Slight Decline In U.S. Treasury Yields After Fed's Rate Cut Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decline in U.S. Treasury Yields After Fed's Rate Cut Forecast

U.S. Treasury yields experienced a modest dip following the Federal Reserve's latest forecast suggesting potential interest rate cuts later this year. This move, though subtle, sent ripples through the financial markets, prompting analysts to scrutinize the implications for future economic growth and inflation. The shift signals a potential change in the Fed's aggressive monetary tightening strategy implemented throughout 2022 to combat inflation.

The Federal Open Market Committee (FOMC) projected a slightly less hawkish stance than previously anticipated, fueling speculation about a pivot towards easing monetary policy. This expectation led to a decrease in yields across the Treasury yield curve, particularly in the shorter-term maturities. While the decline wasn't dramatic, it marks a significant shift in market sentiment after months of consistently rising yields.

Understanding the Impact of the Fed's Forecast

The Fed's updated economic projections played a crucial role in influencing Treasury yields. The central bank hinted at the possibility of interest rate cuts later in 2023, a stark contrast to previous forecasts predicting rates remaining elevated for a more extended period. This change reflects a growing concern about the potential economic slowdown, particularly as inflation shows signs of cooling.

Several factors contributed to this shift in the Fed's outlook:

- Easing Inflation: While inflation remains above the Fed's target, recent data suggests a deceleration in the pace of price increases. This provides some breathing room for the central bank to consider easing its monetary policy.

- Economic Slowdown Concerns: Growing concerns about a potential recession are prompting the Fed to adopt a more cautious approach. The risk of over-tightening and triggering a deeper economic contraction is a key consideration.

- Market Response to Previous Rate Hikes: The market's reaction to previous rate hikes has also influenced the Fed's decision-making. The impact of previous increases on various sectors of the economy is under close scrutiny.

What Does This Mean for Investors?

The slight decline in Treasury yields presents a complex picture for investors. While lower yields may appear less attractive on the surface, they also offer several potential advantages:

- Reduced borrowing costs: Lower yields translate into reduced borrowing costs for businesses and consumers, potentially stimulating economic activity.

- Increased demand for bonds: As yields fall, the demand for U.S. Treasury bonds is likely to increase, driving up their prices.

- Potential for higher returns in other asset classes: Some investors might seek higher returns by shifting investments towards assets that are expected to perform better in a lower interest rate environment. However, this requires careful analysis and risk assessment.

Looking Ahead: Uncertainty Remains

While the slight decline in Treasury yields offers a glimpse of potential future monetary policy, significant uncertainty remains. The economic outlook remains volatile, and several factors could influence the Fed's future decisions. Inflationary pressures, the strength of the labor market, and geopolitical events all play a significant role in shaping the economic landscape. Investors should carefully monitor these developments and adapt their strategies accordingly. For further analysis on the current economic climate, consider reviewing resources from reputable financial news outlets like [link to a reputable financial news source].

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decline In U.S. Treasury Yields After Fed's Rate Cut Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025 -

Esports Star Uzi Gifted Electric Mercedes Benz G Wagon

May 21, 2025

Esports Star Uzi Gifted Electric Mercedes Benz G Wagon

May 21, 2025 -

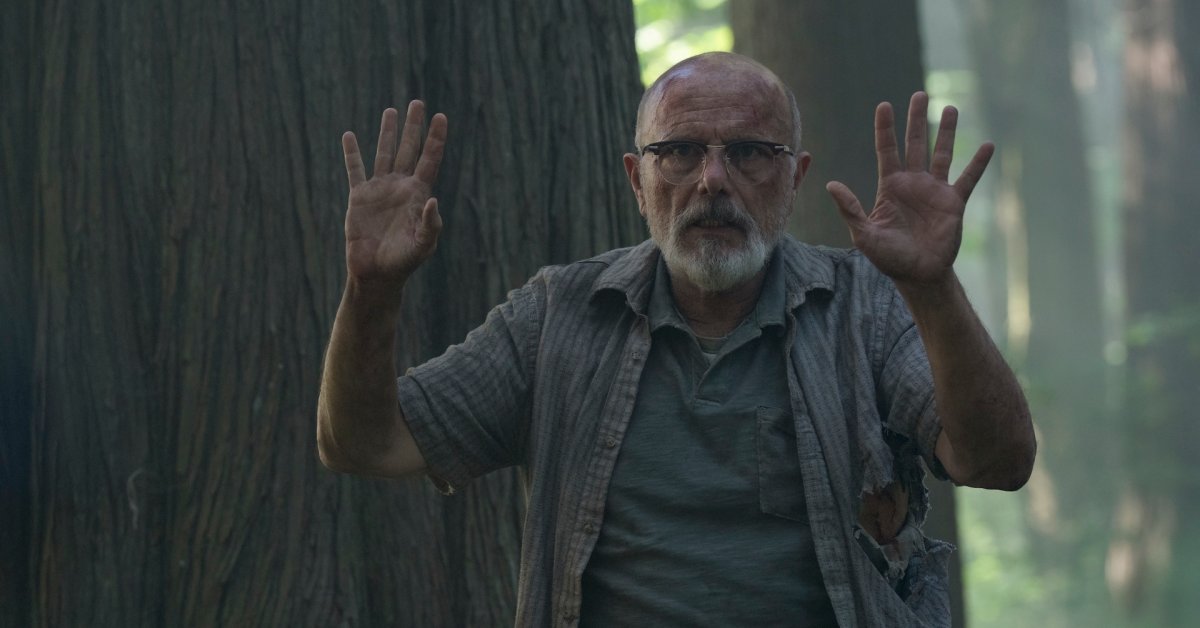

The Last Of Us Season 2 Exploring The Evolving Joel Ellie Bond Beyond The Video Game

May 21, 2025

The Last Of Us Season 2 Exploring The Evolving Joel Ellie Bond Beyond The Video Game

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation Initiative 13 Sector Guidelines Released

May 21, 2025

160 Japanese Firms Compete In Nature Conservation Initiative 13 Sector Guidelines Released

May 21, 2025 -

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe

May 21, 2025

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe

May 21, 2025