Navigating US-China Tensions: 10 Stocks To Watch According To Jim Cramer

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating US-China Tensions: 10 Stocks to Watch According to Jim Cramer

The escalating tensions between the US and China have sent ripples through the global economy, leaving investors scrambling to navigate the uncertain landscape. But for those willing to brave the volatility, opportunities exist. Financial guru Jim Cramer, known for his sharp insights and often-controversial opinions, has identified 10 stocks he believes are particularly noteworthy amidst this geopolitical storm. This article delves into Cramer's picks, examining the rationale behind his selections and providing crucial context for investors considering exposure to these companies.

Understanding the US-China Dynamic:

The ongoing trade war, technological rivalry, and ideological differences between the US and China create a complex and volatile investment environment. Companies with significant exposure to either market face unique risks and rewards. Understanding these nuances is crucial for informed decision-making. [Link to a reputable source on US-China relations]

Cramer's 10 Stocks to Watch:

While specific stock recommendations should always be considered alongside your own due diligence and risk tolerance, Cramer's picks offer a valuable starting point for research. It's crucial to remember that these are suggestions and not financial advice.

Technology & Semiconductors:

- Nvidia (NVDA): A dominant player in AI and high-performance computing, Nvidia's future is intertwined with global technological advancement. Cramer highlights its resilience in the face of geopolitical headwinds. [Link to Nvidia's investor relations page]

- Taiwan Semiconductor Manufacturing Company (TSM): As the world's leading contract chipmaker, TSM faces significant geopolitical risk due to its location in Taiwan. However, its importance to the global tech supply chain makes it a compelling, albeit risky, investment. [Link to TSM's investor relations page]

- Qualcomm (QCOM): A key player in the mobile chip market, Qualcomm's exposure to both US and Chinese markets makes it a bellwether for the broader tech landscape. Cramer suggests monitoring its ability to navigate regulatory hurdles. [Link to Qualcomm's investor relations page]

Consumer Goods & Retail:

- Nike (NKE): While facing challenges in China, Nike's global brand recognition and diversified markets provide a degree of insulation against geopolitical risks. Cramer notes its long-term growth potential despite short-term headwinds. [Link to Nike's investor relations page]

- Apple (AAPL): A significant portion of Apple's manufacturing takes place in China, making it susceptible to supply chain disruptions. However, its strong brand loyalty and global reach offer some resilience. Cramer advises investors to track its China sales figures closely. [Link to Apple's investor relations page]

Other Sectors:

- Caterpillar (CAT): A global leader in construction and mining equipment, Caterpillar's exposure to infrastructure projects worldwide, including in both the US and China, makes it a play on broader economic growth, albeit with sensitivity to geopolitical shifts. [Link to Caterpillar's investor relations page]

- Boeing (BA): The aerospace giant faces both opportunities and challenges in the US-China relationship. Cramer suggests monitoring its international sales and supply chain dynamics. [Link to Boeing's investor relations page]

- Chevron (CVX): As a major energy producer, Chevron's performance is partly tied to global energy demand, which is influenced by the economic health of both the US and China. Cramer emphasizes the importance of understanding global energy markets. [Link to Chevron's investor relations page]

Financials:

- JPMorgan Chase (JPM): A major global financial institution, JPMorgan's performance is naturally impacted by global economic conditions, including the relationship between the US and China. Cramer suggests that its size and diversification provide a degree of protection. [Link to JPMorgan Chase's investor relations page]

- Bank of America (BAC): Similar to JPMorgan, Bank of America's performance is impacted by global economic conditions, making it a key indicator of the broader economic health affected by US-China relations. [Link to Bank of America's investor relations page]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: What are your thoughts on Cramer's picks? Share your insights and perspectives in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating US-China Tensions: 10 Stocks To Watch According To Jim Cramer. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

