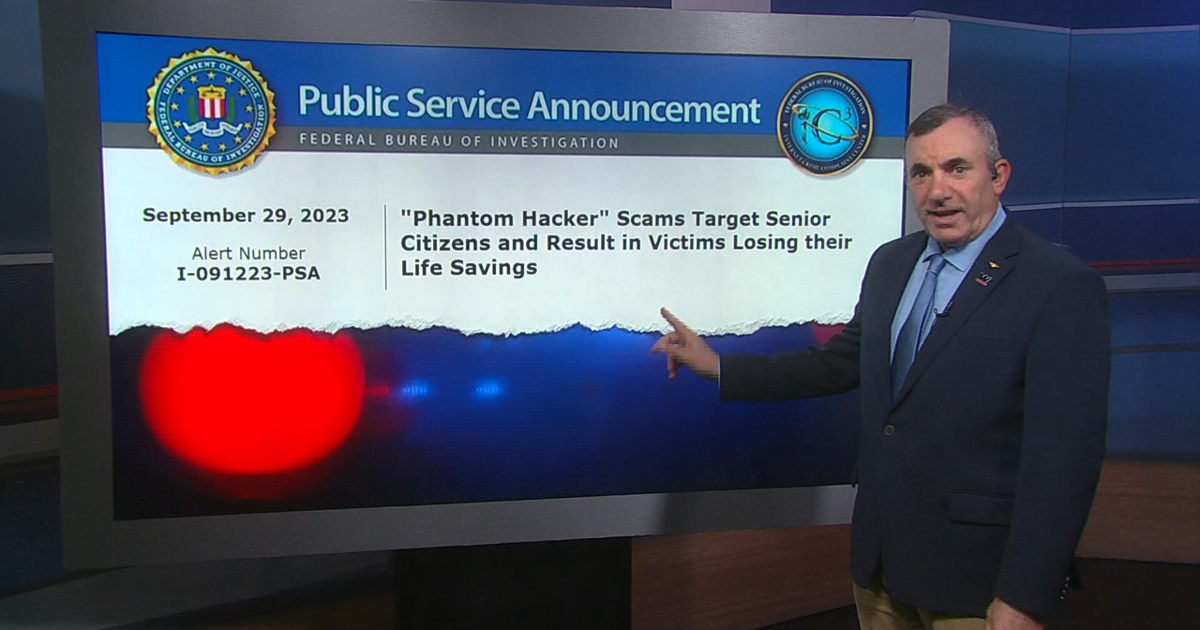

Cybercrime In SWFL: Steps To Protect Your Bank Accounts And Personal Finances

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cybercrime in SWFL: Steps to Protect Your Bank Accounts and Personal Finances

Southwest Florida (SWFL) residents are increasingly becoming targets of sophisticated cybercrime, leading to significant financial losses and personal data breaches. From phishing scams to malware attacks, the threats are real and constantly evolving. This article provides crucial information and actionable steps to protect your bank accounts and personal finances in the face of rising cybercrime in SWFL.

The Growing Threat in Southwest Florida

Cybercriminals are relentless, targeting individuals and businesses alike. SWFL, with its growing population and reliance on technology, is unfortunately a prime target. Recent reports show a surge in phishing emails, ransomware attacks, and identity theft in the region. These attacks can result in:

- Financial losses: Empty bank accounts, fraudulent charges, and costly credit repair.

- Identity theft: Compromised personal information used for fraudulent activities.

- Reputational damage: For businesses, cyberattacks can severely damage their reputation.

Understanding Common Cybercrime Tactics in SWFL

Several common tactics are employed by cybercriminals in SWFL:

- Phishing: Receiving deceptive emails or text messages mimicking legitimate institutions (banks, government agencies) to steal login credentials and personal information. Be wary of urgent requests or suspicious links.

- Malware: Malicious software infecting devices through downloads or infected websites, often leading to data theft or ransomware attacks. Keep your antivirus software updated and avoid suspicious downloads.

- Ransomware: Malware that encrypts your data and demands a ransom for its release. Regular backups are crucial to mitigate the damage.

- Smishing: Similar to phishing, but via text message (SMS). Never click links in unsolicited texts.

- Vishing: Phishing via phone calls. Be cautious of unsolicited calls requesting personal information.

