Market Update: S&P 500, Nasdaq Lower As Investors Grapple With Fed Policy And Iran Situation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500 and Nasdaq Dip as Investors Weigh Fed Policy and Iran Tensions

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq Composite closing lower amidst growing investor uncertainty. The market's jitters stem from a confluence of factors: the ongoing debate surrounding Federal Reserve interest rate hikes and escalating geopolitical tensions in the Middle East, particularly the situation in Iran.

This volatile market behavior underscores the delicate balance investors are currently navigating. The uncertainty surrounding future economic growth and potential inflationary pressures is creating a cautious environment, impacting trading decisions across various sectors.

Fed Policy Remains the Key Driver

The Federal Reserve's monetary policy continues to be a dominant force shaping market sentiment. Recent economic data, including inflation figures and employment reports, have fueled speculation about the central bank's next move. Will the Fed maintain its aggressive rate-hiking strategy to combat inflation, or will it opt for a more cautious approach, potentially risking further economic slowdown? This uncertainty is prompting investors to adopt a wait-and-see attitude, leading to decreased trading volume and price volatility. Analysts are closely monitoring upcoming economic indicators for clues about the Fed's future decisions. For in-depth analysis on the Fed's potential next steps, check out this insightful piece from the [link to reputable financial news source discussing Fed policy].

Iran Tensions Add to Market Volatility

Adding to the market's anxieties are the escalating tensions surrounding Iran. Recent developments in the region have heightened concerns about potential disruptions to global oil supplies and the wider geopolitical implications. The energy sector, already sensitive to geopolitical events, is particularly vulnerable to these uncertainties. Any escalation of conflict could lead to further market instability and a flight to safety, pushing investors toward less volatile assets like government bonds. To stay abreast of the latest developments in the Iran situation, refer to reputable news sources such as [link to a reputable international news source].

Sector-Specific Performance

The decline wasn't uniform across all sectors. While technology stocks, heavily represented in the Nasdaq, experienced significant losses, some defensive sectors showed relative resilience. The healthcare and consumer staples sectors, often considered safer havens during times of uncertainty, displayed less pronounced drops.

- Technology: The tech-heavy Nasdaq Composite experienced a steeper decline than the broader S&P 500, reflecting investor concerns about the impact of higher interest rates on growth stocks.

- Energy: Energy stocks saw mixed performance, reflecting the conflicting pressures of rising oil prices due to geopolitical tensions and concerns about a potential economic slowdown.

- Financials: Financial stocks were also impacted by the uncertainty surrounding interest rate hikes.

What's Next for the Market?

Predicting short-term market movements is notoriously difficult. However, the current climate suggests continued volatility in the near future. Investors should carefully consider their risk tolerance and diversify their portfolios to mitigate potential losses. Staying informed about economic indicators and geopolitical events will be crucial for navigating the current market landscape.

In conclusion, today's market performance highlights the complex interplay between macroeconomic factors and geopolitical events. The ongoing uncertainty surrounding Fed policy and the situation in Iran continues to weigh heavily on investor sentiment. Careful monitoring of key economic indicators and geopolitical developments remains paramount for investors seeking to successfully navigate this challenging period. Consider consulting with a financial advisor for personalized guidance tailored to your individual investment goals and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: S&P 500, Nasdaq Lower As Investors Grapple With Fed Policy And Iran Situation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

