Moody's Downgrade Unfazed: Stock Market Rallies As S&P 500 Extends Winning Streak

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unfazed: Stock Market Rallies as S&P 500 Extends Winning Streak

The stock market shrugged off Moody's downgrade of several US banking giants on Tuesday, extending its impressive winning streak. The S&P 500 closed higher, defying predictions of a significant sell-off, showcasing the resilience of the market and perhaps indicating a growing confidence in the underlying economy. This unexpected rally has left many analysts reassessing their forecasts.

Moody's Actions and Market Reaction:

Moody's Investors Service downgraded 10 small and midsize US banks and placed six others on review for potential downgrades, citing concerns about the credit quality of their assets and the challenging operating environment. This move, usually a trigger for market volatility, had a surprisingly muted impact. Instead of a widespread panic, investors seemed to focus on other positive economic indicators and the continued strength of corporate earnings.

Why the Market Remained Unfazed:

Several factors contributed to the market's resilience in the face of Moody's negative assessment:

- Strong Corporate Earnings: The second-quarter earnings season has largely exceeded expectations, boosting investor confidence. Many companies have demonstrated strong performance despite inflationary pressures and macroeconomic uncertainties.

- Resilient Consumer Spending: Despite inflation, consumer spending remains relatively strong, signaling a degree of economic robustness. This suggests that the economy may be more resilient than initially feared.

- Federal Reserve's Stance: While interest rate hikes have been a concern for the market, the Federal Reserve's recent pause suggests a potential slowdown in monetary tightening, potentially easing pressure on banks and the broader economy. This cautious approach has provided a degree of market stability.

- Selective Downgrades: The downgrades focused primarily on smaller banks, mitigating the systemic risk that a broader downgrade might have triggered. This targeted approach lessened the impact on the overall market sentiment.

- Buying Opportunities: Some investors may have viewed the dip as a buying opportunity, anticipating future growth.

S&P 500's Winning Streak Continues:

The S&P 500's continued upward trajectory highlights a surprising disconnect between credit rating agency concerns and overall market sentiment. This divergence underscores the complexity of the current economic landscape and the multiple factors influencing investor behavior. The rally suggests a level of optimism that may not be entirely reflected in the broader economic forecasts.

Looking Ahead:

While the current rally is encouraging, it's crucial to approach it with caution. The ongoing geopolitical uncertainties, persistent inflation, and the potential for further economic slowdown still pose significant risks. Analysts are closely monitoring upcoming economic data and the Federal Reserve's future policy decisions to assess the sustainability of this positive market trend. The long-term impact of Moody's actions remains to be seen, and continued vigilance is essential. Further analysis of credit risk within the banking sector is warranted.

Keywords: Moody's, Downgrade, Stock Market, S&P 500, Rally, Banking Crisis, US Economy, Federal Reserve, Interest Rates, Credit Rating, Investor Confidence, Market Volatility, Economic Growth, Corporate Earnings

Call to Action: Stay informed about market trends and economic developments by subscribing to our newsletter for regular updates. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unfazed: Stock Market Rallies As S&P 500 Extends Winning Streak. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

