Navigating Disaster: SBA's Guidance For Small Business Recovery And Support

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating Disaster: SBA's Guidance for Small Business Recovery and Support

Hurricane season. Unexpected economic downturns. Cyberattacks. Disasters, both natural and man-made, can strike small businesses without warning, leaving them reeling in the aftermath. But help is available. The Small Business Administration (SBA) offers vital resources and guidance to help businesses navigate these challenging times and rebuild stronger than before. This article explores the SBA's crucial role in disaster recovery and provides actionable steps for small business owners to access the support they need.

Understanding the SBA's Disaster Assistance Programs

The SBA is a critical component of the federal government's disaster response. Their primary role is to provide low-interest disaster loans to businesses of all sizes, as well as homeowners and renters, affected by declared disasters. These loans can cover a wide range of expenses, including:

- Repairing or replacing damaged property: This includes physical structures, equipment, and inventory.

- Working capital: Funds to cover operating expenses while the business recovers.

- Replacing lost inventory: Essential for businesses that rely on physical goods.

Types of SBA Disaster Loans:

The SBA offers several types of disaster loans, each tailored to specific needs:

- Physical Damage Loans: These loans cover damage to real estate and personal property caused by a declared disaster.

- Economic Injury Disaster Loans (EIDLs): These loans help businesses overcome economic losses suffered due to a disaster, even if they didn't experience direct physical damage. EIDLs can cover things like lost revenue, payroll, and operating expenses. This is often crucial for businesses facing supply chain disruptions or decreased customer demand following a disaster.

- Targeted Assistance Loans: The SBA may offer specialized loan programs to address the unique needs of specific industries or communities affected by a disaster. For example, there might be additional support programs targeted for farmers or specific geographical regions.

Accessing SBA Disaster Assistance:

The application process for SBA disaster loans varies slightly depending on the specific disaster and loan type. However, generally, it involves:

- Declaring a disaster: The first step is for the President to declare a major disaster area. This triggers the SBA's disaster assistance programs. You can check the SBA's website for a list of declared disaster areas.

- Applying for assistance: Applications are usually submitted online through the SBA's disaster assistance website. The application process requires detailed information about your business, the damage sustained, and your financial situation.

- Review and approval: The SBA reviews applications and determines eligibility for assistance. This process can take some time, so patience is essential.

Beyond Loans: Additional SBA Support

The SBA's assistance isn't limited to loans. They also offer valuable resources such as:

- Counseling services: SBA-approved counselors can provide guidance on business recovery strategies, financial planning, and navigating the loan application process.

- Training and workshops: The SBA regularly offers workshops and training programs to help small businesses improve their preparedness and resilience in the face of disasters.

Proactive Measures: Preparing for the Unexpected

While no one can completely prevent disasters, proactive measures can significantly reduce their impact. Consider:

- Developing a business continuity plan: This plan should outline procedures for dealing with various disaster scenarios, including communication protocols, data backup strategies, and alternate work locations.

- Maintaining thorough records: Accurate financial records and property insurance policies are crucial for the SBA loan application process.

- Building strong relationships with local and federal agencies: Networking with government agencies can help you access resources and support quickly in the event of a disaster.

Conclusion: Resilience Through Preparedness and Support

Facing a disaster can be devastating for any small business. However, with the right resources and preparation, businesses can significantly improve their chances of recovery and even emerge stronger. The SBA stands as a vital lifeline, offering financial assistance and guidance to navigate the challenges and rebuild. By understanding the SBA's programs and taking proactive steps, small business owners can enhance their resilience and safeguard their futures. Visit the SBA website today to learn more and explore the available resources. [link to SBA website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating Disaster: SBA's Guidance For Small Business Recovery And Support. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After Decades Marlon Wayans Receives Long Overdue College Certificate