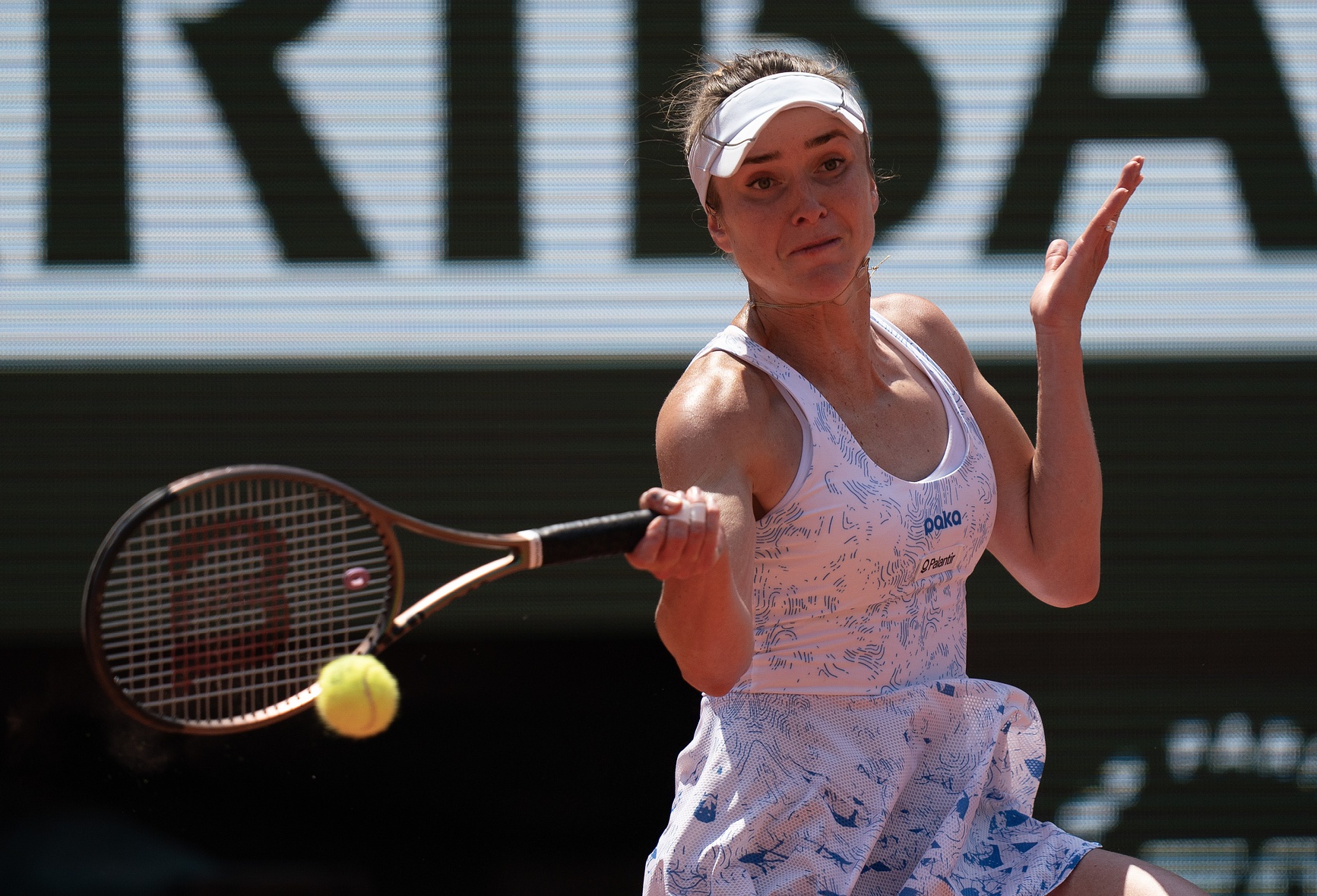

Betting Odds And Analysis Svitolina Vs Baptiste Wta Italian Open Round 3

May 11, 2025

Betting Odds And Analysis Svitolina Vs Baptiste Wta Italian Open Round 3

May 11, 2025 -

Match Point Drama Bouzas Maneiros Winning Shot

May 11, 2025

Match Point Drama Bouzas Maneiros Winning Shot

May 11, 2025 -

Climate Risk And Opportunity A Business And Finance Conversation

May 11, 2025

Climate Risk And Opportunity A Business And Finance Conversation

May 11, 2025 -

Austin Tice Body Found After Decade Long Kidnapping

May 11, 2025

Austin Tice Body Found After Decade Long Kidnapping

May 11, 2025 -

Analyzing The Peshawar Zalmi Karachi Kings Rivalry Highlights From The 2023 Psl

May 11, 2025

Analyzing The Peshawar Zalmi Karachi Kings Rivalry Highlights From The 2023 Psl

May 11, 2025