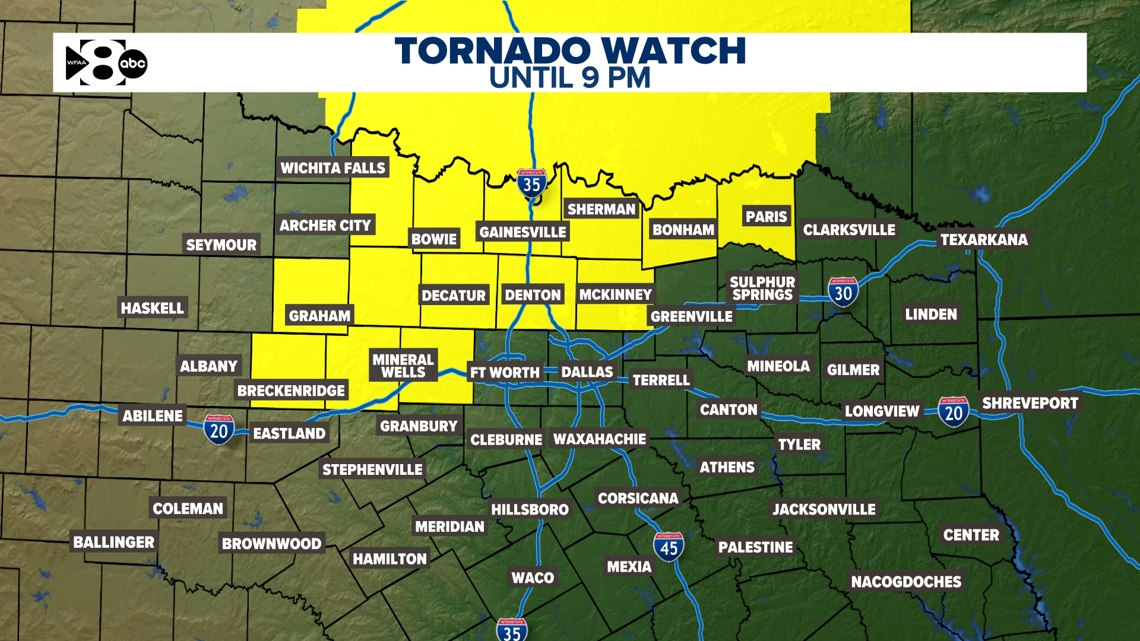

Storms Clear Dfw Area Cold Front Expected Tuesday

May 20, 2025

Storms Clear Dfw Area Cold Front Expected Tuesday

May 20, 2025 -

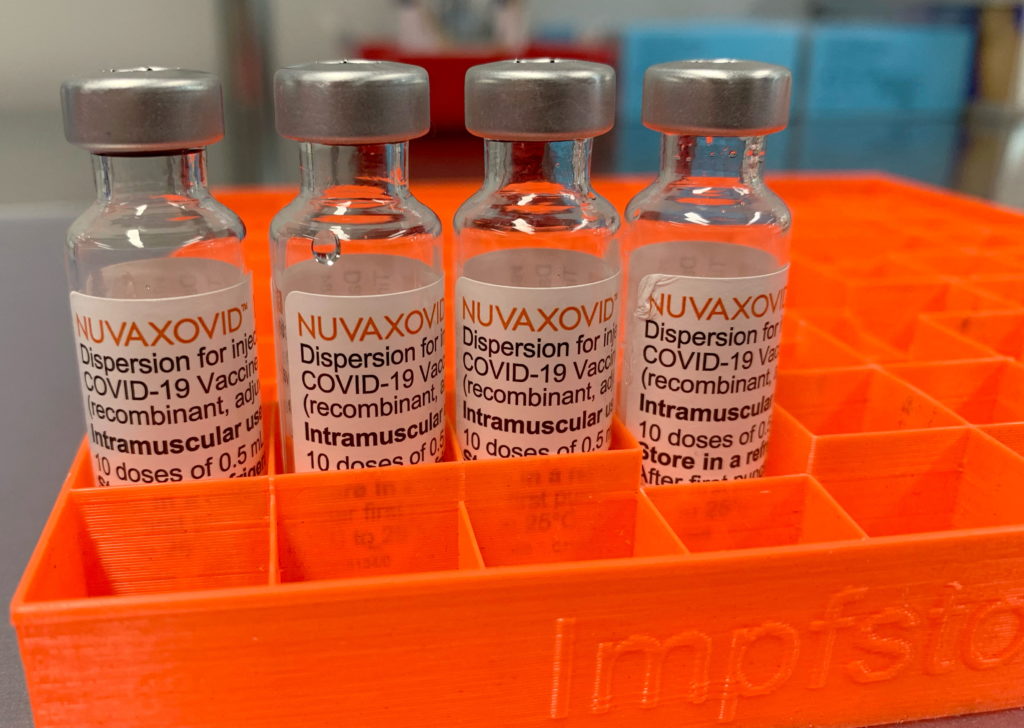

Fda Approval For Novavax Covid 19 Vaccine Key Restrictions Explained

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Key Restrictions Explained

May 20, 2025 -

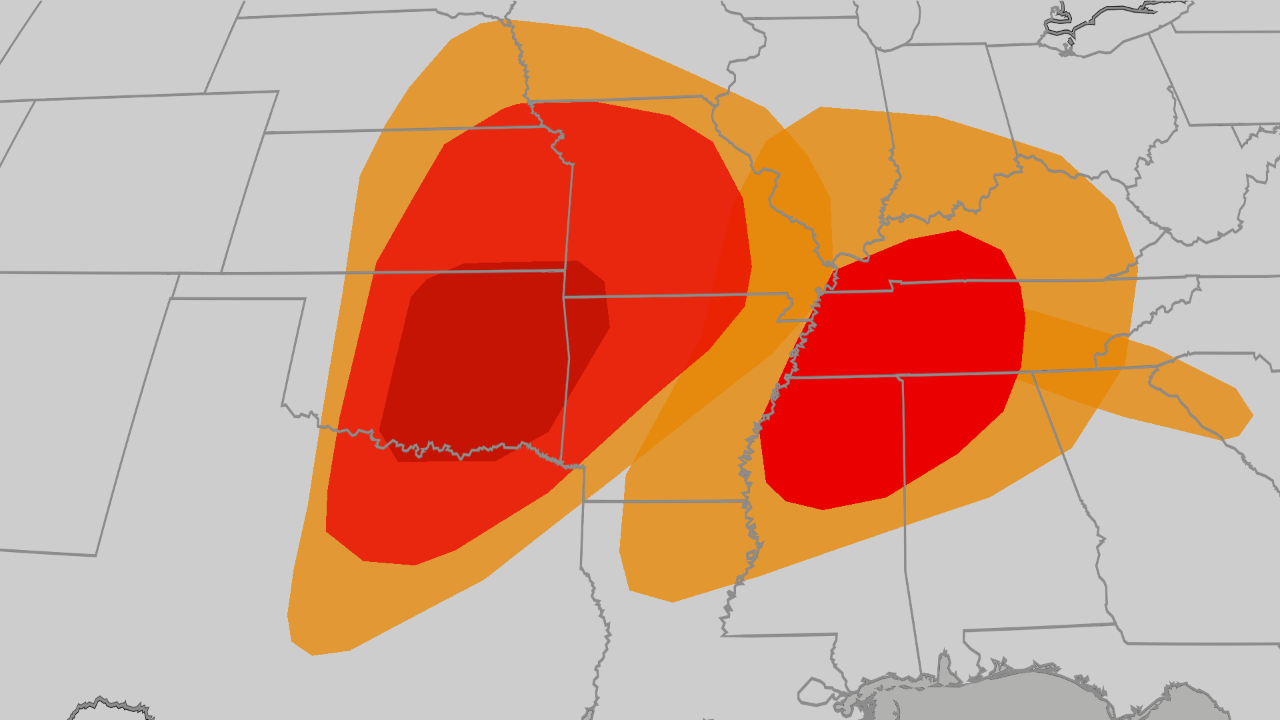

Tornado Warnings Issued As Severe Weather Sweeps Across The Nation

May 20, 2025

Tornado Warnings Issued As Severe Weather Sweeps Across The Nation

May 20, 2025 -

Market Rally Continues S And P 500 Leads Gains As Investors Shake Off Moodys

May 20, 2025

Market Rally Continues S And P 500 Leads Gains As Investors Shake Off Moodys

May 20, 2025 -

Watch Now Powerful Ww 1 Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now Powerful Ww 1 Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025