Market Rally Continues: S&P 500, Dow, And Nasdaq Rise Amidst Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rally Continues: S&P 500, Dow, and Nasdaq Rise Despite Moody's Downgrade

The US stock market defied expectations on Tuesday, staging a robust rally despite Moody's Investors Service downgrading the credit ratings of several small and mid-sized US banks. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all saw significant gains, leaving investors questioning the impact of the downgrade and fueling speculation about the market's resilience. This unexpected surge raises questions about the future direction of the market and the factors driving this surprising upward trend.

Moody's Downgrade and its Limited Impact

Moody's decision to downgrade 10 small and mid-sized banks, citing concerns about the deteriorating credit quality of the banking sector and the economic outlook, sent ripples through the financial world. Many analysts predicted a negative market reaction, expecting a sell-off driven by fears of further banking instability. However, the market's response was quite the opposite.

This seemingly paradoxical reaction highlights the complexities of the current market environment. While the downgrade is certainly a cause for concern, several factors might explain the market's resilience:

- Strong Corporate Earnings: Recent positive earnings reports from several major companies have boosted investor confidence, outweighing the negative sentiment surrounding the Moody's downgrade.

- Anticipation of Fed Pause: The market is increasingly anticipating a pause in the Federal Reserve's interest rate hikes, a move that could potentially stimulate economic growth and boost stock prices. [Link to relevant Fed article/statement]

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively strong, indicating continued economic momentum. [Link to relevant consumer spending data]

- Selective Downgrades: The downgrades were targeted at smaller banks, and many believe the impact on the broader financial system will be limited. Larger, more systemically important banks were unaffected by this round of downgrades.

S&P 500, Dow, and Nasdaq Gains

The rally was broad-based, with all three major indices experiencing significant gains. The S&P 500 closed up [insert percentage] on Tuesday, while the Dow Jones Industrial Average and the Nasdaq Composite saw similar percentage increases. [Insert specific numbers for each index]. This demonstrates a strong sense of optimism among investors, defying the negative predictions following the Moody's announcement.

Looking Ahead: Uncertainty Remains

While Tuesday's rally is encouraging, it's crucial to acknowledge the ongoing uncertainties in the market. Inflation, interest rate hikes, and geopolitical tensions continue to pose significant risks. The impact of the Moody's downgrade might still unfold in the coming weeks and months.

What this means for investors:

Investors should remain cautious and adopt a diversified investment strategy. While the current rally is positive, it's essential to maintain a long-term perspective and carefully consider your risk tolerance. Staying informed about macroeconomic factors and market trends is crucial for making informed investment decisions.

Conclusion:

The unexpected market rally following the Moody's downgrade highlights the complex interplay of factors influencing stock prices. While the long-term implications remain uncertain, the resilience shown by the market on Tuesday suggests a degree of underlying strength. However, continued monitoring of economic indicators and geopolitical developments is crucial for navigating this volatile environment. Consult with a financial advisor for personalized investment guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rally Continues: S&P 500, Dow, And Nasdaq Rise Amidst Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bidens Cancer Diagnosis World Leaders Offer Encouragement And Solidarity

