Massive Bitcoin ETF Investment: Directional Bets And Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Massive Bitcoin ETF Investment: Directional Bets and Market Implications

The recent surge in investment into Bitcoin exchange-traded funds (ETFs) signals a significant shift in the cryptocurrency market, prompting analysts to dissect the implications of these directional bets on the broader financial landscape. This unprecedented influx of capital into Bitcoin ETFs represents a major vote of confidence, potentially paving the way for wider mainstream adoption and influencing price volatility in the short and long term.

A Flood of Institutional Money into Bitcoin ETFs:

The approval of several Bitcoin ETFs in major markets has unleashed a wave of institutional investment. Millions, if not billions, of dollars are flowing into these funds, offering investors a regulated and convenient way to gain exposure to Bitcoin without directly holding the cryptocurrency. This marks a pivotal moment, signifying the growing acceptance of Bitcoin as a legitimate asset class within traditional finance.

Understanding the Directional Bets:

This massive investment represents a clear directional bet – a wager on the future price appreciation of Bitcoin. Institutional investors, known for their rigorous due diligence, aren't pouring money into a market they believe is headed for a crash. Their investment signals a belief in Bitcoin's long-term potential, potentially fueled by factors like increasing adoption by businesses, growing scarcity of Bitcoin, and the ongoing evolution of blockchain technology.

Market Implications – A Bullish Outlook?

The influx of capital into Bitcoin ETFs has several potential market implications:

-

Price Volatility: While the overall trend might be bullish, the increased liquidity brought about by ETF investments could lead to heightened price volatility in the short term. Sudden buying or selling pressure can cause significant price swings.

-

Increased Market Liquidity: The increased trading volume resulting from ETF activity enhances market liquidity, making it easier for investors to buy and sell Bitcoin without impacting the price significantly. This fosters a more mature and stable market.

-

Mainstream Adoption: The success of Bitcoin ETFs further legitimizes Bitcoin in the eyes of mainstream investors, potentially encouraging broader adoption and increasing demand.

-

Regulatory Scrutiny: The significant growth of the Bitcoin ETF market might attract increased regulatory scrutiny, potentially leading to stricter regulations in the future.

Beyond the Price:

While the price of Bitcoin is a key factor, the implications of this investment extend beyond simple price appreciation. The increasing institutionalization of Bitcoin through ETFs signifies a maturing market, attracting sophisticated investors seeking diversification and exposure to alternative assets. This trend fosters innovation and development within the broader cryptocurrency ecosystem.

Looking Ahead:

The future trajectory of Bitcoin remains uncertain, subject to various macroeconomic factors and regulatory developments. However, the massive investment in Bitcoin ETFs points towards a growing acceptance of Bitcoin as a viable investment asset, potentially signaling a new era of growth and stability within the cryptocurrency market. It's crucial for investors to conduct their own thorough research and consider their individual risk tolerance before investing in any cryptocurrency-related products. For more in-depth analysis on cryptocurrency market trends, consider exploring resources like [link to reputable financial news source].

Call to Action: Stay informed about the evolving cryptocurrency landscape and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Massive Bitcoin ETF Investment: Directional Bets And Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis Opens Up About Her Longstanding Friendship With Lindsay Lohan

May 21, 2025

Jamie Lee Curtis Opens Up About Her Longstanding Friendship With Lindsay Lohan

May 21, 2025 -

Nature Conservation Boosts Corporate Value 160 Japanese Companies And 13 Industry Benchmarks

May 21, 2025

Nature Conservation Boosts Corporate Value 160 Japanese Companies And 13 Industry Benchmarks