Sep 01, 2025

After Decades Marlon Wayans Receives Long Overdue College Certificate

Sep 01, 2025 -

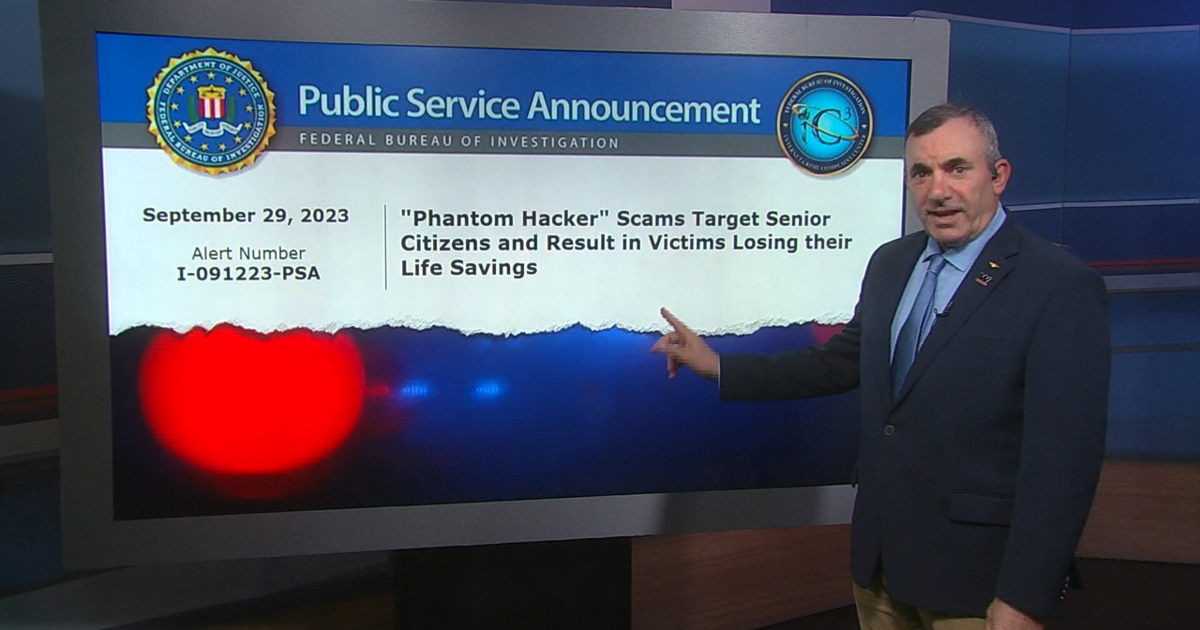

Cybercrime In Swfl Steps To Protect Your Bank Accounts And Personal Finances

Sep 01, 2025

Cybercrime In Swfl Steps To Protect Your Bank Accounts And Personal Finances

Sep 01, 2025 -

300 Million Spent On Water Unveiling The Technology Behind Gta Vis Oceans

Sep 01, 2025

300 Million Spent On Water Unveiling The Technology Behind Gta Vis Oceans

Sep 01, 2025 -

Exclusive Unseen Photos From Axl Duhamels Birthday Party Celebrated By Parents Fergie And Josh Duhamel

Sep 01, 2025

Exclusive Unseen Photos From Axl Duhamels Birthday Party Celebrated By Parents Fergie And Josh Duhamel

Sep 01, 2025 -

Day Of Struggle In Israel Thousands Demand End To Conflict Hostage Return

Sep 01, 2025

Day Of Struggle In Israel Thousands Demand End To Conflict Hostage Return

Sep 01, 2025

Latest Posts

-

Ok Ja Yeon Receives Rave Reviews For Role In The Effect

Sep 02, 2025

Ok Ja Yeon Receives Rave Reviews For Role In The Effect

Sep 02, 2025 -

Minneapolis Shooting Separating Fact From Fiction In The Ongoing Investigation

Sep 02, 2025

Minneapolis Shooting Separating Fact From Fiction In The Ongoing Investigation

Sep 02, 2025 -

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025

What To Expect From Apples September Event 7 Potential Product Launches

Sep 02, 2025 -

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025

Gta Vi Rockstars 300 Million Water Technology Revealed

Sep 02, 2025 -

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025

Apples September Event Unveiling 7 Groundbreaking Devices

Sep 02, 2025