May 20, 2025

Bidens Cancer Diagnosis World Leaders Offer Encouragement And Solidarity

May 20, 2025 -

Americas Economic Future Hangs In The Balance The Clean Energy Tax Debate

May 20, 2025

Americas Economic Future Hangs In The Balance The Clean Energy Tax Debate

May 20, 2025 -

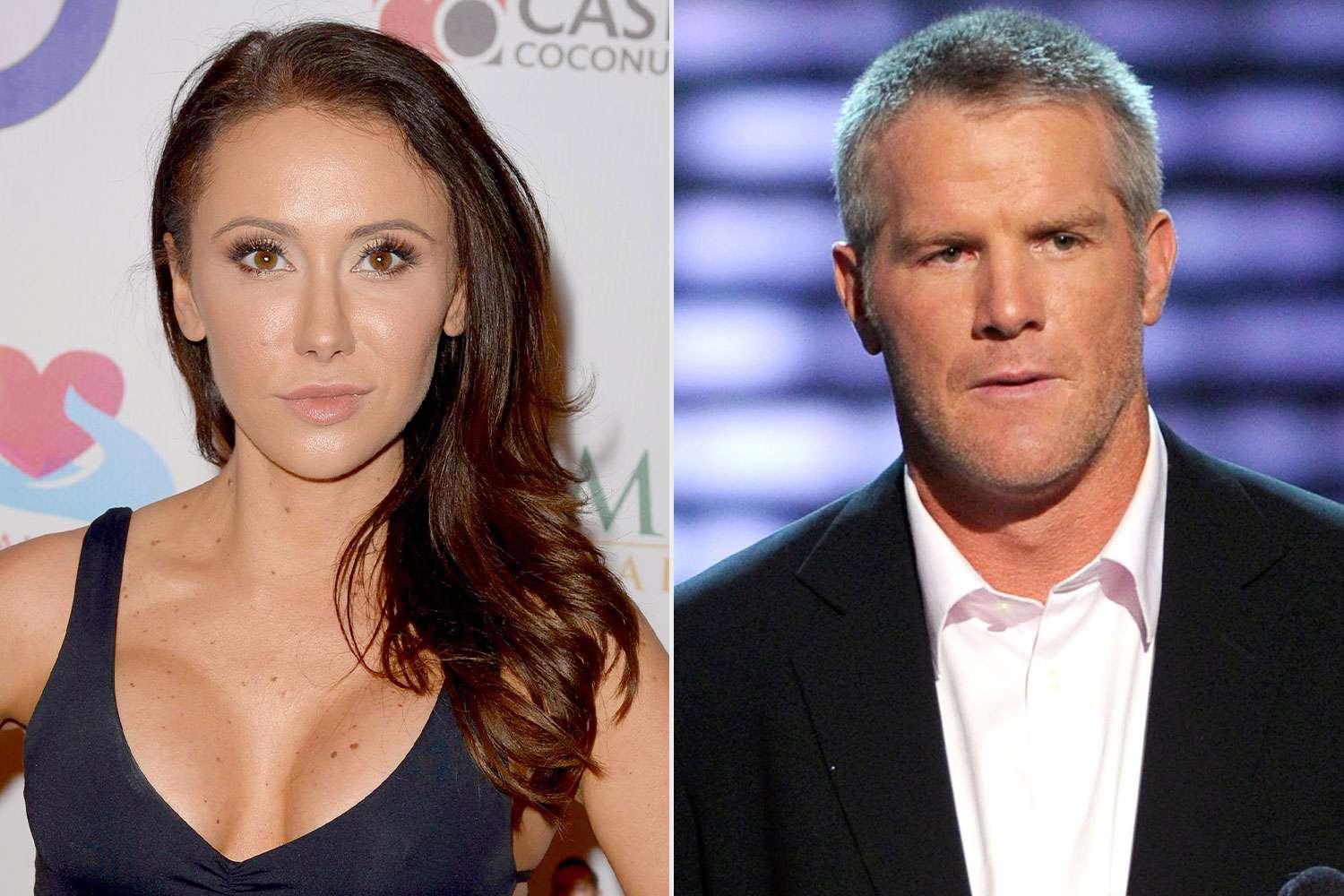

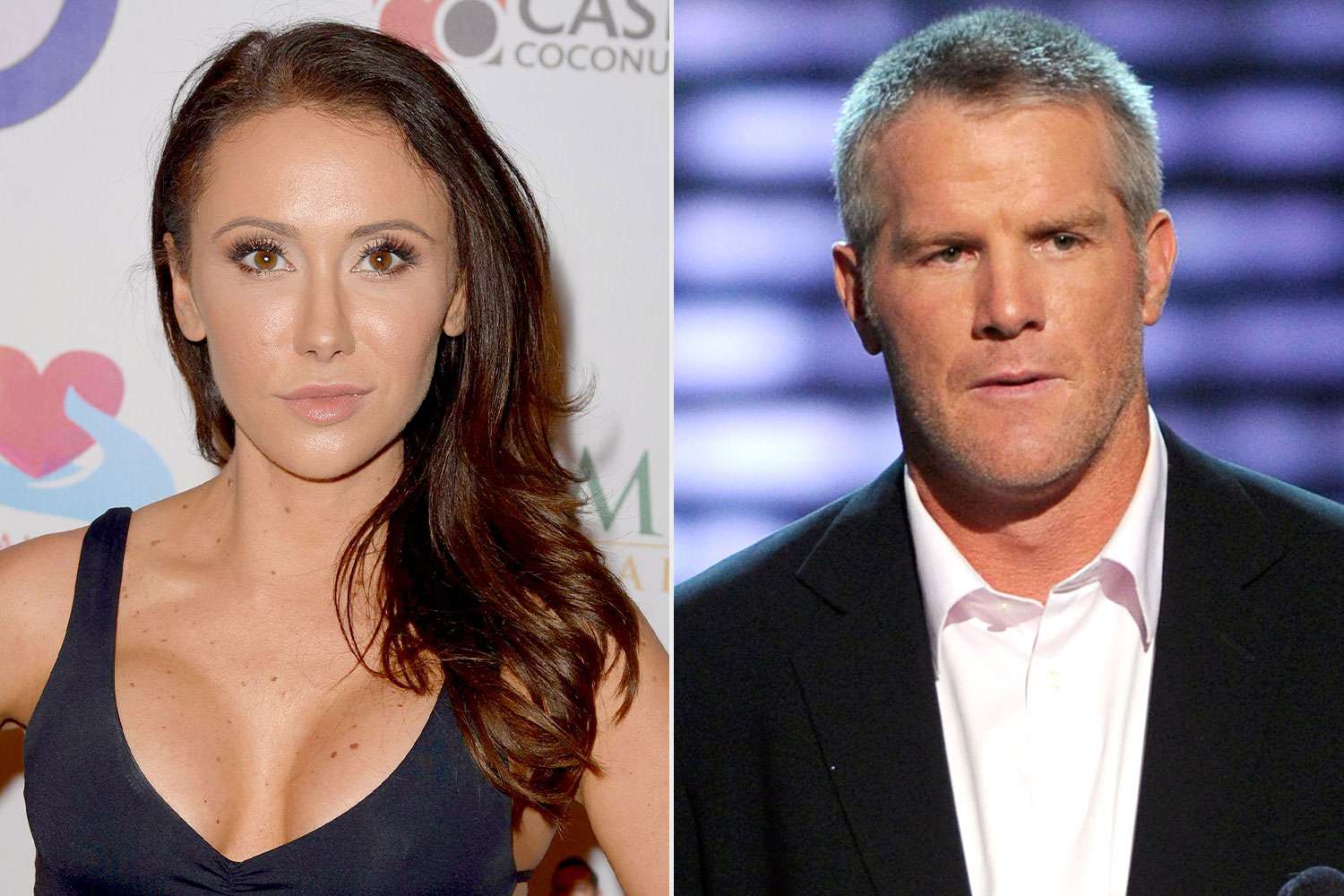

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Fallout

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Fallout

May 20, 2025 -

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025 -

I M Done Jon Jones Hints At Retirement Amidst Aspinall Fight Delays

May 20, 2025

I M Done Jon Jones Hints At Retirement Amidst Aspinall Fight Delays

May 20, 2025