May 21, 2025 -

Slight Decline In U S Treasury Yields After Feds Rate Cut Forecast

May 21, 2025

Slight Decline In U S Treasury Yields After Feds Rate Cut Forecast

May 21, 2025 -

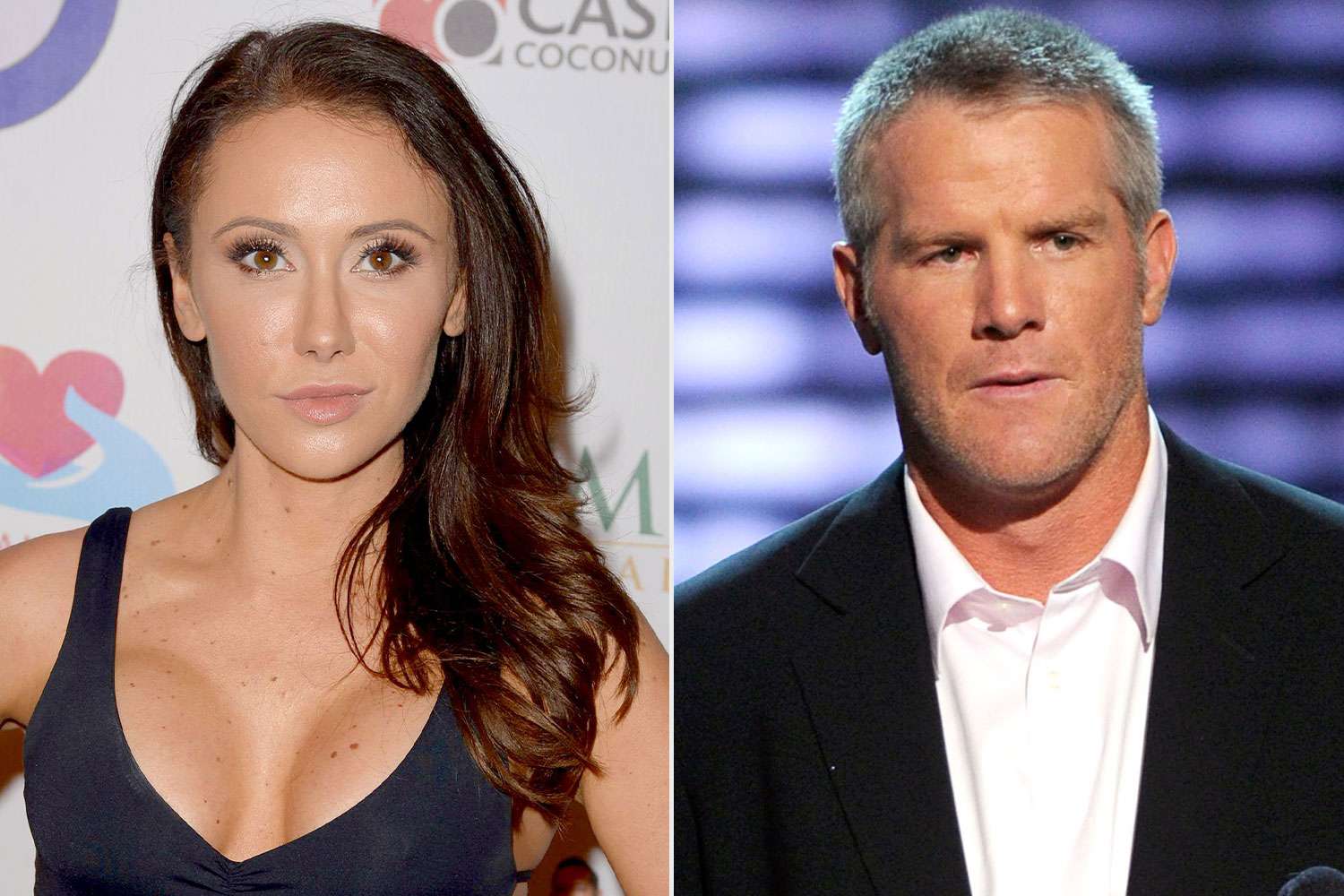

Years Later Jenn Sterger Recounts Her Experience In The Brett Favre Scandal

May 21, 2025

Years Later Jenn Sterger Recounts Her Experience In The Brett Favre Scandal

May 21, 2025 -

Wes Andersons The Phoenician Scheme A Departure From His Usual Vibrancy

May 21, 2025

Wes Andersons The Phoenician Scheme A Departure From His Usual Vibrancy

May 21, 2025