Mortgage Rate Increase: Economic Data Fuels Higher Borrowing Costs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rate Increase: Economic Data Fuels Higher Borrowing Costs

The dream of homeownership is becoming more expensive. Recent economic data releases have sent shockwaves through the mortgage market, leading to a significant increase in borrowing costs for prospective homebuyers. This surge in mortgage rates is impacting affordability and potentially slowing down the housing market, raising concerns among economists and consumers alike.

The Culprit: Stronger-Than-Expected Economic Data

The primary driver behind this increase is a series of positive, albeit potentially concerning, economic reports. Stronger-than-anticipated job growth figures, coupled with persistent inflation, have fueled concerns about the Federal Reserve's (Fed) future monetary policy. The Fed's mandate is to control inflation and maintain stable employment. When economic data points to sustained inflation, the Fed is more likely to raise interest rates to cool down the economy.

This expectation of further interest rate hikes by the Fed is directly impacting mortgage rates. Mortgage rates are closely tied to the yield on Treasury bonds, which in turn are influenced by the Fed's actions. As investors anticipate higher interest rates, they demand higher yields on bonds, pushing up mortgage rates consequently.

How Much Have Rates Increased?

The increase isn't negligible. We've seen average 30-year fixed mortgage rates jump by [Insert Percentage]% in the last [Insert Timeframe – e.g., month, few weeks]. This translates to a significant increase in monthly mortgage payments for potential homebuyers. For example, a buyer looking for a $300,000 home would now be facing [Insert approximate dollar amount] more in monthly payments compared to [Insert timeframe] ago.

Impact on the Housing Market:

This rise in mortgage rates is already having a noticeable impact on the housing market. Demand is softening, with fewer buyers able to afford homes at current prices. This could lead to a slowdown in home price appreciation, or even a slight correction in some markets. However, the impact will vary geographically, depending on local market conditions and inventory levels. Areas with already low inventory may see less of a slowdown than those with a surplus of homes on the market.

What Does the Future Hold?

Predicting future mortgage rates is notoriously difficult, but several factors will play a significant role. These include:

- Further Fed rate hikes: The Fed's future decisions on interest rates will be crucial in shaping mortgage rates.

- Inflation data: Persistent inflation will likely continue to put upward pressure on rates.

- Economic growth: Strong economic growth might lead to further rate increases, while a slowdown could ease pressure.

- Investor sentiment: Investor confidence and expectations significantly influence bond yields and mortgage rates.

What Can Homebuyers Do?

For prospective homebuyers, this presents a challenging but not insurmountable situation. Strategies to navigate the higher rates include:

- Improving credit score: A better credit score can qualify you for lower interest rates.

- Increasing down payment: A larger down payment can reduce the loan amount and monthly payments.

- Shopping around for mortgages: Comparing offers from multiple lenders is crucial to securing the best rate.

- Considering adjustable-rate mortgages (ARMs): ARMs might offer lower initial rates, but carry higher risk due to fluctuating interest rates. (Consult with a financial advisor before making this decision.)

The increase in mortgage rates is a significant development with broad implications for the economy and the housing market. While the situation presents challenges, understanding the factors driving these changes and employing strategic planning can help both buyers and sellers navigate the current landscape successfully. Stay informed about economic news and consult with financial professionals for personalized advice.

Keywords: Mortgage rates, interest rates, housing market, home buying, Federal Reserve, inflation, economy, economic data, borrowing costs, mortgage affordability, 30-year fixed mortgage, adjustable-rate mortgage, ARM.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rate Increase: Economic Data Fuels Higher Borrowing Costs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lsg Vs Srh Live Score Ipl 2025 Verbal Sparring Mars Intense Match