Protecting Yourself: Actionable Steps to Secure Your Finances

Taking proactive measures is crucial to safeguarding your financial well-being. Here's what you can do:

1. Strong Passwords and Multi-Factor Authentication (MFA):

- Use unique, strong passwords for all online accounts. Consider using a password manager.

- Enable MFA whenever possible. This adds an extra layer of security, requiring a second verification method (e.g., code from your phone) before accessing your account.

2. Software Updates and Security Software:

- Keep your operating system, software, and antivirus software updated. Regular updates patch security vulnerabilities.

- Install reputable antivirus and anti-malware software on all your devices.

3. Secure Wi-Fi and Online Practices:

- Avoid using public Wi-Fi for sensitive transactions.

- Be cautious of clicking links or downloading attachments from unknown sources.

- Regularly review your bank and credit card statements for unauthorized activity.

4. Financial Monitoring and Fraud Alerts:

- Enroll in fraud alerts from your bank and credit card companies.

- Regularly monitor your credit report for any suspicious activity. You can obtain a free credit report annually from .

5. Education and Awareness:

- Stay informed about the latest cyber threats and scams. Follow reputable cybersecurity news sources.

- Educate your family and friends about cybercrime prevention.

What to Do If You Become a Victim:

If you suspect you've been a victim of cybercrime, act swiftly:

- Contact your bank and credit card companies immediately.

- Report the incident to the appropriate authorities. This may include the local police and the Federal Trade Commission (FTC).

- Change your passwords and enable MFA on all affected accounts.

- Consider credit monitoring services.

By staying vigilant and taking proactive steps, you can significantly reduce your risk of becoming a victim of cybercrime in SWFL. Remember, prevention is key. Don't hesitate to seek professional help if you need assistance with cybersecurity measures for your business or personal accounts.

Call to Action: Share this article with your friends and family in SWFL to help spread awareness and protect our community from cybercrime.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cybercrime In SWFL: Steps To Protect Your Bank Accounts And Personal Finances. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gta Vis Water Rockstars 300 Million Detail Obsession

Sep 01, 2025

Gta Vis Water Rockstars 300 Million Detail Obsession

Sep 01, 2025 -

Real Life Soccer Drama Ted Lasso Actresss Partner In Assault After Infidelity

Sep 01, 2025

Real Life Soccer Drama Ted Lasso Actresss Partner In Assault After Infidelity

Sep 01, 2025 -

Eu Leaders Strongly Condemn Russias Attack On Kyiv Putin Faces International Outrage

Sep 01, 2025

Eu Leaders Strongly Condemn Russias Attack On Kyiv Putin Faces International Outrage

Sep 01, 2025 -

Gta 6 Pc System Requirements Character Roster And Indian Pricing Expectations

Sep 01, 2025

Gta 6 Pc System Requirements Character Roster And Indian Pricing Expectations

Sep 01, 2025 -

Fergie Posts Heartwarming Birthday Tribute To Son Axl Duhamel

Sep 01, 2025

Fergie Posts Heartwarming Birthday Tribute To Son Axl Duhamel

Sep 01, 2025

Latest Posts

-

The Untold Story Keeley Hazell And The Ted Lasso Keeley Jones Casting Controversy

Sep 02, 2025

The Untold Story Keeley Hazell And The Ted Lasso Keeley Jones Casting Controversy

Sep 02, 2025 -

Court Ruling Against Trump Tariffs Analysis And Potential Impacts

Sep 02, 2025

Court Ruling Against Trump Tariffs Analysis And Potential Impacts

Sep 02, 2025 -

Ok Ja Yeons Theatrical Journey Growth And Emotional Depth

Sep 02, 2025

Ok Ja Yeons Theatrical Journey Growth And Emotional Depth

Sep 02, 2025 -

The Enduring Impact Of Hurricane Katrina A 20 Year Assessment

Sep 02, 2025

The Enduring Impact Of Hurricane Katrina A 20 Year Assessment

Sep 02, 2025 -

Industry Funding Shoring Up Georgia Tech Research In Face Of Federal Funding Shortfalls

Sep 02, 2025

Industry Funding Shoring Up Georgia Tech Research In Face Of Federal Funding Shortfalls

Sep 02, 2025