Is Hims & Hers (HIMS) Stock A Buy Or Sell? A Realistic Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Buy or Sell? A Realistic Look

Hims & Hers Health, Inc. (HIMS), the telehealth company disrupting the personal care market, has seen its stock price fluctuate significantly since its IPO. For investors, the question remains: is HIMS stock a buy, a sell, or should you hold tight? This in-depth analysis provides a realistic look at the company's prospects and helps you make an informed decision.

Hims & Hers: A Quick Overview

Hims & Hers offers a convenient and discreet way to access medical advice and prescriptions for various health concerns, including hair loss, sexual health, and skincare. Their direct-to-consumer model, leveraging telehealth technology, has resonated with a significant portion of the market, leading to impressive growth in recent years. However, the company also faces significant challenges in a rapidly evolving and competitive landscape.

Arguments for Buying HIMS Stock:

- Strong Market Opportunity: The telehealth market is booming, with increasing demand for convenient and accessible healthcare solutions. Hims & Hers is well-positioned to capitalize on this growth, particularly among younger demographics comfortable with online platforms.

- Expanding Product Line: The company continues to expand its product offerings, diversifying its revenue streams and reducing reliance on any single product category. This strategic move minimizes risk and broadens their appeal to a wider customer base.

- Brand Recognition: Hims & Hers has built a strong brand presence, fostering trust and loyalty among its customers. This established brand recognition is a significant asset in a crowded market.

- Potential for International Expansion: The company has the potential to expand its operations internationally, unlocking significant growth opportunities in new markets. This expansion could dramatically increase revenue and shareholder value.

Arguments Against Buying HIMS Stock:

- High Competition: The telehealth market is becoming increasingly competitive, with both established players and new entrants vying for market share. This competition could put pressure on HIMS's pricing and profitability.

- Regulatory Risks: The healthcare industry is heavily regulated, and changes in regulations could negatively impact Hims & Hers's operations and profitability. Staying abreast of regulatory changes is crucial for the company's long-term success.

- Profitability Concerns: While revenue growth has been impressive, Hims & Hers is still striving for consistent profitability. Investors should carefully analyze the company's financial statements and future projections before investing.

- Dependence on Marketing: A substantial portion of Hims & Hers's expenses are allocated to marketing and advertising. Continued success hinges on maintaining effective marketing strategies, which can be costly and challenging to sustain.

Analyzing the Financials: A Key Consideration

Before making any investment decisions, thoroughly examine HIMS's financial statements, including revenue growth, profitability margins, and debt levels. Consult reputable financial news sources and analyst reports to gain a comprehensive understanding of the company's financial health. Look for trends in key performance indicators (KPIs) to project future performance. Consider comparing HIMS's financials to those of its competitors to gain a better perspective on its relative strength.

Conclusion: A Cautiously Optimistic Outlook

Hims & Hers operates in a dynamic and promising sector. While the company possesses considerable potential for growth, investors must carefully weigh the risks and rewards before committing capital. The competitive landscape and regulatory environment demand a thorough due diligence process. HIMS stock could be a worthwhile investment for long-term, risk-tolerant investors, but it's crucial to monitor the company's progress and adapt your investment strategy accordingly. Always consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves significant risk, and you could lose money. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Buy Or Sell? A Realistic Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nio Stock Price Drops Ahead Of Q1 Results Is It A Buying Opportunity

Jun 04, 2025

Nio Stock Price Drops Ahead Of Q1 Results Is It A Buying Opportunity

Jun 04, 2025 -

Subway Parents Hot Chicken Acquisition Fuels Expansion 155 New Locations Planned

Jun 04, 2025

Subway Parents Hot Chicken Acquisition Fuels Expansion 155 New Locations Planned

Jun 04, 2025 -

New Movie And Console Ballerina And Nintendo Switch 2 Arrive This Week

Jun 04, 2025

New Movie And Console Ballerina And Nintendo Switch 2 Arrive This Week

Jun 04, 2025 -

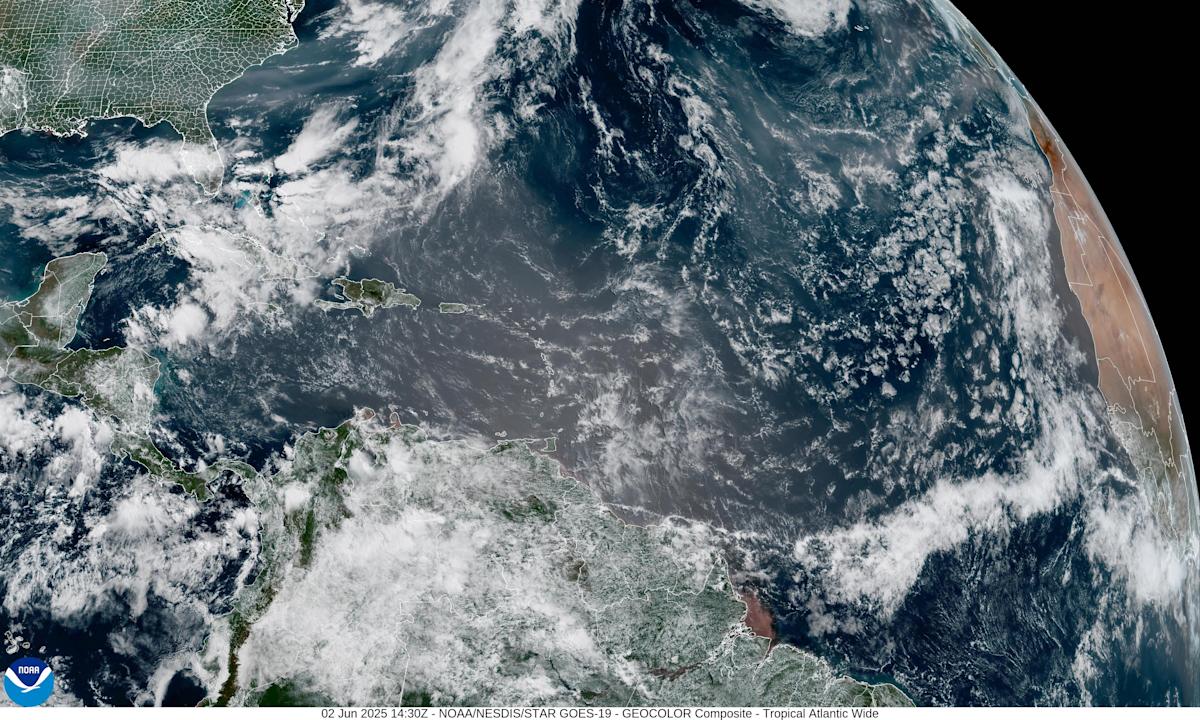

Canadian Wildfires Send Smoke Saharan Dust Blankets Florida Air Quality Alert

Jun 04, 2025

Canadian Wildfires Send Smoke Saharan Dust Blankets Florida Air Quality Alert

Jun 04, 2025 -

India Vs Thailand Live Follow The International Friendly Game Here

Jun 04, 2025

India Vs Thailand Live Follow The International Friendly Game Here

Jun 04, 2025