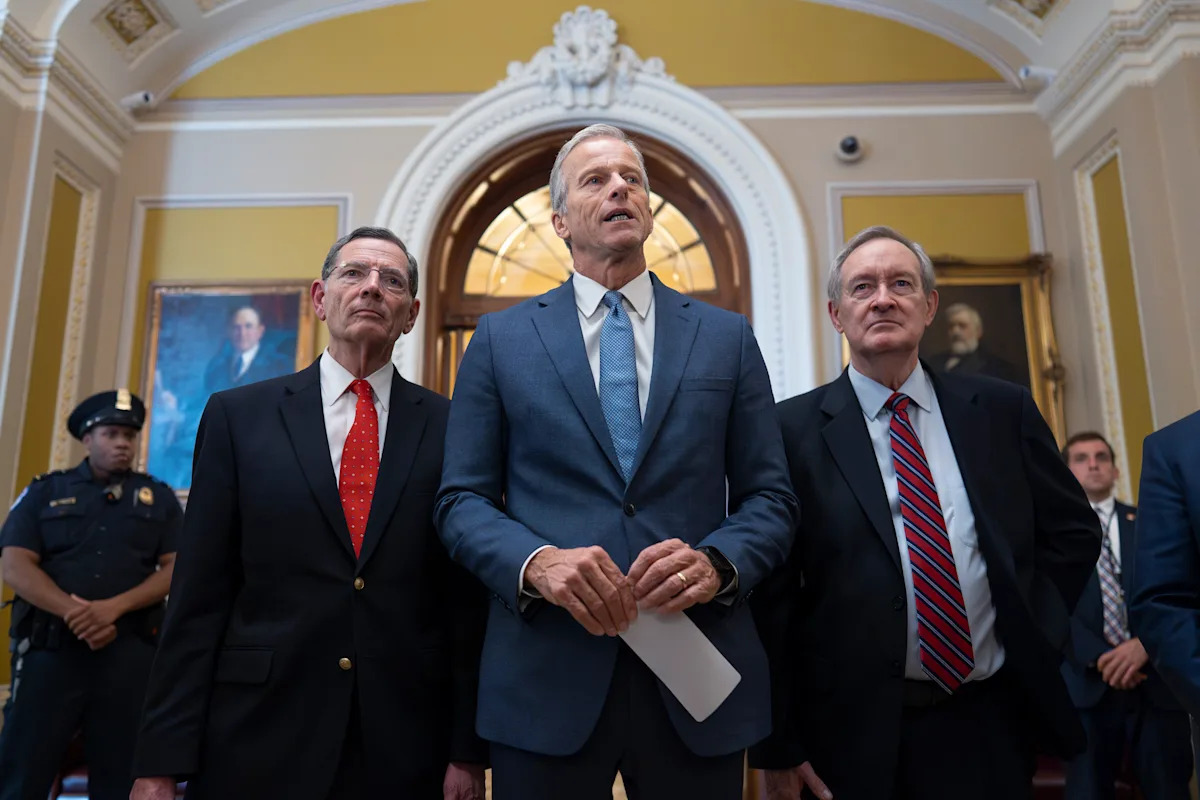

Millions At Risk: How The Trump Tax Bill Could Affect Healthcare Coverage

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Millions at Risk: How the Trump Tax Bill Could Affect Healthcare Coverage

The 2017 Tax Cuts and Jobs Act, often referred to as the Trump tax bill, significantly altered the American tax landscape. While touted for its economic benefits, its impact on healthcare coverage remains a complex and concerning issue, potentially leaving millions at risk. This article delves into the bill's lasting consequences on healthcare access and affordability.

The Repeal of the Individual Mandate: A Domino Effect

Perhaps the most impactful change within the Trump tax bill was the repeal of the individual mandate penalty. This penalty, part of the Affordable Care Act (ACA), required individuals to maintain health insurance or pay a tax penalty. The repeal, effective in 2019, aimed to simplify the tax code, but inadvertently destabilized the ACA insurance marketplaces.

- Increased Premiums: With fewer healthy individuals enrolling due to the lack of penalty, the risk pool shifted, leading to higher premiums for those remaining in the marketplace. This price increase disproportionately affects lower and middle-income families, making healthcare less accessible.

- Reduced Enrollment: The higher premiums and uncertainty surrounding the future of the ACA discouraged enrollment, leading to a decrease in the number of insured individuals. This further shrinks the risk pool, creating a vicious cycle of rising premiums and declining coverage.

- Impact on Pre-existing Conditions: While the ACA protects individuals with pre-existing conditions from denial of coverage, the weakened insurance marketplaces due to the repeal of the individual mandate create vulnerabilities. The shrinking pool of insured individuals could potentially lead to insurers raising premiums or narrowing coverage for those with pre-existing conditions in the future.

Beyond the Individual Mandate: Other Impacts

The Trump tax bill's impact extends beyond the individual mandate. Indirect consequences include:

- Reduced Funding for Public Health Programs: The tax cuts led to a reduction in government revenue, potentially impacting funding for crucial public health programs, preventative care initiatives, and community health centers – resources vital for underserved populations.

- State-Level Impacts: States also faced budgetary challenges due to the federal tax changes, potentially affecting their ability to maintain or expand their own healthcare programs. This has created a patchwork of varying healthcare access across different states.

