis City Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025

St Louis City Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025