Climate Risk And Opportunity: A Business And Finance Conversation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Climate Risk and Opportunity: A Business and Finance Conversation

The conversation surrounding climate change is no longer a fringe discussion; it's a central theme shaping the future of business and finance. From escalating physical risks to burgeoning opportunities in green technologies, understanding the interplay of climate risk and opportunity is crucial for both investors and companies alike. This article explores the key aspects of this critical conversation.

The Growing Reality of Climate-Related Financial Risks

The financial implications of climate change are becoming increasingly undeniable. Extreme weather events, like hurricanes, floods, and wildfires, are causing billions of dollars in damage annually, impacting infrastructure, supply chains, and ultimately, corporate profitability. The insurance industry, for example, is already feeling the strain, with increased payouts and a growing reluctance to underwrite high-risk areas. [Link to a relevant insurance industry report on climate risk].

Beyond physical risks, there are also transition risks. As governments worldwide implement policies to reduce carbon emissions – such as carbon pricing mechanisms and stricter environmental regulations – companies reliant on fossil fuels or high-carbon processes face significant challenges. This includes potential stranded assets, decreased profitability, and the need for costly adaptations.

Identifying and Managing Climate Risks: A Proactive Approach

Forward-thinking businesses are recognizing the need for proactive climate risk management. This involves:

- Scenario planning: Modeling the impact of different climate scenarios on their operations and financial performance.

- Carbon footprint analysis: Measuring and reducing their greenhouse gas emissions.

- Disclosure and transparency: Publicly reporting climate-related risks and opportunities in accordance with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). [Link to TCFD website]

- Investing in resilience: Improving infrastructure and operations to withstand the impacts of climate change.

Climate Change: Unlocking New Opportunities

While climate change presents significant challenges, it also opens doors to substantial opportunities. The global transition to a low-carbon economy is driving significant investment in:

- Renewable energy: Solar, wind, and other renewable energy technologies are experiencing explosive growth, attracting substantial capital and creating new jobs.

- Energy efficiency: Companies are investing in energy-efficient technologies and processes to reduce costs and their environmental impact.

- Sustainable agriculture and food systems: The demand for sustainably produced food is increasing, creating opportunities for businesses in this sector.

- Green finance: The growth of green bonds, sustainable investment funds, and other climate-focused financial instruments is providing capital for climate-related projects. [Link to an example of a green bond issuance].

The Role of Investors and Financial Institutions

Investors are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their investment decisions. This includes:

- ESG investing: Choosing investments that meet specific environmental and social criteria.

- Divestment from high-carbon assets: Reducing exposure to companies with high carbon footprints.

- Engagement with companies: Encouraging companies to improve their climate performance.

Financial institutions play a crucial role in channeling capital towards sustainable investments and away from high-carbon activities. They are developing new products and services to support the transition to a low-carbon economy.

Conclusion: Embracing a Sustainable Future

The integration of climate considerations into business and finance is not just a matter of compliance; it’s a matter of long-term sustainability and profitability. Businesses that proactively manage climate risks and seize emerging opportunities will be better positioned for success in a rapidly changing world. Ignoring the issue is no longer an option; embracing a sustainable future is a necessity. Learn more about incorporating ESG principles into your investment strategy. [Link to a relevant resource on ESG investing]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Climate Risk And Opportunity: A Business And Finance Conversation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Marina Silva Warns Planet Nearing Climate Limits