Looking Ahead: The Future of Healthcare Access

The long-term effects of the Trump tax bill on healthcare coverage are still unfolding. The debate surrounding healthcare reform continues, with ongoing discussions about expanding access, controlling costs, and addressing the needs of vulnerable populations. Understanding the consequences of the 2017 tax bill is crucial to shaping future policy and ensuring access to affordable and quality healthcare for all Americans.

Keywords: Trump tax bill, healthcare coverage, ACA, Affordable Care Act, individual mandate, healthcare reform, premiums, insurance marketplaces, pre-existing conditions, public health, healthcare access, affordability.

Further Reading:

Call to Action: Stay informed about healthcare policy changes and advocate for policies that promote access to affordable and quality healthcare for all. Contact your elected officials to share your concerns and perspectives.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Millions At Risk: How The Trump Tax Bill Could Affect Healthcare Coverage. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Disaster To Victory The Unbelievable Tale Of A Titanic Survivors Sporting Achievements

Jul 03, 2025

From Disaster To Victory The Unbelievable Tale Of A Titanic Survivors Sporting Achievements

Jul 03, 2025 -

Clark Countys New Detention Basin A Flash Flood Defense Strategy

Jul 03, 2025

Clark Countys New Detention Basin A Flash Flood Defense Strategy

Jul 03, 2025 -

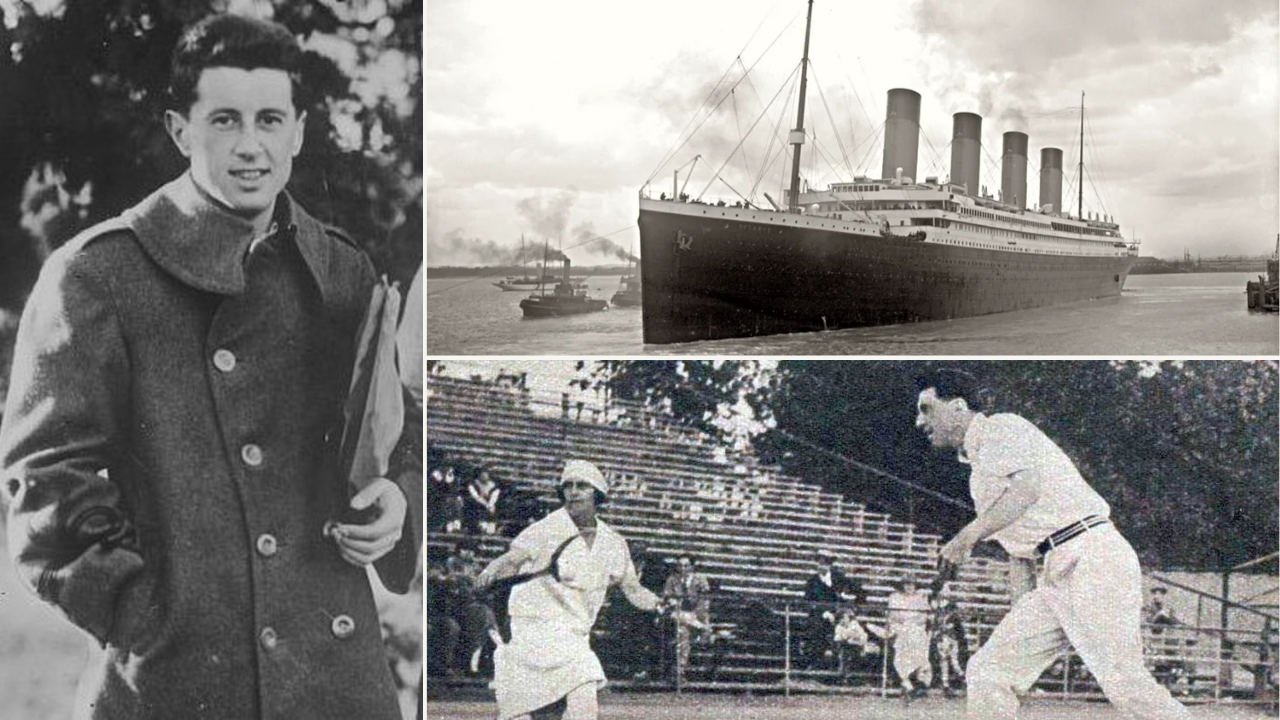

Is A Strong Monsoon Season Coming To Southern Nevada Meteorologists Offer Insights

Jul 03, 2025

Is A Strong Monsoon Season Coming To Southern Nevada Meteorologists Offer Insights

Jul 03, 2025 -

The Sandmans Short Life On Netflix Analyzing The Reasons Behind Its Cancellation

Jul 03, 2025

The Sandmans Short Life On Netflix Analyzing The Reasons Behind Its Cancellation

Jul 03, 2025 -

Sandman Season 2 Hype Vs Reality A Critical Review

Jul 03, 2025

Sandman Season 2 Hype Vs Reality A Critical Review

Jul 03, 2025

Latest Posts

-

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025

Male Confessions Private Thoughts Men Keep From Women

Jul 03, 2025 -

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025

Will Trumps Tax And Spending Bill Reduce Snap Benefits A Deep Dive

Jul 03, 2025 -

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025

Call Of Duty Warzone And Black Ops 6 Team Up With Beavis And Butt Head Official Trailer Breakdown

Jul 03, 2025 -

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025

Unlock Every Call Of Duty Beavis And Butt Head Skin And Weapon

Jul 03, 2025 -

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025

Neil Gaimans Sandman Season 2 Does The Pretentiousness Overshadow The Story

Jul 03, 2025