May 20, 2025

Lsg Vs Srh Live Score Ipl 2025 Verbal Sparring Mars Intense Match

May 20, 2025 -

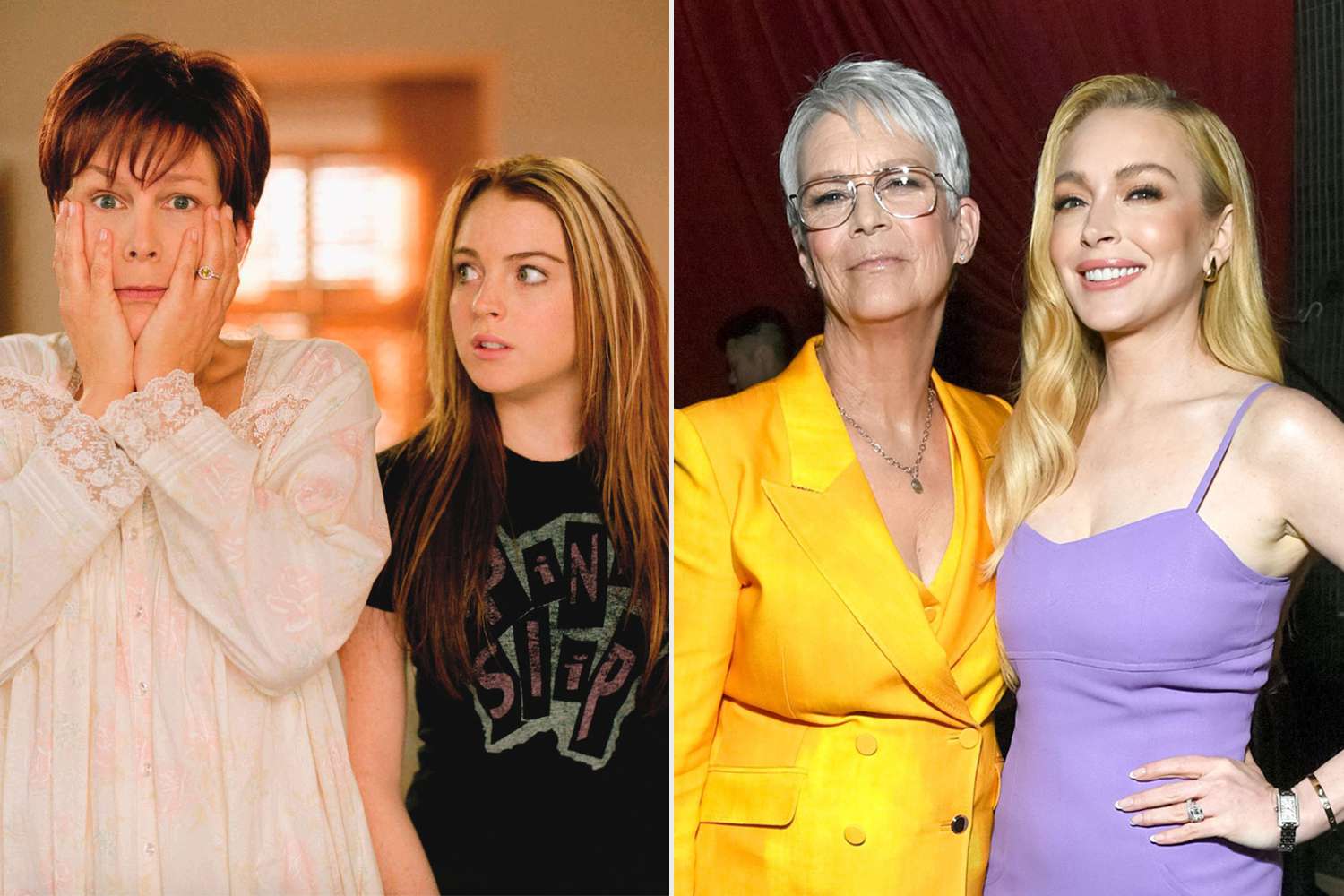

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Ongoing Bond With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Ongoing Bond With Lindsay Lohan

May 20, 2025 -

The Economic Impact Of Clean Energy Tax Proposals In The United States

May 20, 2025

The Economic Impact Of Clean Energy Tax Proposals In The United States

May 20, 2025 -

Transparency Concerns Jon Jones And The Ufcs Handling Of Tom Aspinall Injury

May 20, 2025

Transparency Concerns Jon Jones And The Ufcs Handling Of Tom Aspinall Injury

May 20, 2025 -

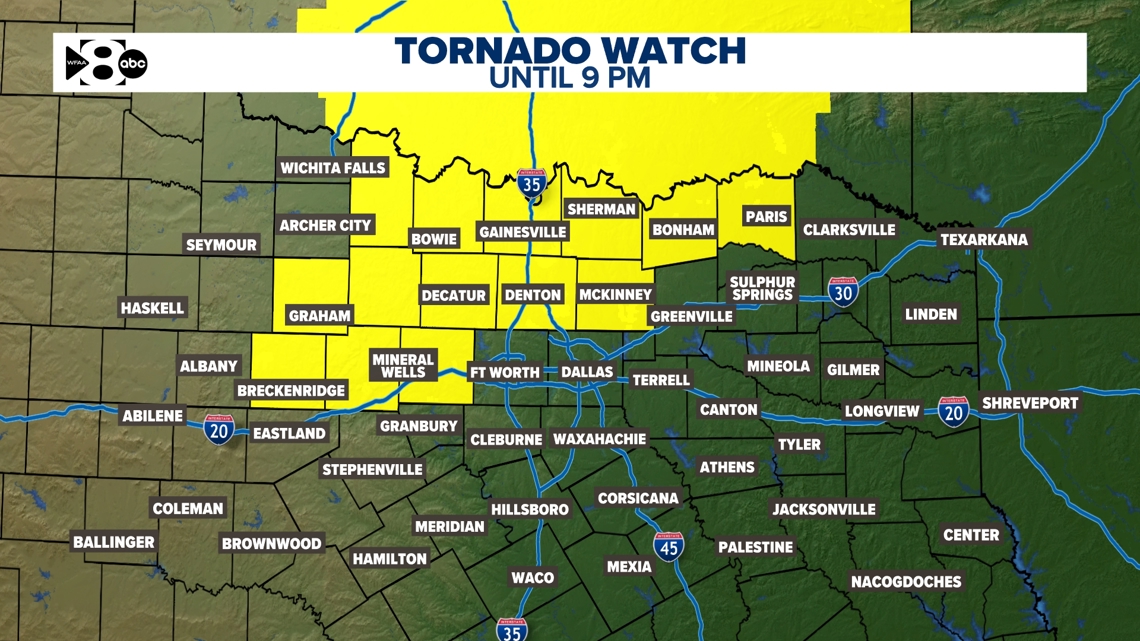

Dallas Fort Worth Weather Monday Storms Tuesday Cold Front

May 20, 2025

Dallas Fort Worth Weather Monday Storms Tuesday Cold Front

May 20, 2025