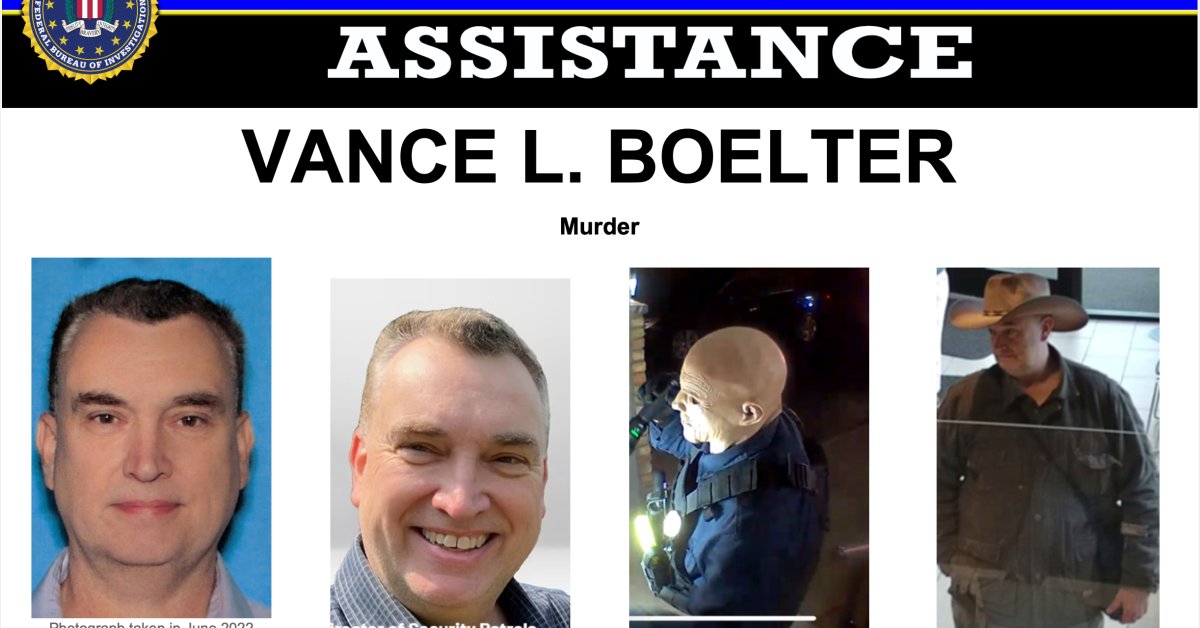

Vance L Boelter In Custody The Latest On The Minnesota Lawmaker Shooting Investigation

Jun 21, 2025

Vance L Boelter In Custody The Latest On The Minnesota Lawmaker Shooting Investigation

Jun 21, 2025 -

Mlb World Reacts The Unexpected Timing Of The Rafael Devers Trade

Jun 21, 2025

Mlb World Reacts The Unexpected Timing Of The Rafael Devers Trade

Jun 21, 2025 -

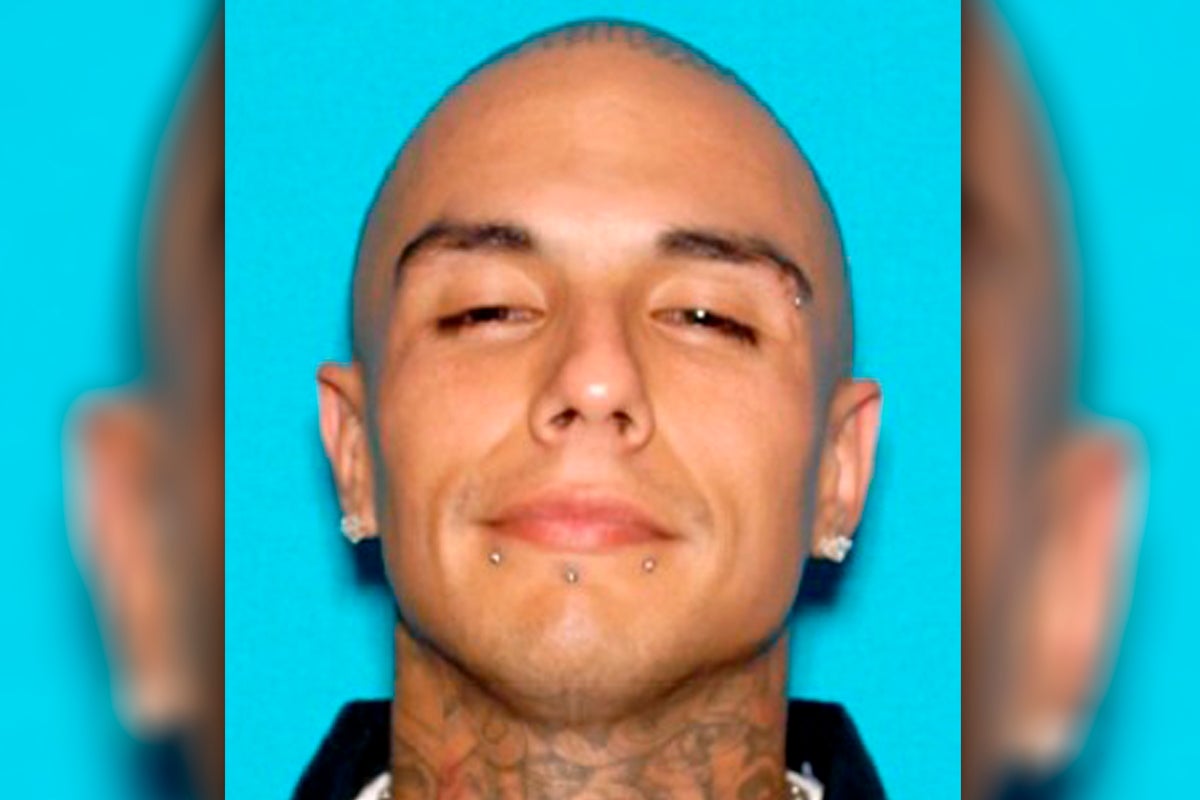

Major Drug Trafficking And Murder Conspiracy 19 Mexican Mafia Members Arrested

Jun 21, 2025

Major Drug Trafficking And Murder Conspiracy 19 Mexican Mafia Members Arrested

Jun 21, 2025 -

Rafael Devers Trade Was The Timing A Strategic Masterstroke

Jun 21, 2025

Rafael Devers Trade Was The Timing A Strategic Masterstroke

Jun 21, 2025 -

Stock Market Dip S And P 500 And Nasdaq Fall On Fed Rate Concerns And Iran Tensions

Jun 21, 2025

Stock Market Dip S And P 500 And Nasdaq Fall On Fed Rate Concerns And Iran Tensions

Jun 21, 2025