Stock Market Dip: S&P 500 And Nasdaq Fall On Fed Rate Concerns And Iran Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Dip: S&P 500 and Nasdaq Fall on Fed Rate Concerns and Iran Tensions

The stock market experienced a significant downturn today, with both the S&P 500 and Nasdaq Composite suffering notable losses. This sharp decline can be attributed to a confluence of factors, primarily fueled by persistent concerns surrounding Federal Reserve interest rate hikes and escalating geopolitical tensions in Iran. Investors, already grappling with inflation and economic uncertainty, reacted with caution, leading to widespread selling.

Fed Rate Hike Jitters Continue to Haunt Investors

The Federal Reserve's ongoing efforts to combat inflation through interest rate increases remain a central driver of market volatility. While the Fed has signaled a potential slowdown in the pace of hikes, the persistent threat of further increases continues to weigh heavily on investor sentiment. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings – a major concern for stock valuations. This uncertainty has created a climate of risk aversion, prompting investors to seek safer havens for their investments. [Link to recent Fed statement]

Iran Tensions Add to Market Instability

Adding to the pre-existing anxieties, recent developments in Iran have further destabilized the market. Rising geopolitical tensions in the region have injected a significant dose of uncertainty into global markets. The potential for escalation and its impact on oil prices and global trade are contributing to a broader sense of unease among investors. This uncertainty creates a ripple effect, impacting various sectors and increasing the overall risk perception associated with investing in equities. [Link to reputable news source on Iran tensions]

S&P 500 and Nasdaq Suffer Significant Losses

The impact of these intertwined factors is clearly reflected in today's market performance. The S&P 500, a broad measure of the U.S. stock market, experienced a [percentage]% decline, while the tech-heavy Nasdaq Composite saw an even steeper drop of [percentage]%. This downturn underscores the sensitivity of the market to both economic and geopolitical events.

What Does This Mean for Investors?

This market dip highlights the inherent volatility of the stock market and the importance of diversification and a long-term investment strategy. For those with a long-term horizon, this could represent a buying opportunity, particularly if the underlying fundamentals of the companies they own remain strong. However, investors should carefully assess their risk tolerance and investment goals before making any significant decisions.

Key Takeaways:

- Interest Rate Hikes: The Fed's monetary policy remains a key driver of market volatility.

- Geopolitical Risks: International tensions, particularly in Iran, contribute to market uncertainty.

- Market Volatility: The S&P 500 and Nasdaq experienced significant declines.

- Investor Strategy: Long-term investors should consider their risk tolerance and diversification strategies.

Looking Ahead:

The coming days and weeks will be crucial in determining the market's trajectory. Close monitoring of economic data, Federal Reserve announcements, and geopolitical developments will be essential for navigating the current uncertainty. Investors should stay informed and consult with financial advisors before making any significant investment decisions. [Link to reputable financial news source]

Call to Action: Stay informed about market trends by subscribing to our newsletter for daily updates and insightful analysis. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Dip: S&P 500 And Nasdaq Fall On Fed Rate Concerns And Iran Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Summer Of Reckoning Trumps Actions Against Climate Scientists

Jun 21, 2025

Summer Of Reckoning Trumps Actions Against Climate Scientists

Jun 21, 2025 -

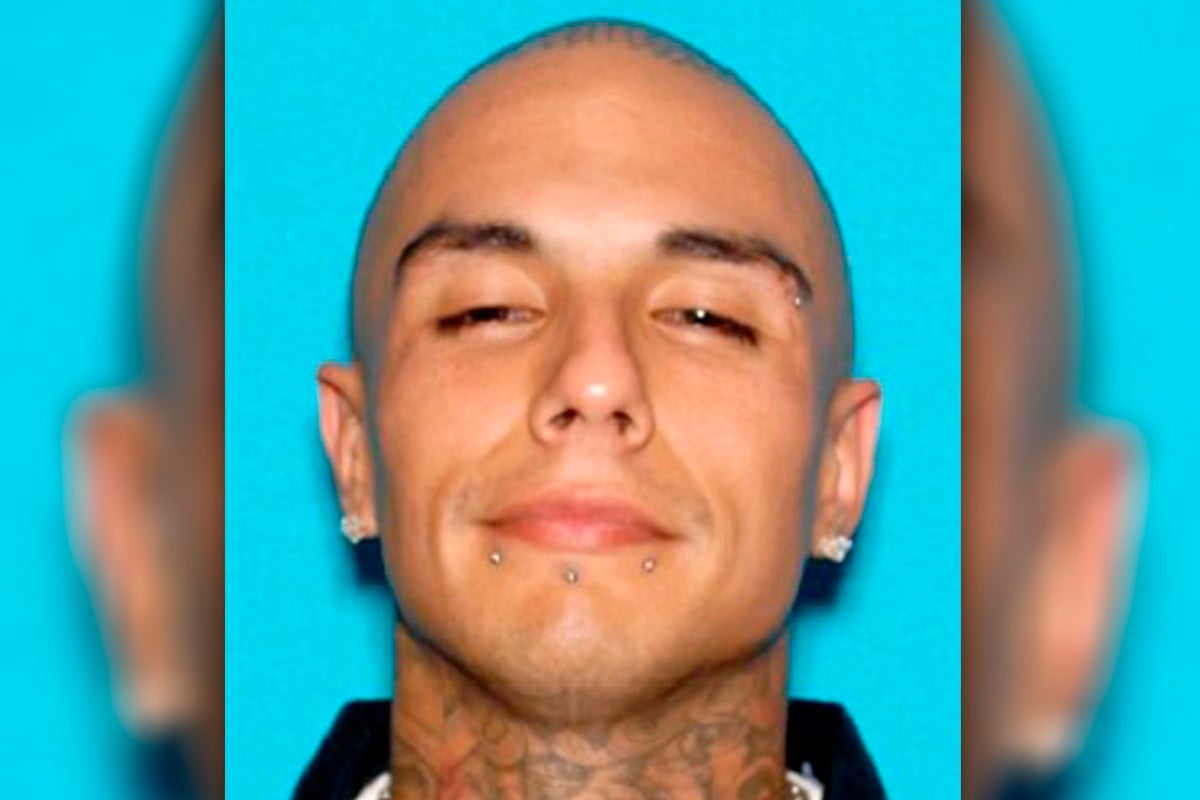

19 Arrested In Alleged Mexican Mafia Hit On Rapper

Jun 21, 2025

19 Arrested In Alleged Mexican Mafia Hit On Rapper

Jun 21, 2025 -

Gabbards Shifting Stance A Source Of Friction With Trumps Intel Team

Jun 21, 2025

Gabbards Shifting Stance A Source Of Friction With Trumps Intel Team

Jun 21, 2025 -

Trump Administration And Tulsi Gabbard A Growing Rift

Jun 21, 2025

Trump Administration And Tulsi Gabbard A Growing Rift

Jun 21, 2025 -

Keshas New Single Attention A Deep Dive Into The Track

Jun 21, 2025

Keshas New Single Attention A Deep Dive Into The Track

Jun 21, 2025