May 11, 2025

Marina Silva Warns Planet Nearing Climate Limits

May 11, 2025 -

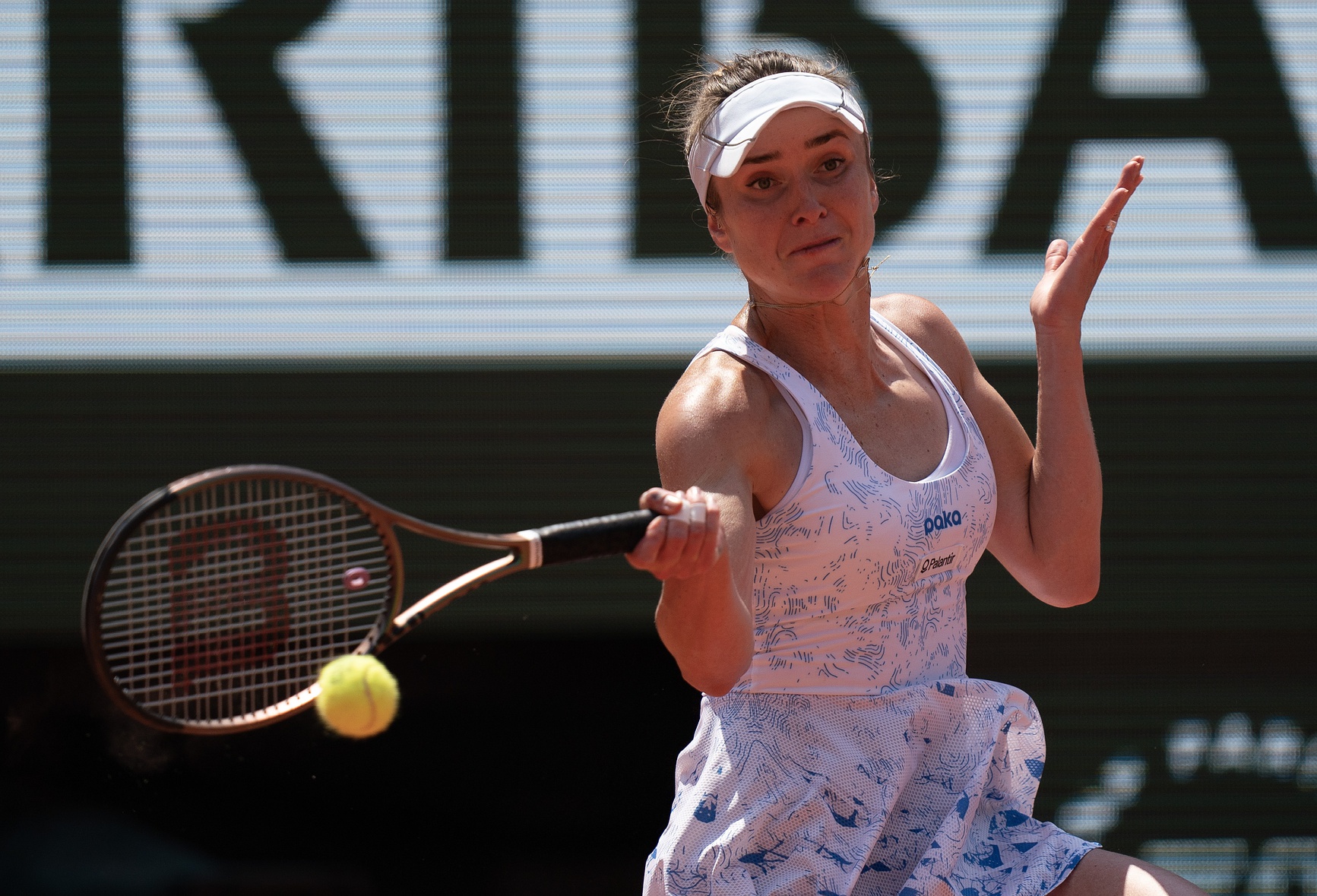

Wta Italian Open 2025 Elina Svitolina Vs Hailey Baptiste Betting Tips And Preview

May 11, 2025

Wta Italian Open 2025 Elina Svitolina Vs Hailey Baptiste Betting Tips And Preview

May 11, 2025 -

Who Made The Time 100 2025 List Influential Figures Revealed

May 11, 2025

Who Made The Time 100 2025 List Influential Figures Revealed

May 11, 2025 -

New Pope Leo First Mass Reflects Weight Of Papacy

May 11, 2025

New Pope Leo First Mass Reflects Weight Of Papacy

May 11, 2025 -

Robert Lewandowski Pokaz Sily Przeciwko Realowi

May 11, 2025

Robert Lewandowski Pokaz Sily Przeciwko Realowi

May 11, 2025